- Analytics

- News and Tools

- Market News

- Gold price is 'smelting' below $1,700 and just $20.00 away from key weekly pivot

Gold price is 'smelting' below $1,700 and just $20.00 away from key weekly pivot

- Gold price is now awaiting the outcome of the ECB meeting on Thursday.

- US yields and US dollar are playing their role in the yellow metals decline.

- Italian politics stole the show on Wednesday ahead of central bank business.

Gold price is down 0.85% at $1,696,84 as the US dollar strengthens which left XAUUSD for December delivery down US$10.40 to US$1,717.70. Still, the spot gold price is below the psychological threshold and traders are eyeing a move to the weekly pivot of $1,676. Bonds and the US dollar are picking up the bid from safe-haven flows making the yellow metal more expensive for international buyers. Markets are second-guessing the Federal Reserve's next move but will be distracted by Thursday's European Central Bank decision, political turmoil in Italy and key US data before the showdown FOMC meeting taking place on July 26/27 July.

Gold price pressured by US yields edging higher, firm US dollar

Bond yields and the US dollar were firmer on Wednesday which weighed on the gold price, bearish for gold since it offers no interest to investors seeking yield with their idle capital. The US 10-year note was last seen paying 3.032%, up 0.1 basis points in early Asia after bond investors balanced their positions ahead of another Federal Reserve meeting next week. A strong US 20-year bond auction helped to support bond values on the longer end of the curve, pushing their yields lower compared with those with shorter-term maturities and keeping the curve inverted. However, the inversion is regarded as a risk to markets as it warns of aggressive Fed hikes that might be expected to send the US economy over the edge.

Meanwhile, the US dollar gains were capped ahead of the crucial European Central Bank policy decision on Thursday. The greenback, as measured by the DXY, hit 107.252 before slumping towards 107.00 in late New York trade. The majority of the leg work in forex was centred around the euro due to political uncertainties in Italy as well as the ECB.

EUR/USD could be a driver for gold price on Thursday

EUR/USD has rallied about 2% in the last three trading sessions as markets get prepared for a possible 50 basis point rate hike by the ECB. However, it came up against bears on Wednesday due to the prospects of Italian politics plunging into months of upheaval surrounding the resignation of the prime minister, Mario Draghi.

Read more here: Italian PM Draghi will announce his resignation in the chamber tomorrow

The ECB meeting meanwhile will come to the forefront of Thursday's trading activity and the outcome would be expected to move the needle in forex and ultimately in the gold price as a bi-product of what happens to the US dollar.

ECB outlook

The European Central Bank

The ECB is expected to hike by 25bps and announce an anti-fragmentation tool. However, the risk of a 50bps hike has grown materially and is almost a coin toss as analysts at TD Securities argued. ''it is the sensible outcome to the meeting, but goes against recent communications.''

With regards to how the outcomes and scenarios might play out in forex, the analysts make a case for a buy the rumour, sell the fact playbook. ''Markets should respect the risk for a 50bp 'surprise'. But in doing so, the ECB is pulling forward its limitations to tighten aggressively later in its cycle as energy constraints risk choking-off domestic demand. A move to 1.0340/00 in EURUSD risks being a fade.''

US dollar holds below a 20-year peak ahead of PMI & Fed

The US dollar is trying to establish below the 20-year highs but from a daily perspective, the price is hovering over a void of offers that leaves 105.27 vulnerable should DXY bears continue to hit the bids. Gold traders will be keeping a close eye on price action at this juncture. Meanwhile, beyond the ECB, key US PMI data will be eyed. Analysts at TD Securities explained, ''business surveys fell markedly in June, led by broad declines in the S&P Global PMIs. The manufacturing index, in particular, posted a large retreat to 52.7 from 57.0 in May.''

'While we look for relief in the pace of declines in the mfg PMI, we still expect it to register a new drop in the flash estimate. Conversely, we expect a steady number for the services index after recent declines.''

The Federal Reserve is around the corner and for the time being, ''gold prices are being supported by the markets' repricing for odds of a 100bp hike after Fedspeak from notable hawks has pushed back against this narrative, which is raising the risk of a near-term short-squeeze,'' analysts at TD Securities argued. ''Notwithstanding, this scenario would create the ideal set-up for additional downside in the yellow metal.''

Gold price technical analysis

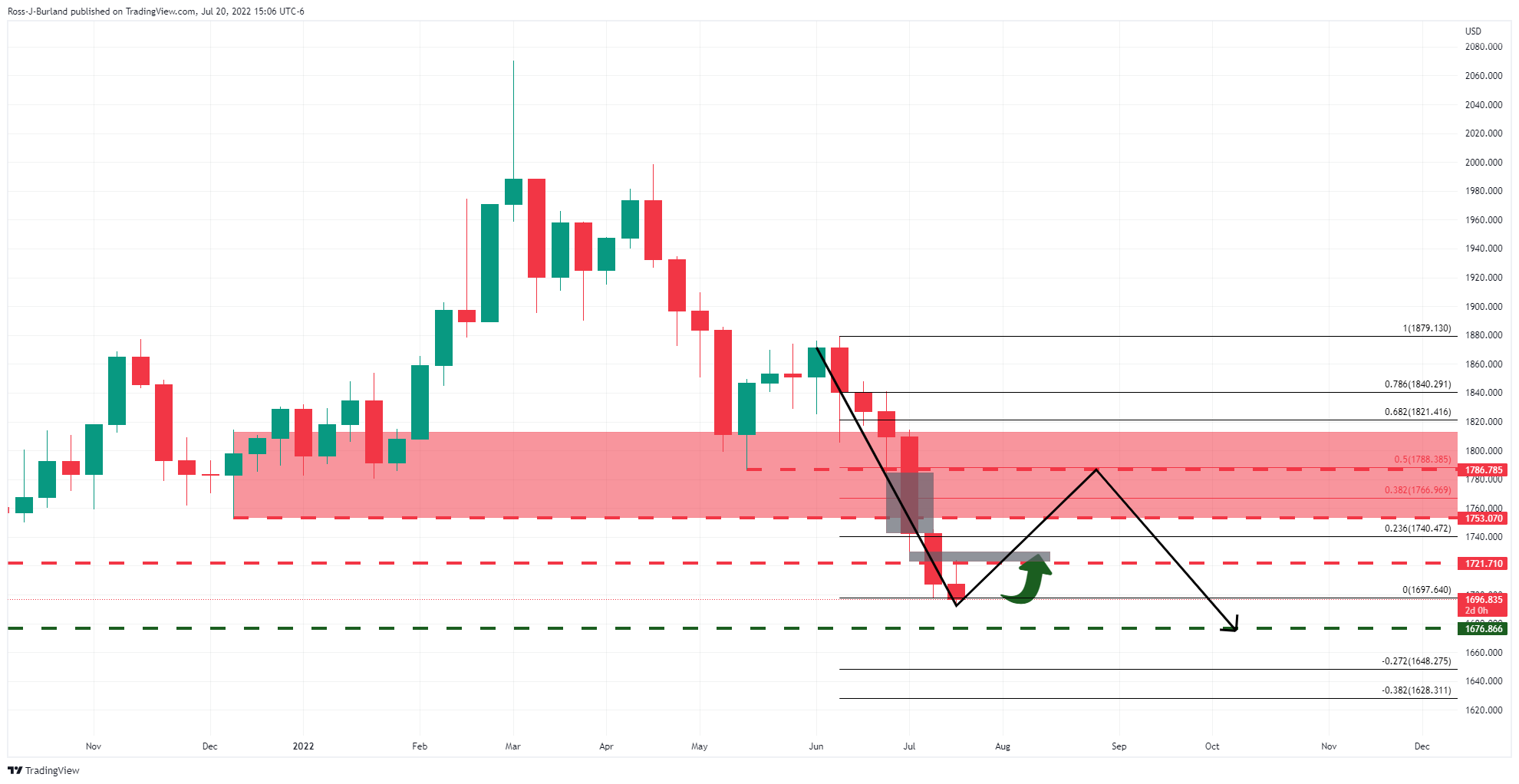

Gold price, from a weekly perspective, the bull correction has stalled and bears are moving in again. This puts the lows of $1,676.86, as illustrated on the chart below and up for grabs from a technical perspective:

The greyed-out areas on the chart above are void of bids which could draw XAUUSD to test the commitments of bears near a 50% mean reversion. On the way there, however, we have a couple of major pivot points that could offer resistance at $1,721 and $1,753. On the other hand, if the bears stay committed, the $1,677 pivot area could be hit sooner than later.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.