- Analytics

- News and Tools

- Market News

- When is the UK Q2 GDP and how could it affect GBP/USD?

When is the UK Q2 GDP and how could it affect GBP/USD?

The UK Economic Data Overview

The British economic calendar is all set to entertain the cable traders in early Friday, at 06:00 GMT, with the preliminary GDP figures for Q2 2022. Also increasing the importance of that time are monthly GDP figures for March, Trade Balance, Manufacturing Production, and Industrial Production details for the stated period.

Having witnessed an 8.7% YoY jump in economic activities during the previous quarter, market players might not get delighted with the first estimation of the Q1 GDP figures, expected 2.8% YoY, as it is insufficient to back the BOE’s rate hikes. More interestingly, the QoQ figures are expected to display a de-growth of 0.2% against the expansion of 0.3%.

On the other hand, the GBP/USD traders also eye the Index of Services (3M/3M) for the same period, bearing forecasts of 0.9% versus 0.1% prior, for further insight.

Meanwhile, Manufacturing Production, which makes up around 80% of total industrial production, is expected to contract to 1.8% MoM in June versus 1.4% in May. Further, the total Industrial Production is also expecting a contraction of 1.3% against a positive reading of 0.9% MoM.

Considering the yearly figures, the Industrial Production for June is expected to improve to 1.6% versus 1.4% previous whereas the Manufacturing Production is anticipated to have weakened to 0.9% in the reported month versus 2.3% last.

Separately, the UK Goods Trade Balance will be reported at the same time and is expected to show a deficit of £22.3 billion versus a £21.44 billion deficit reported in the last month.

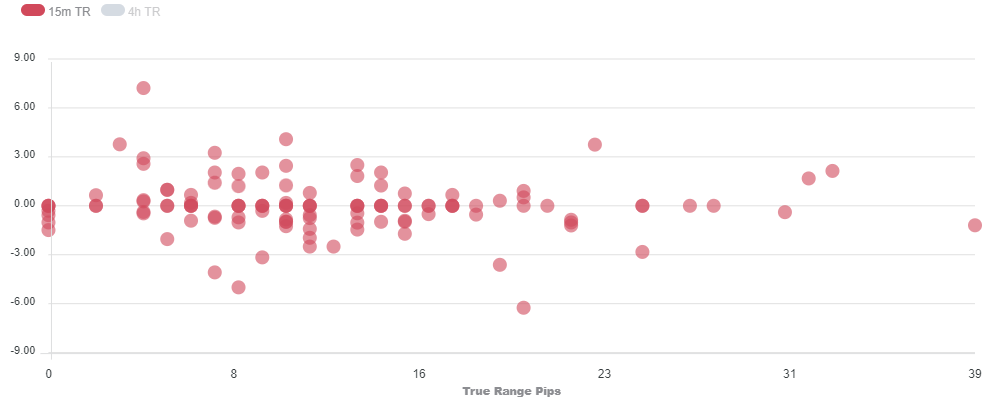

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 30-40 pips.

How could affect GBP/USD?

GBP/USD is hovering around the immediate hurdle of 1.2200 after a modest rebound from 1.2185. The asset defended Wednesday’s low at around 1.2180 but is now displaying a torpid rebound, which could be fragilized effortlessly by the market participants.

Cable’s upside momentum is backed by a significant decline in the US dollar index (DXY). After displaying a downward print in the US Consumer Price Index (CPI), a sense of optimism in the FX domain that the Federal Reserve (Fed) won’t hike rates now vigorously underpinned the risk-sensitive assets.

However, any headline over UK’s political domain could bring wild swings in the GBP/USD pair. The pound bulls still fear the UK’s political instability. After the resignation of UK PM Boris Johnson, a sense of high volatility is engaged with the sterling.

Apart from that, an underperformance by the UK economic data will create more troubles for the Bank of England (BOE). The central bank is already stuck in the laborious job of dealing with ramping up inflation and over that, a slump in growth rates will restrict the BOE to combat price pressures with full power.

The UK households are forced to higher payouts due to ramping inflation and subdued Average Hourly Earnings, which is hurting their sentiment and the overall demand. Over that, the release of weak GDP data will cripple the pound bulls.

While considering this, FXStreet’s Anil Panchal said,

The BOE has already revealed its grim outlook and hence today's UK GDP are less likely to surprise the markets even after avoiding technical recession.

Key Notes

GBP/USD slides below 1.2200 with eyes on UK GDP, US Michigan Consumer Sentiment Index

GBP/USD struggles around 1.2200 ahead of UK GDP data

GBP/USD retraces from weekly highs, approaches 1.2200

About the UK Economic Data

The Gross Domestic Product released by the Office for National Statistics (ONS) is a measure of the total value of all goods and services produced by the UK. The GDP is considered as a broad measure of the UK economic activity. Generally speaking, a rising trend has a positive effect on the GBP, while a falling trend is seen as negative (or bearish).

The Manufacturing Production released by the Office for National Statistics (ONS) measures the manufacturing output. Manufacturing Production is significant as a short-term indicator of the strength of UK manufacturing activity that dominates a large part of total GDP. A high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or bearish).

The trade balance released by the Office for National Statistics (ONS) is a balance between exports and imports of goods. A positive value shows trade surplus, while a negative value shows trade deficit. It is an event that generates some volatility for the GBP.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.