- Analytics

- News and Tools

- Market News

- When is the UK inflation and how could it affect GBP/USD?

When is the UK inflation and how could it affect GBP/USD?

The UK CPIs Overview

The cost of living in the UK as represented by the Consumer Price Index (CPI) for June month is due early on Wednesday at 06:00 GMT. June’s inflation data will be keenly watched by the GBP/USD traders as a positive side deviation in overall and core inflation figures will strengthen the odds of a consecutive 50 basis point (bps) rate hike by the Bank of England (BOE). Also, it will add downside pressure on already vulnerable Gross Domestic Product (GDP) numbers.

As per the market consensus, the annual UK Inflation may refresh the four-decade high at 9.3% vs. 9.1% reported earlier. While the Core CPI that doesn’t include volatile food and energy prices is expected to shift lower to 5.8% against the prior print of 5.9%. Talking about the monthly figures, the CPI is seen as stable at 0.7%.

The investing community should note that the downbeat Average Hourly Earnings, stable Unemployment Rate, and decent slippage in Claimant Count Change highlight the Producer Price Index (PPI) as an important catalyst for the immediate GBP/USD direction. That being said, the PPI Core Output YoY may shift higher to 15.5% against the prior release at 14.8% on a non-seasonally adjusted basis. Adding to that, the monthly print may increase to 2% versus 1.5% reported earlier.

Furthermore, the Retail Price Index (RPI) is also on the table for release and is expected to rise minutely to 11.8% YoY from 11.7% prior while the MoM prints could hit 0.8% from 0.7%, as recorded in previous readings.

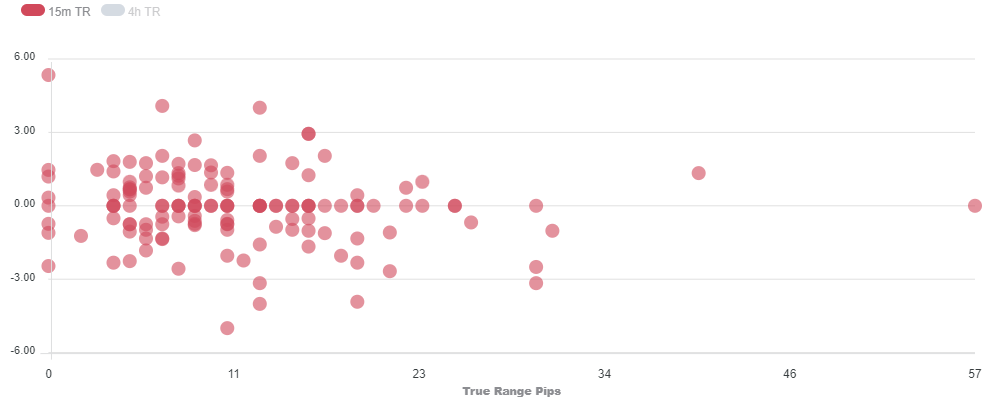

Deviation impact on GBP/USD

How could it affect GBP/USD?

GBP/USD is displaying an upbeat performance after a firmer rebound below the psychological support of 1.2000 in early Tokyo. The cable is poised to record more gains despite accelerating odds of more complexity for the households in the UK. The release of the unchanged Unemployment Rate at 3.8% and slippage in Claimant Count Change at 20k will delight the Bank of England (BOE) to tighten policy further. However, a significant plunge in Average Hourly Earnings is going to torture the pound bulls when the dust over the inflation rate in the US economy will settle.

The economic data plunged to 6.2% from the expectations of 6.9% and the prior release of 6.8%. The investing community is aware of the fact that the UK economy is already facing the headwinds of higher price pressures led by higher energy bills and food prices. Lower earnings along with price pressures are going to hurt the sentiment of the market participants dramatically.

Technically, the cable has established above the psychological resistance of 1.2000. The pair has breached a prolonged Falling Channel on the upside and is poised to register a two-week high above 1.2056. Short-to-long term Exponential Moving Averages (EMAs) are scaling higher on medium-range timeframe.

Keynotes

GBP/USD Forecast: Next bullish target aligns at 1.2060

GBP/USD Analysis: Descending channel breakout in play, UK jobs data eyed for fresh impetus

About the UK CPIs

The Consumer Price Index released by the Office for National Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of GBP is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or Bearish).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.