- Analytics

- News and Tools

- Market News

- EUR/USD: Bears face paramount hurdle at parity

EUR/USD: Bears face paramount hurdle at parity

- EUR/USD remains offered and challenges parity.

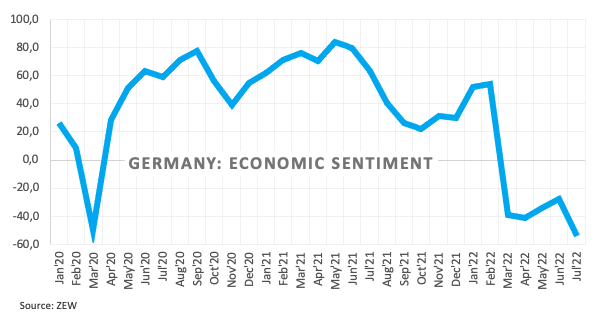

- Germany Economic Sentiment plunges in July.

- German 10y Bund yields drop to 3-day lows near 1.12%.

Sellers remain well in control of the sentiment around the European currency and prompt EUR/USD to struggle around the parity level on Tuesday.

EUR/USD in nearly 2-decade lows

EUR/USD sheds ground for the second session in a row and flirts with the crucial parity level for the first time since December 2002, as the sour mood persists among market participants.

Indeed, market chatter around the likelihood of a recession in the euro area appears reinforced on Tuesday after the Economic Sentiment tracked by the ZEW Institute in both Germany and the broader Euroland deteriorated beyond estimates for the month of July.

In addition, the risk aversion continues to swell in the global markets, adding an extra layer of weakness to the single currency and the rest of the risk galaxy.

There are no more data releases in the euro area on Tuesday, whereas the IBD/TIPP Economic Optimism index and the NFIB Business Optimism Index along with the speech by Richmond Fed T.Barkin are all due later in the NA session.

What to look for around EUR

Bears maintain the EUR/USD under heavy pressure and the acceleration of the downside opens the door to a probable visit to the parity level any time soon.

In the meantime, the price action around the single currency continues to follow increasing speculation of a probable recession in the euro area, dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence.

Key events in the euro area this week: Germany, EMU ZEW Economic Sentiment (Tuesday) – Germany Final Inflation Rate, EMU Industrial Production (Wednesday) – EMU Balance of Trade (Friday).

Eminent issues on the back boiler: Fragmentation risks. Kickstart of the ECB hiking cycle in July? Asymmetric economic recovery post-pandemic in the euro bloc. Impact of the war in Ukraine on the region’s growth prospects and inflation.

EUR/USD levels to watch

So far, spot is down 0.33% at 1.0005 and faces the next contention at 1.0000 (2022 low July 12) seconded by 0.9859 (low December 2002) and finally 0.9685 (low October 2002). On the upside, a breakout of 1.0515 (55-day SMA) would target 1.0615 (weekly high June 27) en route to 1.0773 (monthly high June 9).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.