- Analytics

- News and Tools

- Market News

- EUR/USD stays vigilant above 1.0200 ahead of US data

EUR/USD stays vigilant above 1.0200 ahead of US data

- EUR/USD alternates gains with losses above 1.0200.

- Investors look cautious ahead of key US data and the Fed event.

- US Conference Board’s Consumer Confidence takes centre stage later.

EUR/USD exchanges ups and downs above the 1.0200 mark on Tuesday amidst the broad-based consolidative mood in the global markets.

EUR/USD focused on the US calendar

EUR/USD gyrates in the low-1.0200s as a clear direction in the markets remains absent in the first half of the week, while cautiousness remains on the rise among market participants in light of the upcoming Fed event.

In the meantime, threats of further deterioration of the energy scenario, particularly regarding the supply of Russian gas to Germany (via the Nord Stream 1 pipeline), keeps undermining the growth outlook in the country and the region as a whole and could eventually be a source of extra weakness for the single currency in the upcoming months.

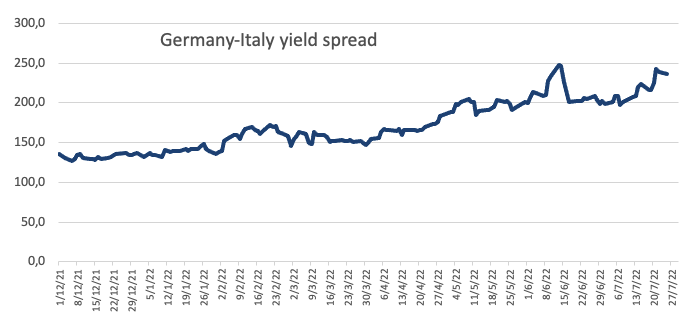

On the political side, the euro is predicted to face further headwinds, as the far-right party Fratelli d’Italia (Brothers of Italy) keeps leading the race to the general elections in Italy on September 25.

Nothing scheduled data wise in the Euroland on Tuesday leaves all the attention to publications across the pond: the US Consumer Confidence gauged by the Conference Board, the House Price Index tracked by the FHFA and New Home Sales.

What to look for around EUR

EUR/USD remains within the pre-FOMC consolidative phase above the 1.0200 region, broadly in line with the generalized side-lined mood in the rest of the global assets.

The pair extends its range bound stance, as market participants continue to gauge the latest ECB announcements and appear cautious ahead of the upcoming FOMC event on Wednesday.

In the meantime, the price action around the European currency closely follows increasing speculation of a probable recession in the euro area, dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

Key events in the euro area this week: Germany GfK Consumer Confidence (Wednesday) – EMU Final Consumer Confidence, Economic Sentiment, Germany Flash Inflation Rate (Thursday) – Germany Unemployment Change, Unemployment Rate, Flash Q2 GDP, EMU Flash Inflation Rate, Advanced Q2 GDP (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of monetary conditions. Performance of the economic recovery post-pandemic in the region. Impact of the war in Ukraine on the region’s growth prospects and inflation.

EUR/USD levels to watch

So far, spot is losing 0.12% at 1.0206 and faces initial contention at 1.0129 (low July 22) seconded by 0.9952 (2022 low July 14) and finally 0.9859 (low December 2002). On the upside, a breakout of 1.0278 (weekly high July 21) would target 1.0446 (55-day SMA) en route to 1.0615 (weekly high June 27).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.