- Analytics

- News and Tools

- Market News

- Silver Price Forecast: XAGUSD oscillates around $20.15 sideways ahead of US NFP

Silver Price Forecast: XAGUSD oscillates around $20.15 sideways ahead of US NFP

- Silver price is still directionless amid the lack of tier 1 US economic data.

- Sentiment is fragile due to increased concerns of a recession, as the BoE concedes that the UK might tap into one.

- US Initial Jobless Claims could be a prelude to Friday’s NFP, estimated to add 250K jobs.

Silver price climbs for two straight days, registering gains of 0.51%, as US equities finished mixed, while Asian stock futures are fluctuating as recession fears reignited, courtesy of the Bank of England. That said, alongside a soft US dollar, underpinned by falling US Treasury yields, bolstered the white metal on Thursday. At the time of writing, XAGUSD is trading at $20.14.

Silver trades range-bound, waiting for a catalyst

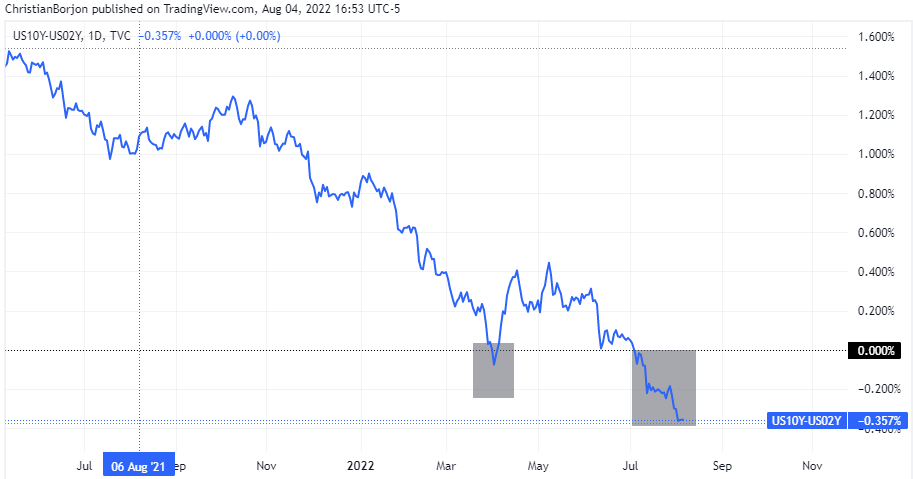

The story of the day is the BoE hiking rates by 50 bps but acknowledged that the UK might tap into a 15-month recession, beginning at the end of the 2022 Q4. Meanwhile, in the US, the 2s-10s yield curve inversion further deepened, sits at -0.357%, and extended to 23 days, while the US 10-year benchmark note rate retraced five bps to 2.694%.

US 2s-10s yield curve inversion

Data-wise, the US calendar featured Initial Jobless Claims for the week ending July 30, which increased by 260K, more than estimated, showing signs that the labor market is easing. At the same time, the US Trade Balance narrowed its deficit from -$80.1 B in May to -$79.6 B in June, propelled by Exports.

In the meantime, the US Dollar Index, a gauge of the buck’s value vs. a basket of peers, tumbled 0.58% at 105.700, accumulating losses from the YTD peak of 3.8%, a tailwind for the dollar-denominated XAGUSD.

Late in the day, Fed speaking, led by Cleveland’s Fed Loretta Mester, reiterated that there’s a path for a soft landing but recognized that recession fears have risen, adding some fuel to the uncertainty confirmed by the UK, recession lingering worldwide.

Shifting to geopolitical jitters, tensions between the US and China persist. In response to US House Speaker Nancy Pelosi’s trip to Taiwan, China fired missiles over Taiwan during military drills, while Japan complained that five of those missiles landed in Japan’s exclusive economic zone. The US National Security spokesman John Kirby said that “China has chosen to overreact,” while adding they’re using the visit to increase military activity around Taiwan.

Those plays, amongst market mood, will keep the silver price fluctuating. Nevertheless, it appears that buyers don’t have the strength to crack the XAGUSD’s 50-day EMA at $20.39.

What to watch

The US economic docket will feature July’s Nonfarm Payrolls estimated at 250K, less than June’s 372K. At the same time, the Unemployment Rate is foreseen to persist unchanged at 3.6%.

Silver (XAGUSD) Key Technical Levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.