- Analytics

- News and Tools

- Market News

- EURUSD Price Forecast: Sellers regain the upper hand ahead of 1.0100

EURUSD Price Forecast: Sellers regain the upper hand ahead of 1.0100

- EUR/USD reverses the post-ECB advance to the 1.0280 region.

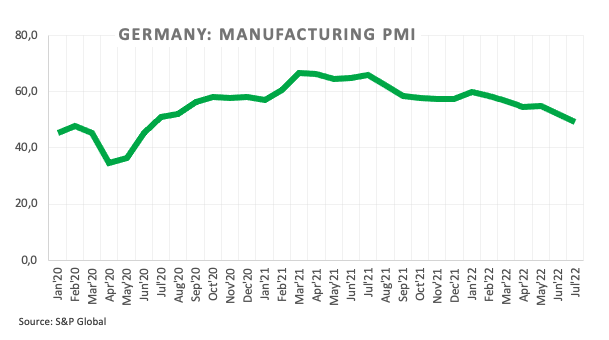

- German, EMU, France Manufacturing PMIs drop below 50 in July.

- Investors started to pencil in a couple of 50 bps rate hikes.

Following Thursday’s advance to the proximity of the 1.0300 neighbourhood – or 2-week highs – EUR/USD gives away all of those gains at the end of the week on the back of the resumption of the buying interest surrounding the greenback and dwindling enthusiasm in the wake of the ECB event.

ECB: Further tightening remains well in place

EUR/USD comes under selling pressure on Friday, as market participants seem to have already digested the unexpected ECB 50 bps rate hike, while others appear to have sold the uptick ahead of the weekend and the upcoming FOMC gathering on July 27. However, another test of the parity zone does not look favoured now, as the central bank expects inflation to remain elevated and therefore the door remains open to further hikes at the next couple of meetings (September and October). On this, a 50 bps raise appears on the cards, while speculation of a 50 bps/75 bps hike in October already runs high.

PMIs slipped back to the contraction region

Friday’s offered stance in EUR/USD also gathers extra pace after advanced figures now see the Manufacturing PMIs in the core Euroland (Germany, France and the whole bloc) slipping back to the contraction territory (<50) for the month of July. Despite these readings could fan the flames around a potential recession in the euro area, the “obsession” of the ECB to bring down inflation to the bank’s 2% goal should leave prospects for further tightening well in place for the time being.

The dollar and Ukraine keep weighing on sentiment

Looking at the broader picture, the outlook for the greenback still looks constructive despite occasional bouts of weakness and remains well propped up by the Fed’s normalization plans. In addition, the war in Ukraine and the idea that the spectre of the energy crunch could extend further and hurt the economies in the old continent emerges as a tangible risk for the euro and a solid source of extra weakness in the near term.

Short-term Technical Outlook

The post-ECB high at 1.0280 now emerges as the initial barrier for EUR/USD in case of the resumption of the buying bias. North from here comes the temporary 55-day SMA at 1.0457, which precedes the 5-month resistance line in the 1.0500 neighbourhood. If the pair manages to clear the latter on a sustainable fashion, then it could open the door to extra rebound to, initially, the weekly top at 1.0615 (June 27). If bears push harder, then there are no contention levels of note until the parity zone ahead of the 2022 low at 0.9952 (July 14).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.