- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bears test bulls at a key area on daily chart ahead of the Fed

Gold Price Forecast: XAU/USD bears test bulls at a key area on daily chart ahead of the Fed

- Gold price is headed into a key area of support on a busy week ahead.

- It is a huge week for financial markets and gold will be sure to be in the spotlight around the key events.

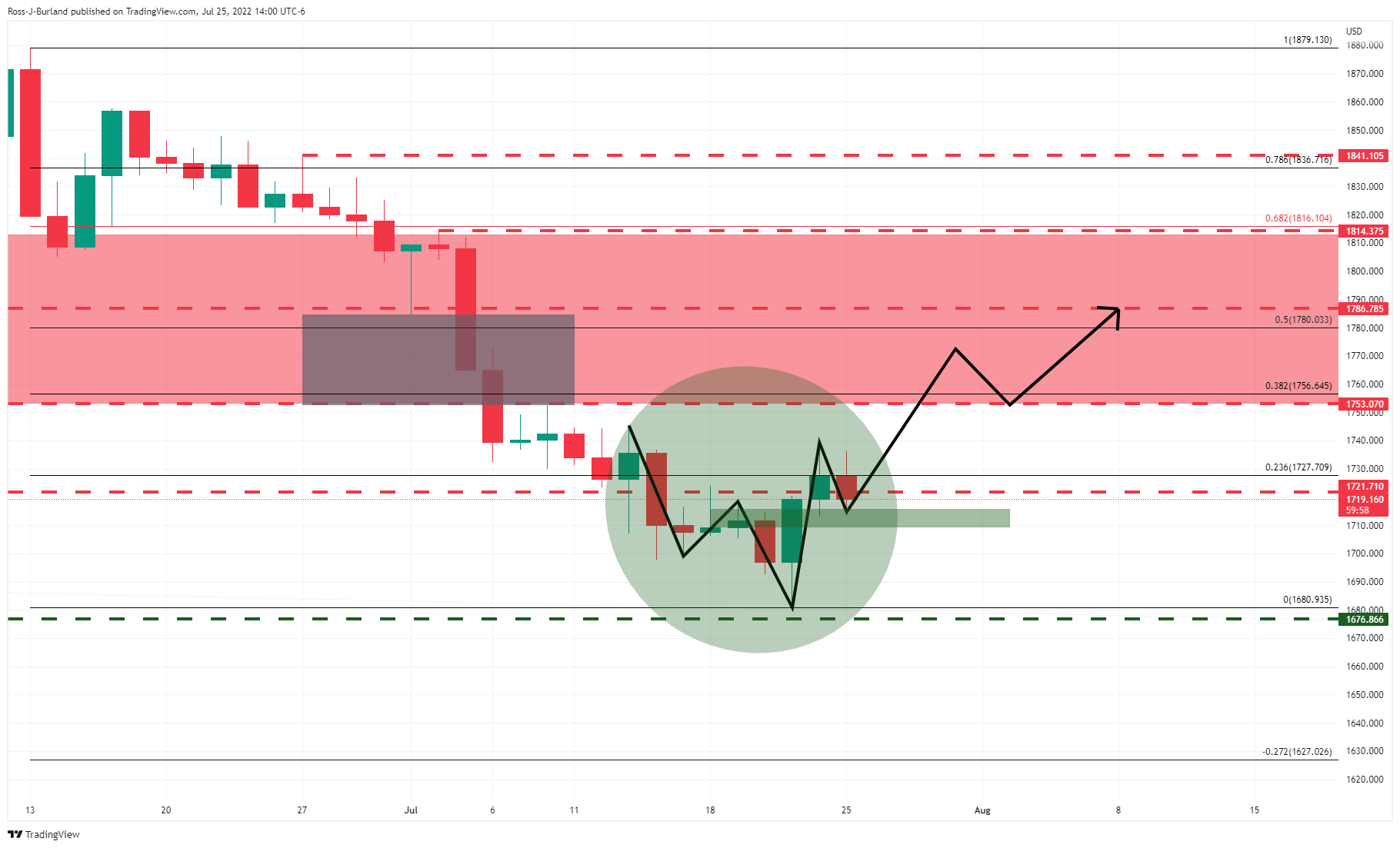

- A 50% mean reversion level of around $1,780 could be in the offing if bulls commit through this critical week.

The gold price is down on the day by some 0.58% and falls from a high of $1,736.30 to a low of $1,714.80 despite a softer greenback. Meanwhile, traders are bracing for the showdown this week that will come in the form of the Federal Reserve ahead of some key US data points, such as the Fed's preferred inflation measure and fresh growth data towards the end of a very busy week.

All eyes are on the Fed

The Fed is expected to end its two-day meeting with another 75bps hike for the second-straight time. Expectations for a hike of 75 basis points from the Fed stand at about 75%, according to CME's Fedwatch tool with a 25% chance of a 100 basis point hike. Analysts at Brown Brothers Harriman said WIRP suggests only around 10% odds of a 100 bp move, noting that updated macro forecasts and Dot Plots won’t come until the September meeting.

''Another 75 bp hike on September 21 is only about 45% priced in, with a 50 bp move favoured then. A 25 bp hike is priced in for November 2 but after that, one last 25 bp hike is only partially priced in. The swaps market paints a similar picture, with 175 of tightening priced in over the next 6 months that would see the policy rate peak near 3.5%. Then, an easing cycle is priced in for the subsequent 6 months.''

Gold has been pressured in this environment as the yellow metal offers no yield. Nevertheless, analysts at TD Securities are of the mind that a CTA whipsaw would be the most obvious driver for additional short covering in the yellow metal.

The analysts say that prices would need to close north of $1,775 to spark a buying program. ''Ultimately, a behemoth position held by prop traders remains nearly twice its typical size, suggesting a substantial amount of pain will reverberate across gold markets if prices revert lower. We have yet to see capitulation in gold, suggesting the recent rally will ultimately fade when faced with a wall of offers.''

However, rising bond yields ahead of the Fed are contributing to a gap between the 2- and 10-year Treasury notes which observers would argue signal a looming recession in the US. Gold's allure as a safe haven asset could see higher prices, especially if the Fed were to start to dial back its hawkish rate hike path for the fear of crashing the economy.

Recent data has shown signs of an economic slowdown while inflation remains stubbornly high, with claims for jobless benefits rising to their highest in eight months. Moreover, on Friday, data showed that the US Composite PMI Output Index fell far more than expected to 47.5 this month from a final reading of 52.3 in June. This is showing that the world's largest economic power could be headed for a recession.

However, the greenback found some support from safe-haven flows late on Friday while investors' stepped aside from stocks on the back of some weak earnings reports. Meanwhile, to start the week, pre-Fed jitters are keeping the greenback off its highs. This makes the end of the week's data highly critical for the path of both the greenback and gold.

Key data ahead

Investors will eye the advance reading for second-quarter Gross Domestic Product, for one. If this were to show negative growth, the US will be showing a traditional definition of recession. We then have the Fed's preferred inflation measure which will be released in the form of Personal Consumption Expenditures, PCE.

Gold technical analysis

Meanwhile, the daily chart's W-formation has been pulling the gold price towards the neckline for a restest of the bull's commitments near $1,700 prior to what could turn out to be a full-on drive higher in the coming days. The greyed area on the chart above is a price imbalance that could be mitigated in the process and exposes the 50% mean reversion level around $1,780.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.