- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bulls got free drinks on the house, but hangovers could await them

Gold Price Forecast: XAU/USD bulls got free drinks on the house, but hangovers could await them

- Gold is back under pressure following a relief rally to the weekly 61.8% Fibo.

- Bulls will be seeking space above $1,800 but the Fed is still a long way off from its target despite today's CPI miss of expectations.

At $1,791.43, gold is around 0.17% higher on the day. It has rallied from a low of $1,787.60 to a fresh bullish corrective high of $1,807.96. The gold price has shot up to finally move to the 61.8% golden ratio on the weekly chart following today's US inflation data that came in below expectations. The data has raised hopes that inflation may have seen a peak. Consequently, the US 10-Year Treasury yield dropped, as did the US dollar. In turn, gold bulls enjoyed the ride higher.

However, it is too soon to claim victory by the gold bugs for there is a long way to go until the Federal Reserve's next meeting in September, which means potential speed bumps along the way for gold.

''The Fed will be looking for "clear and convincing" evidence of inflation turning the corner, and we are not there yet,'' analysts at TD Securities argued. ''An epic collapse across USD pairs. The question is whether this will stick.''

Federal Reserve's Neel Kashkari has recently crossed the wires and has said that while he is happier to see inflation surprised to the downside, the Fed is far, far, far away from declaring victory on inflation. He added that ''this doesn't change my rate hike path'', and he is expecting 3.9% end of this year 4.4% end of next year.

Gold for December delivery was last seen down $2.5 to $1,809.90 per ounce, after rising to US$1,824.60 immediately following the release of US July inflation figures. The spot price is also giving back some ground as US yields recover as the market digest the inflation report. Prices rose 8.5% on an annualized basis in July, a slower pace than the 9.1% rise reported in June and below analysts' consensus expectations for an 8.7% rise.

Despite the prospects of peak inflation, the broader sentiment in the markets is for the Fed to maintain its aggressive tightening bias in the months ahead. There are fewer possibilities of a 75bps hike in September, however, with markets in anticipation of a 50bp rate hike instead but the pedal will be to the metal as the Fed aims to reach a more restrictive policy posture before the end of the year.

This means, depending on data and other potential surprises, the gold price will be vulnerable to ongoing strength in US yield and the US dollar.

''The first downside surprise in monthly headline inflation since September 2021 pushed investors to lower the odds of a 75bp hike in September from 85% to just 44% and the pricing for the terminal funds rate to 3.5% from nearly 3.7%,'' analysts at TD Securities noted.

''We expect market pricing for hikes to continue gyrating between extremes as investors digest more data ahead of the September FOMC.''

''We think short-term price action will reflect risk sentiment,'' the analysts explained with respect to the values of the US dollar.

Between now and the next meeting, there will be plenty of noise between Fed speakers and US data as well as global calendar events to keep the US dollar in tow.

Not only do we have another inflation reading but also the Jackson Hole Economic Symposium scheduled for August 25-27 will be keenly eyed. Fed Chairs often use this symposium in August to announce or hint at policy shifts ahead of the September FOMC meetings.

The analysts at BBH explained that ''by late August, we will have seen all the major July data and some of the early August surveys such as the preliminary S&P Global PMI readings and regional Fed surveys. The Fed will also have a good idea of how the economy is doing in Q3. That said, we do not think the Fed will make any major policy announcements or paint itself into a corner ahead of next month’s FOMC meeting.''

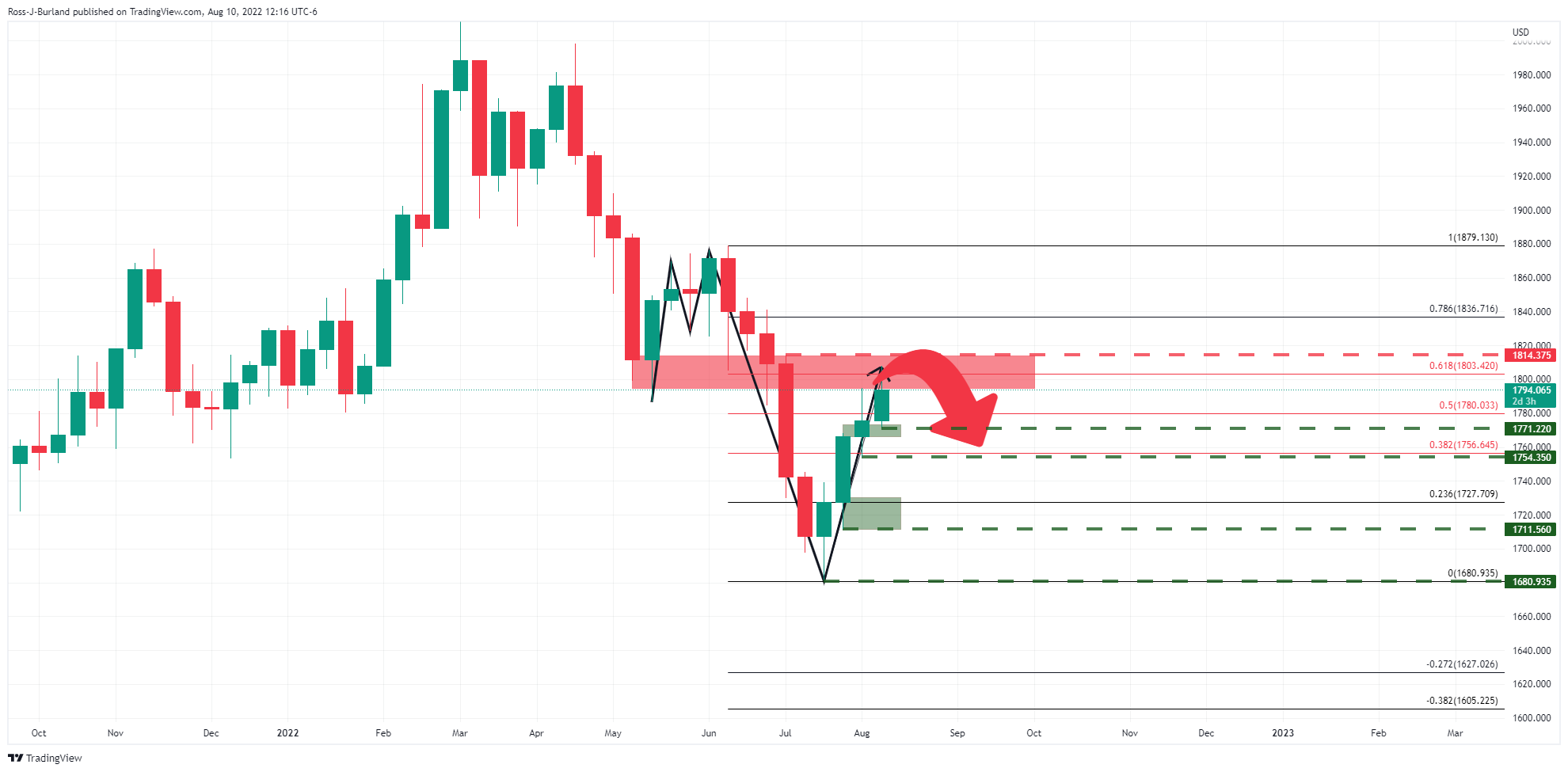

Gold technical analysis

As illustrated, the price has run up to the 61.8% golden ratio where some profit taking would be expected to occur. A build-up of supply could pick up over the course of the coming days and weeks ahead resulting in a topping of this correction of the M-formation's bearish leg.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.