- Analytics

- News and Tools

- Market News

- GBP/USD reclaims the 1.2000 figure on US PMIs flashing recession

GBP/USD reclaims the 1.2000 figure on US PMIs flashing recession

- GBP/USD snaps three straight weeks of losses, set to gain around 1.34%.

- US S&P Global PMIs flashes purchasing managers’ worries about current US economic conditions.

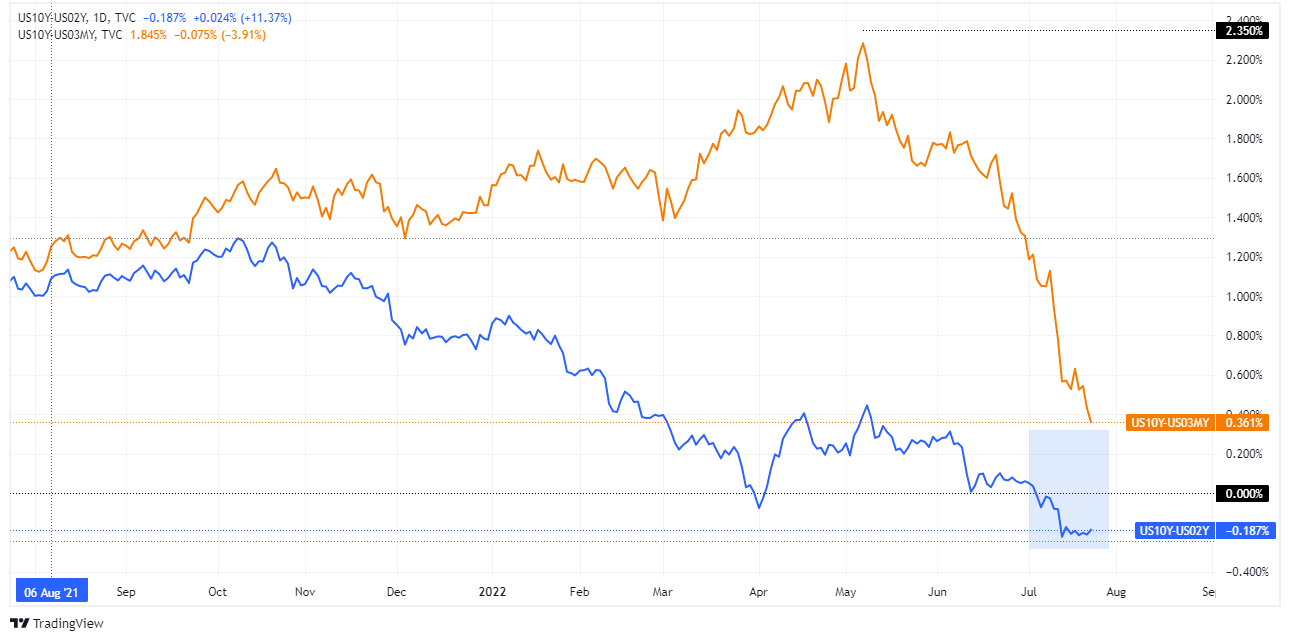

- The US 2s-10s yield curve remains inverted for 14 consecutive days.

GBP/USD recaptures the 1.2000 figure amidst a fragile market mood, as equities are seesawing of late, due to US S&P Global PMI data, flashing a contraction in the services sector and its Composite index, while traders seek safety towards US Treasuries, with US bond yields falling, undermining the greenback.

The GBP/USD is trading at 1.2028 after diving towards its daily low at around 1.1915. Nevertheless, the major bounced back and rallied towards a daily high at 1.2063 before stabilizing around current price levels.

US PMIs show signs of further deterioration

In the meantime, US S&P Global reported PMIs Indices for July. Manufacturing rose by 52.3, above expectations, but Services and Composite tumbled to 47 and 47.6, respectively, suggesting that the economy is deteriorating, according to the survey. When news crossed wires, the US Dollar Index, a basket of peers that measure the buck’s performance, slides 0.18%, sits at 106.407, while the US 10-year benchmark note coupon plunges ten bps to 2.789%.

Traders should be aware that the US 2s-10s yield curve remains inverted, at -0.174%, signaling an impending recession. Nonetheless, the US 3-month to 10-year yield curve bear flattened towards the 0.367% area, which, although positive, has erased since its peak in May at 2.350%, almost 200 bps.

US 2s-10s in blue - US 3m-10y in orange

Meanwhile, on the UK side, UK Retail Sales contracted, showing the pressure of elevated prices in the UK. June sales dropped by -5.8% YoY, more than estimations, while the monthly reading shrank -0.1%, less than the -0.3% contraction estimated.

Later, UK S&P Global PMIs for July held above the expansionary territory, easing some pressures on the shoulders of the Bank of England (BoE) Governor Andrew Bailey. Nevertheless, the political issues surrounding the resignation of the current PM Boris Johnson keep Britons entertained with the battle between Rishi Sunak and Liz Truss. That, alongside Brexit jitters, might cap any upside reaction on the GBP/USD.

What to watch

Next week, an absent UK economic docket would keep GBP/USD traders leaning on US economic data. On the US calendar, the Federal Reserve Open Market Committee (FOMC) monetary policy decision, US inflation data, and Q2 Gross Domestic Product on its advance reading will keep GBP/USD traders glued to their screens.

GBP/USD Key Technical Levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.