- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bulls eye $1,800, but Taiwan is the wild card

Gold Price Forecast: XAU/USD bulls eye $1,800, but Taiwan is the wild card

- Gold is back under pressure as US yields spike, but bulls are not far away.

- There is room for further upside with the 68.2% Fibonacci meeting prior weekly structure around $1,800.

- Markets are cautious over US/Sino tensions over Taiwan.

The gold price is dipping below $1,770 in the midday US session from $1,788.12 the high that was scored in the New York open. XAU/USD is down some 0.18% on the day currently as it moves in on the lows of the day at $1,767.76.

The price has been driven by US bond yields that have been waning in the wake of a less hawkish narrative surrounding the Federal Reserve. This has lifted gold futures and for December delivery, the precious metals climbed back above $1,800 per ounce on Tuesday.

The yield on the US 10-year note was last seen up 2.732 % after recovering from the lowest since early April and at the bottom of the broadening formation's daily range:

The rebound in yields is a weight on the yellow metal. Meanwhile, the US dollar rose off the lowest in nearly a month early on Tuesday, with the DXY index last seen up 0.72% to 106.166.

US/Sino relations are the wild card for gold

To add insult to injury, the US dollar is attracting a safe haven bid on worries a visit by U.S. House of Representatives Speaker Nancy Pelosi to Taiwan would further harm relations between China and the United States. China has threatened repercussions if Pelosi visited the self-ruled island, which Beijing claims as its territory.

said on Monday it would not be intimidated by China. Consequently, US long-term Treasury yields dropped to a four-month low while the US dollar gained against a basket of currencies. Gold also picked up a bid, but that is being demolished with the sudden corrective spike in US yields.

''Nonetheless, for further significant short covering from CTA trend followers to take place, gold prices would need to close north of $1820/oz to spark a change in trend signals,'' analysts at TD Securities argued.

''However, on the other hand, we see risks that Fed speakers can push back against market expectations for an early Fed pivot. In this sense, gold markets are faced with a massive amount of complacent length held by prop traders, which still hold the title as the dominant speculative force in gold.''

''We have yet to see capitulation in gold, suggesting the pain trade is still to the downside and we expect the recent rally will ultimately fade, facing a wall of offers.''

Gold technical analysis

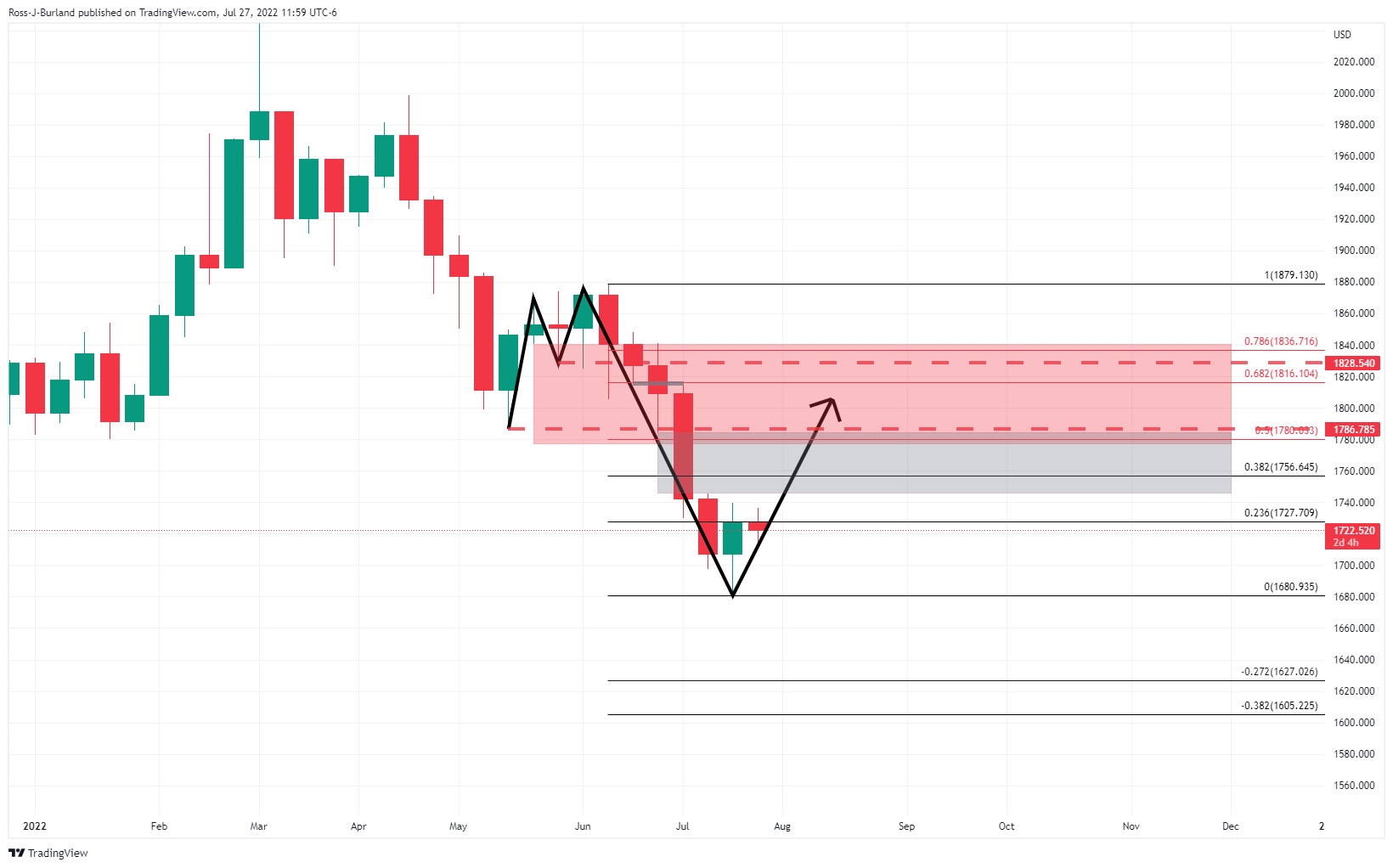

As per the prior analysis, Gold Price Forecast: XAU/USD bulls are back in play, it was explained that the price was running higher in a correction of the weekly M-formation:

The grey area was a price imbalance that has now been mitigated by a 50% mean reversion:

There is room for further upside with the 68.2% Fibonacci meeting prior structure around $1,800.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.