- Analytics

- News and Tools

- Market News

- EURUSD faces pressure at 1.0050 on stable German Inflation, US Inflation eyed

EURUSD faces pressure at 1.0050 on stable German Inflation, US Inflation eyed

- EURUSD has faced selling pressure around 1.0500 on stable Germany Inflation data

- Eurozone is advancing towards a large real income shock amid a delay in policy tightening.

- A situation of higher inflation and lower Average Hourly Earnings will reduce consumption and savings.

The EURUSD pair has resumed its downside journey as Germany's Harmonized Index of Consumer Prices (HICP) has landed stable at 8.2%. Earlier, the asset was displaying back-and-forth moves in a narrow range of 1.0023-1.0047 in the Asian session after a mild correction from 1.0074. The asset has turned sideways after dropping below the magical figure of 1.0000 on Tuesday after almost two decades of time. The sideways movement is not warranting any bullish reversal as the ongoing inventory distribution is hinting at more losses ahead.

The US dollar index (DXY) has displayed some exhaustion signals after printing a fresh 19-year high of 108.56 on Tuesday. The loss of momentum after a significant high indicates that the intermittent high is available for reference. In today’s session, the DXY has delivered a lackluster performance and the downside move will be witnessed by the market participants if it loses the opening price level at 108.15.

Also Read: EUR/USD Forecast: Tepid bounce hints at a bearish breakout

Inflation fears catch headlines

Stable print for Germany HICP

The European session will be filled with gigantic volatility as the Federal Statistics Office has reported Germany's HICP at 8.2%, in line with the estimates and the prior release. This has accelerated the odds of a rate hike by the European Central Bank (ECB). Apart from that, more European countries will also report their HICP. France's Consumer Price Index (CPI) is seen at 6.5% while Spain’s HICP may land at 8.5%.

Large income shocks seem real for Eurozone

Price pressures are hot red in eurozone and the European Central Bank (ECB) has not elevated its interest rates yet. Unlike, the other Western leaders, the ECB’s interest rates are grounded at zero. However, the Asset Purchase Program (APP) has been concluded but soaring price pressures demand more rate hike measures. There is no denying the fact that higher energy bills and food prices have depreciated the real income of the households and any delay in policy tightening may result in large income shocks.

Consequences of higher consensus for US Inflation

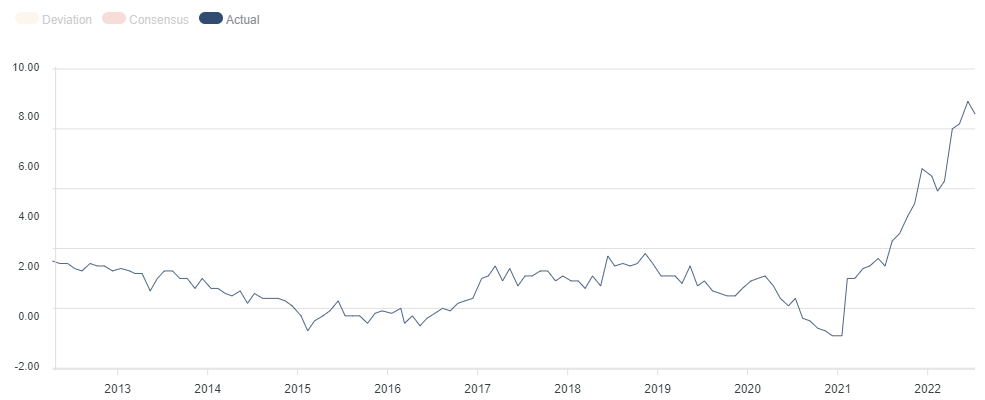

A preliminary estimate for the US CPI is 8.8%, higher than the prior release of 8.6%. While the core CPI may decline to 5.7% vs. 6% recorded earlier.

Taking into account the last week’s US employment data, the Average Hourly Earnings remained lower than their prior print. A situation of a higher inflation rate and lower Average Hourly Earnings will reduce the consumption and savings by the households significantly, which may have adverse effects on the growth prospects.

-637932901205197685.png)

Negative Divergence in plain-vanilla CPI and core CPI

Considering the prior release of 8.6%, the mathematics indicates an increment in the annual inflation rate by 20 basis points (bps). However, the impact of energy bills and food products is more than that.

The core Consumer Price Index (CPI) that doesn’t inculcate oil and food prices may slip to 5.7% from the prior release of 6%. A simultaneous increase in plain-vanilla CPI and a fall in core CPI indicate that the impact of oil food prices is more than expected.

EURUSD technical analysis

The EURUSD pair is overlapping the 20-period Exponential Moving Average at 1.0040 and is hinting at a volatility squeeze ahead of the mega-events. Also, the descending 50-period EMA at 10061 indicates that the short-term trend is bearish.

A range shift by the Relative Strength Index (RSI) (14) to 40.00-60.00 indicates that the shared currency bulls are not bearish for a while. However, a downside break of 40.00 will activate a fresh downside impulsive wave.

On an hourly scale, the asset has witnessed hurdles around July 8 low at 1.0072, which acted as a major cushion. A phase of inventory distribution is ongoing in a range of 1.0000-1.0074, which may turn into an initiative selling structure if the asset drops below the magical figure of 1.0000 decisively. This will drag the asset towards November 2020 low at 0.9880, followed by June 2000 high at 0.9701.

While a confident move above July 8 high at 1.0191 will drive the asset towards June 6 high at 1.0277. A breach of the latter will expose the asset to hitting June 1 low at 1.0366.

Summing up the whole context, the magical figure of 1.0000 is very much crucial for the eurozone bulls. The violation of the same could collapse the shared currency.

EURUSD: Hourly Chart

-637932885446875938.png)

Elliott Wave trading strategies: DAX 40, FTSE 100, STOXX 50, Dollar Index, EUR/USD [Video]

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.