- Analytics

- News and Tools

- Market News

- US Dollar Index: Bulls remain in control and target 106.00

US Dollar Index: Bulls remain in control and target 106.00

- The index adds to Friday’s advance near the 106.00 mark.

- The better tone in the greenback weighs on the risk complex.

- The NAHB Index and TIC Flows are due next in the US docket.

The greenback, in terms of the US Dollar Index (DXY), extends Friday’s gains and trades at shouting distance from the 106.00 yardstick on Monday.

US Dollar Index bolstered by risk-off mood

The index advances for the second session in a row at the beginning of the week amidst the so far tepid bounce in US yields across the curve while the recent improvement in the risk-associated universe continues to take a breather.

On the latter, Chinese results from key fundamentals released earlier in the Asian trading hours came in below expectations, while the interest rate cut by the PBoC also added to the sour mood in the risk complex.

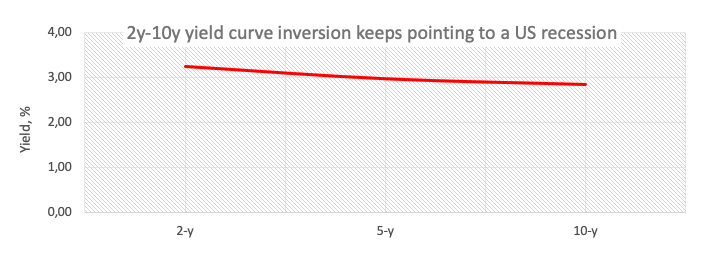

Regarding US yields, the short end of the curve extends the uptrend seen in the last couple of days, while the belly and the long term manage to leave behind part of the Friday’s pullback. The persistent inversion of the curve, in the meantime, continues to support market chatter pointing to a US recession.

In the US data space, the NAHB Index is due seconded by TIC Flows.

What to look for around USD

The recent corrective downside in the index appears to have met firm contention in the 104.60 region - where the 6-month support line also converges – and sparked a corrective bounce to the boundaries of the 106.00 zone so far.

The dollar, in the meantime, is poised to suffer some extra volatility amidst investors’ repricing of the next move by the Federal Reserve, namely a 50 bps or 75 bps hike in September.

Looking at the macro scenario, the dollar appears propped up by the Fed’s divergence vs. most of its G10 peers (especially the ECB) in combination with bouts of geopolitical effervescence and occasional re-emergence of risk aversion.

Key events in the US this week: NAHB Index, TIC Flows (Monday) – Building Permits, Housing Starts, Industrial Production (Tuesday) – MBA Mortgage Applications, Retail Sales, Business Inventories, FOMC Minutes (Wednesday) – Initial Claims, Philly Fed Manufacturing Index, CB Leading Index, Existing Home Sales (Thursday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Escalating geopolitical effervescence vs. Russia and China. Fed’s more aggressive rate path this year and 2023. US-China trade conflict.

US Dollar Index relevant levels

Now, the index is losing 0.20% at 104.98 and a breach of 104.63 (monthly low August 10) would expose 103.67 (weekly low June 27) and finally 103.58 (100-day SMA). On the upside, a breakout of 107.42 (weekly high post-FOMC July 27) would expose 109.29 (2022 high July 15) and then 109.77 (monthly high September 2002).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.