- Analytics

- News and Tools

- Market News

- USD/CAD sits firm following a significant drop

USD/CAD sits firm following a significant drop

- USD/CAD has been pressured in a resurgence in the commodity currency.

- CAD strengthens despite a drop in oil prices.

The Canadian dollar USD/CAD was flat at 1.2846 to the greenback, but the loonie managed to regain some of the previous day's sharp decline as investors raised bets on another oversized interest rate hike by the Bank of Canada. Data has shown rising underlying inflation pressures.

Canada's annual inflation rate slowed to 7.6% in July as gasoline prices eased, but that was still far above the Bank of Canada's 2% target. Canadian inflation may have peaked, but it remains far too high, BoC Governor Tiff Macklem said in a newspaper op-ed. In July, the BoC hiked by a full percentage point. Money markets have been pricing in 59 basis points of tightening by the central bank at its next policy announcement on Sept. 7, up from 53 basis points before the data. Canadian government bond yields jumped across a flatter curve.

Meanwhile, the move higher for the Canadian dollar happened despite pressure on the price of oil. The prospect of an Iran nuclear deal continued to weigh on crude oil prices, analysts at ANZ Bank explained. US crude oil futures CL1! settled 3.2% lower at $86.53 a barrel, their lowest since before Russia's invasion of Ukraine, as economic data spurred concerns about a potential global recession.''

Brent futures fell 3.2% as talks between Iran and European Union negotiators signalled progress on a renewal of the 2015 agreement. EU mediators had circulated a final proposal last week. It has been reported that Iran’s response was constructive, and they are now consulting with the US on a way ahead for the protracted talks,'' analysts at ANZ Bank explained.

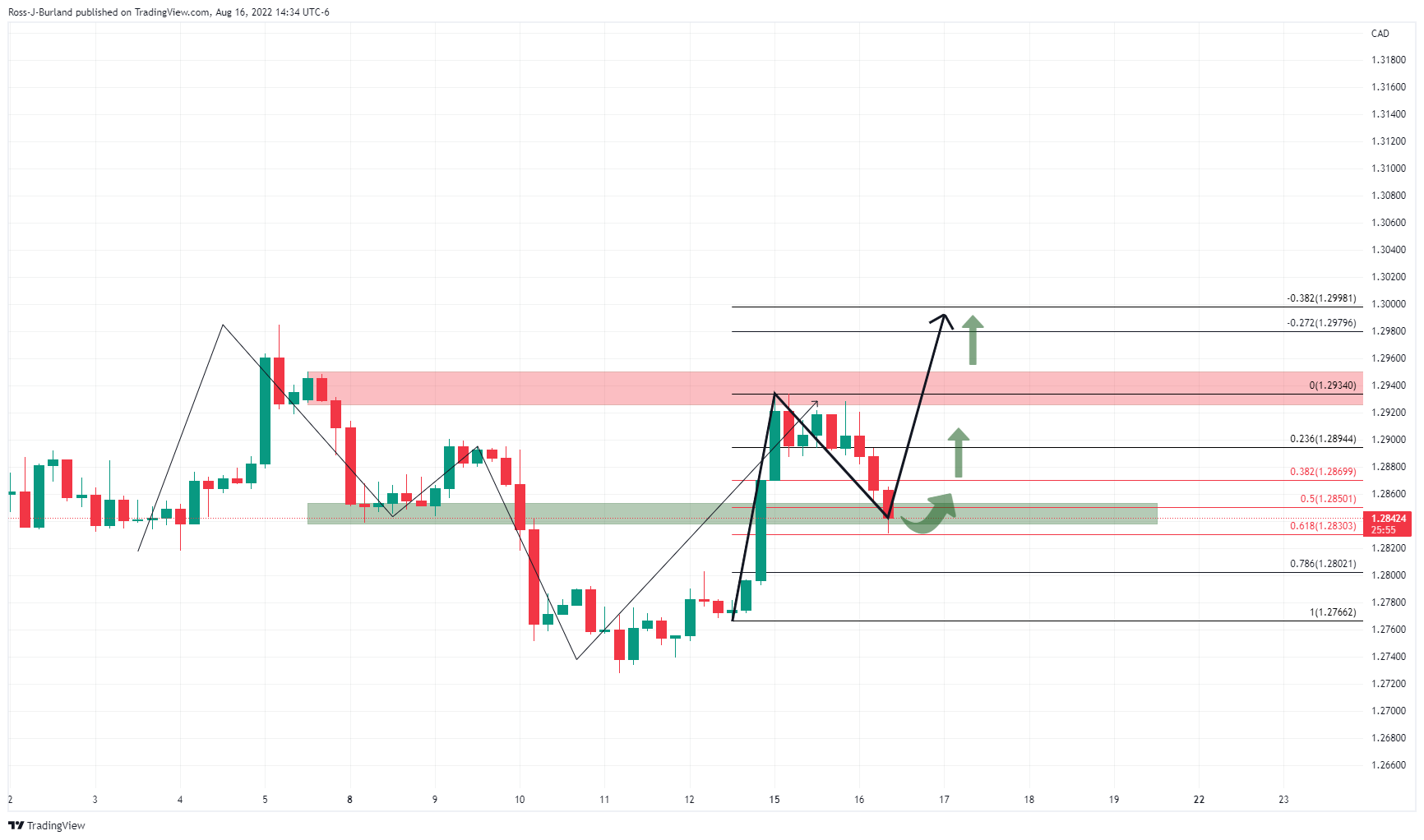

USD/CAD H4 chart

On the charts, a break of the 61.8% ratio to the downside would be a significant move but while it holds, the bias is to the upside as per the chart above.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.