- Analytics

- News and Tools

- Market News

- USD/JPY Price Analysis: Bulls take on fresh bull cycle highs, but how far can this run?

USD/JPY Price Analysis: Bulls take on fresh bull cycle highs, but how far can this run?

- USD/JPY has been a head-turner at the start of the week.

- The pair has rallied to fresh bull cycle highs, but corrections are anticipated.

The US dollar soared to a 24-year high on the yen following Japan's ruling conservative coalition's strong election showing indicated no change to loose monetary policies. This has seen the pair move deeper into blue skies making analysis to the upside a tricky task. 109.77 is the Sep 2002 high in the DXY which leaves plenty of room for USD/JPY to move higher.

The dollar has already climbed to as high as 137.75, its firmest since late 1998. However, corrections are anticipated along the way and the following illustrates the potential trajectory for the pair on a multi-timeframe basis:

USD/JPY monthly chart

The pair is showing no signs of slowing and it is feasible for it to add to today's gains this week. But the question is how far can this run before pulling back?

USD/JPY daily chart

The bulls have taken out prior highs following a higher low. The old highs come as new support.

USD/JPY hourly chart

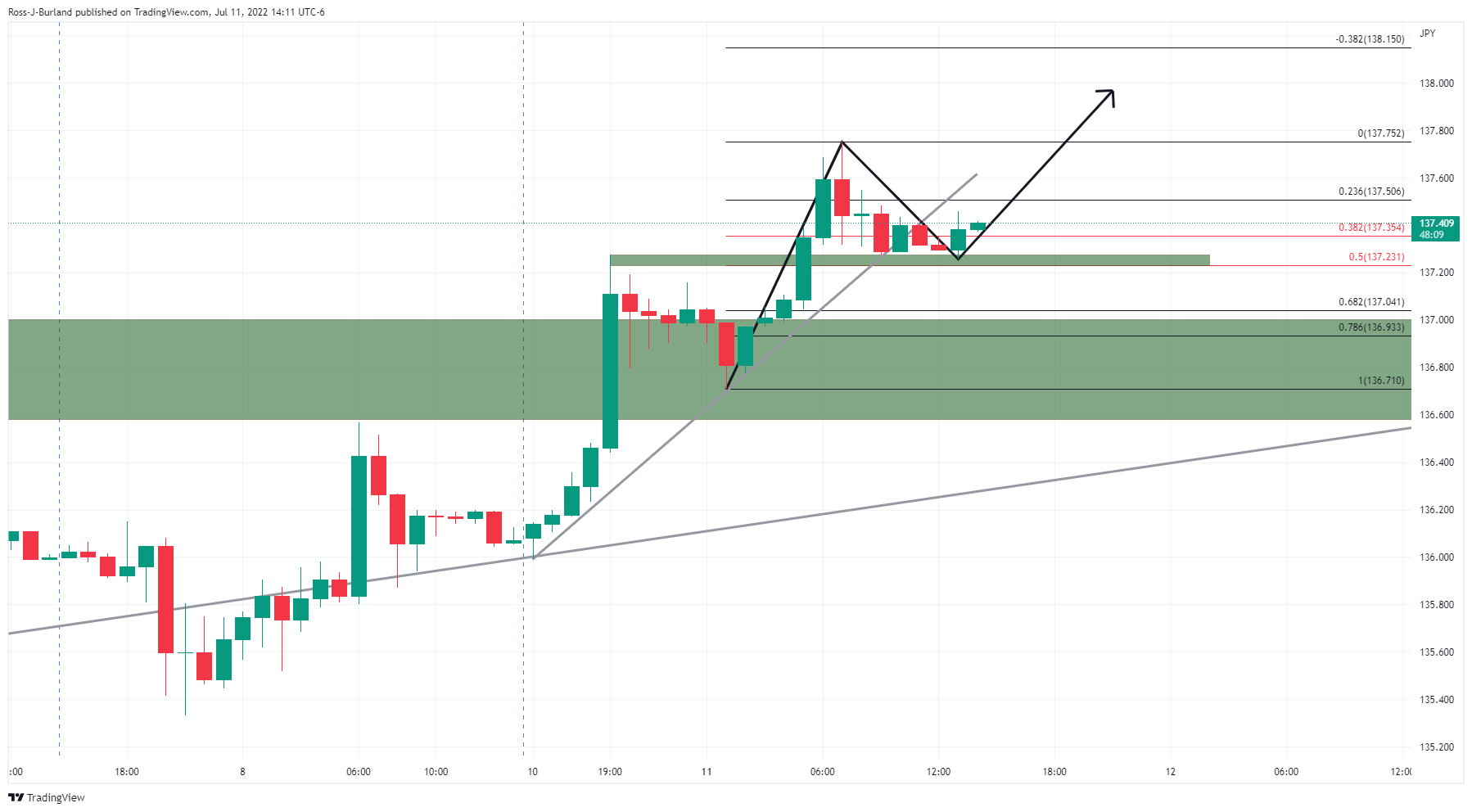

We have a classic impulse, correction and expected fresh impulse stacking up on the hourly chart with the price holding above prior highs and having made a deep 38.2% Fibonacci correction.

However, the downside cannot be ruled out given the break of the supporting trendline.

USD/JPY 15 min chart

If the downside were to play out, it could look something like the above with price imbalances, the grey boxes, being mitigated along the way as price targets.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.