- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bears extending the bear cycle ahead of critical US CPI

Gold Price Forecast: XAU/USD bears extending the bear cycle ahead of critical US CPI

- Gold is under pressure as the greemback contiunues to pick up the bids.

- The US CPI event is stacking up to be critical for markets this week.

Gold is back under pressure and establishing fresh lows for the week within the bearish cycle as markets flip risk-off in the latter part of the New York session with the Dow printing fresh lows and down 1% at the time of writing. In turn, the US dollar is climbing the board in a correction as per the DXY index. At $1,725.00, gold is down 0.5% while DXY is moving back towards a flat position for the day at 108.15.

The US dollar's strength comes ahead of this week's key US inflation data, both of which are headwinds for the US stock market during the earnings season. Should the US dollar continue on its bullish trajectory, this will be a headwind for the company's results and in turn, the recession fears would be expected to continue supporting the greenback and pressuring gold.

The event to watch will be Wednesday's Consumer Price Index report which is expected to show the largest jump since 1981, to 8.8% YoY. The expectations have led to a massive liquidation in the gold market. ''While the steepest outflows from broad commodity funds since the Covid-19 crisis sparked a cascade of selling, including from CTA funds, another strong inflation print could still fuel additional downside,'' analysts at TD Securities said.

''Indeed, the coming data could be particularly concerning for gold prices given the still extremely bloated length remaining in gold markets from proprietary traders. We have previously cautioned that the substantial size accumulated by this cohort during the pandemic appears complacent in the face of a steadfastly hawkish Fed. In a liquidation vacuum, these positions are now vulnerable, which suggests the yellow metal remains prone to further downside still.''

Gold technical analysis

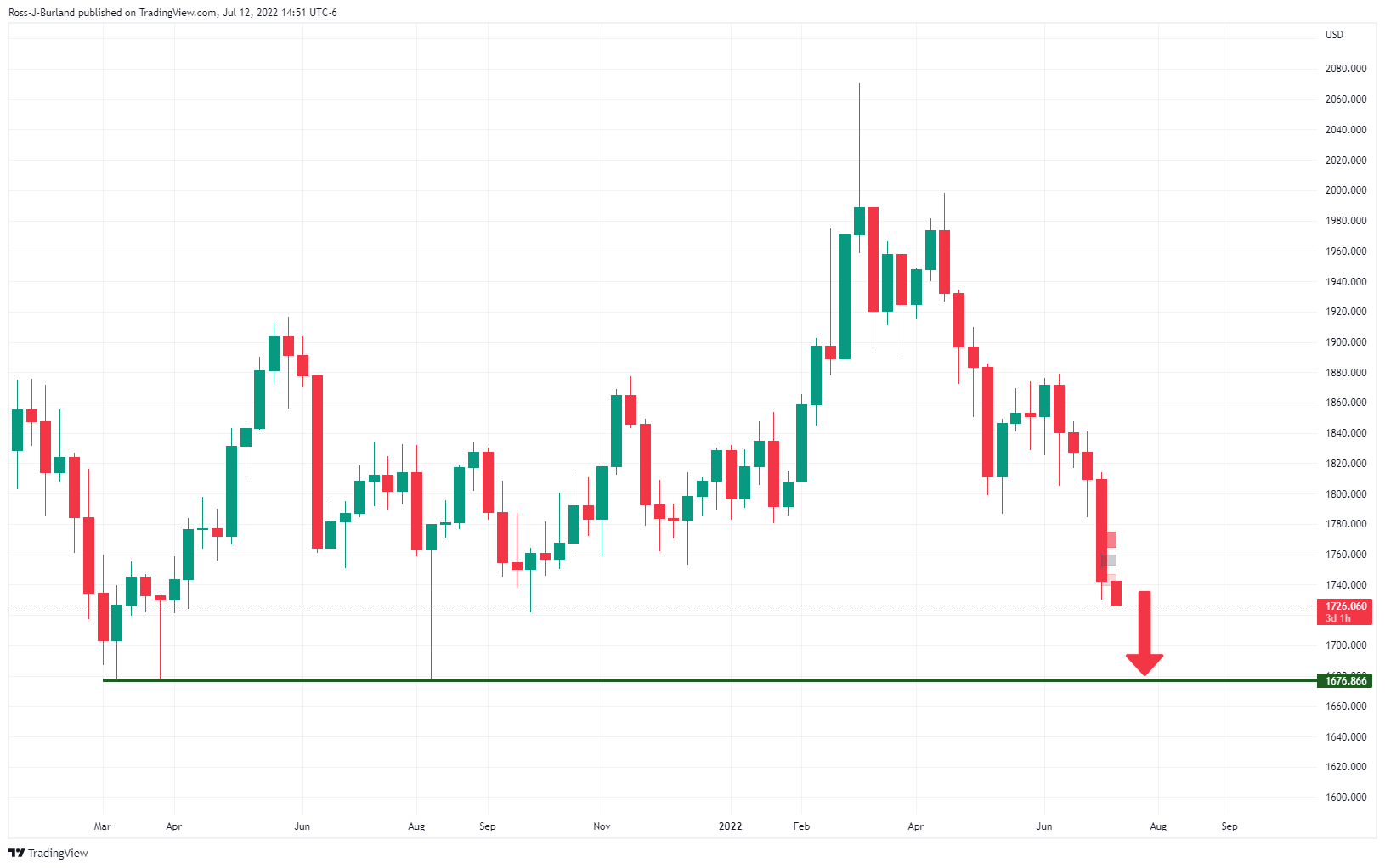

The consolidation is being drawn out but could well be turning into a breakout of redistribution indicating lower prices to come for the foreseeable future. In prior analysis, a potential spring in a phase of possible accumulation was identified on the 4-hour chart which has now been invalidated with lower closes:

As illustrated, the price has deteriorated into fresh lows which pits the emphasis on the downside, although does not completely invalidate the prospects of continued sideways action.

There is still the possibility of a move higher if the bulls commit but the likelyhood is gearing up to be a move lower in an extension of supply following the bullish correction:

This will put the focus on the weekly lows from a longer term perspective:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.