- Analytics

- News and Tools

- Market News

- US Dollar Index regains the smile and re-targets 107.00

US Dollar Index regains the smile and re-targets 107.00

- DXY reverses the recent weakness and approaches 107.00.

- US yields advance marginally across the curve on Monday.

- The Chicago Fed National Activity Index will take centre stage later.

The greenback, in terms of the US Dollar Index (DXY), manages to reclaim some ground lost and trades close to the 107.00 region at the beginning of the week.

US Dollar Index focuses on FOMC, data

The index trades with decent gains after two consecutive daily pullbacks on Monday and approach the key 107.00 barrier on the back of some correction in the risk-associated universe.

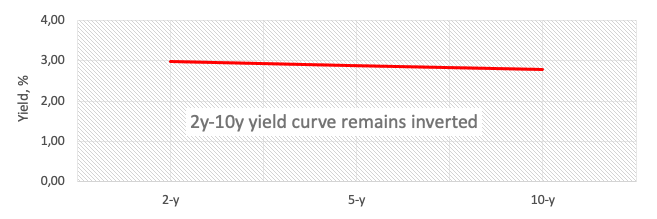

In the US money markets, the recent strong appetite for bonds appears somewhat mitigated ahead of the opening bell in the old continent, lending in return some support to yields across the curve.

Investors, in the meantime, are expected to keep the cautious tone well and sound ahead of the FOMC event on Thursday as well as flash Q2 GDP figures and inflation tracked by the PCE, both due in the second half of the week.

Furthermore, and according to CME Group’s FedWatch Tool, the probability of a 75 bps rate hike on Wednesday is now close to 80% and just above 21% when it comes to a full point raise.

In the US data space, the Chicago Fed National Activity Index will be in the limelight later in the NA session seconded by the Dallas Fed Manufacturing Index.

What to look for around USD

The index came under downside pressure following nearly 20-year highs north of the 109.00 mark in mid-July, although it seems to have met some decent support near 106.00 for the time being.

So far, the dollar remains underpinned by the Fed’s divergence vs. most of its G10 peers (especially the ECB) in combination with bouts of geopolitical effervescence and the re-emergence of the risk aversion among investors.

On the flip side, market chatter of a potential US recession could temporarily undermine the uptrend trajectory of the dollar somewhat.

Key events in the US this week: Chicago Fed National Activity Index (Monday) – House Price Index, CB Consumer Confidence, New Home Sales (Tuesday) – MBA. Mortgage Applications, Durable Goods Orders, Advanced Goods Trade Balance, Pending Home Sales, Fed Interest Rate Decision, Powell Press Conference (Wednesday) – Flash Q2 GDP, Initial Claims (Thursday) – PCE Price Index, Personal Income, Personal Spending, Final Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Escalating geopolitical effervescence vs. Russia and China. Fed’s more aggressive rate path this year and 2023. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is up 0.14% at 106.69 and a break above 109.29 (2022 high July 15) would expose 109.77 (monthly high September 2002) and then 110.00 (round level). On the downside, the initial support comes at 106.11 (weekly low July 22) followed by 103.67 (weekly low June 27) and finally 103.41 (weekly low June 16).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.