- Analytics

- News and Tools

- Market News

- US Dollar Index remains firm and prints new YTD peaks

US Dollar Index remains firm and prints new YTD peaks

- The index fades the recent weakness and clinches new 2022 peaks.

- US yields show some signs of recovery across the curve.

- Weekly Claims, Producer Prices next on tap in the US docket.

The greenback, in terms of the US Dollar Index (DXY), leaves behind two consecutive daily drops and advances to new cycle tops past 108.60 on Thursday.

US Dollar Index looks stronger post-CPI

The index resumes the upside following a brief correction and trades in fresh peaks beyond 108.60, an area las visited in October 2002.

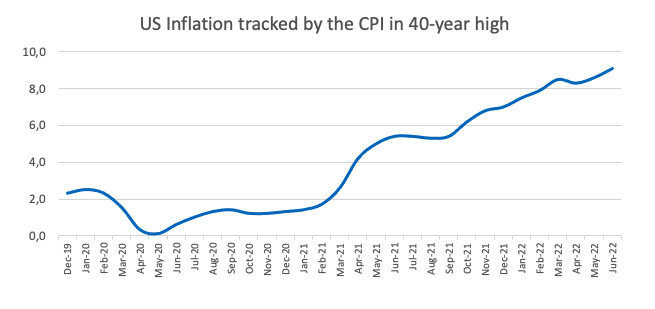

The move higher in the dollar appears to be supported by renewed speculation of a full-point interest rate hike at the next Fed gathering on July 27. This view was particularly exacerbated after the US inflation rose more than estimated in June, running at new 40-year highs beyond 9% YoY.

Further tailwinds for the greenback come, as usual, from the unabated weakness in the risk complex, which in turn appears reinvigorated by the likelihood of a recession in the euro area amidst the persevering energy crunch.

In the US docket, June Producer Prices are due along with the usual weekly Claims. In addition, the Fed’s black-out period kicks in today.

What to look for around USD

The index pushed higher and clinched new cycle highs past 108.60 on Thursday. It is worth noting, however, that the recent sharp move in the dollar comes largely in response to the accelerated decline in the euro and persistent uncertainty around a potential recession in the old continent.

Further support for the dollar is expected to come from the Fed’s divergence vs. most of its G10 peers (especially the ECB) in combination with bouts of geopolitical effervescence and the re-emergence of the risk aversion among investors. On the flip side, market chatter of a potential US recession could temporarily undermine the uptrend trajectory of the dollar somewhat.

Key events in the US this week: Producer Prices, Initial Claims (Thursday) – Retail Sales, Industrial Production, Flash Consumer Sentiment, Business Inventories (Friday).

Eminent issues on the back boiler: Hard/soft/softish? landing of the US economy. Escalating geopolitical effervescence vs. Russia and China. Fed’s more aggressive rate path this year and 2023. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is up 0.45% at 108.50 and a break above 108.63 (2022 high July 14) would expose 108.74 (monthly high October 2002) and then 109.00 (round level). On the flip side, the next support aligns at 103.67 (weekly low June 27) seconded by 103.41 (weekly low June 16) and finally 101.29 (monthly low May 30).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.