- Analytics

- News and Tools

- Market News

- Gold, the Chart of the Week: XAU/USD broke the mold but bulls are moving in

Gold, the Chart of the Week: XAU/USD broke the mold but bulls are moving in

- Gold could be on the verge of a deeper correction to the upside.

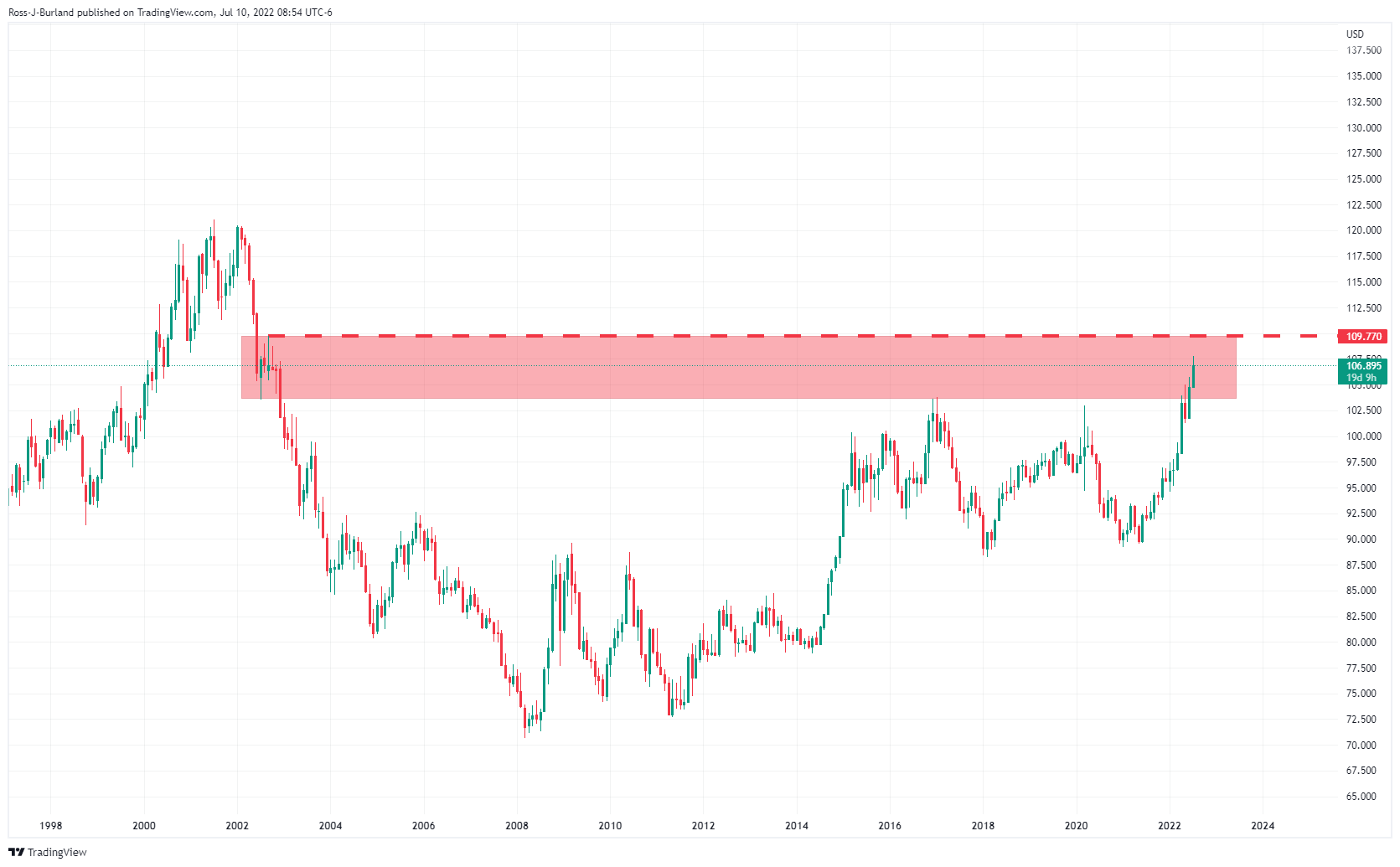

- The US dollar is showing signs of topping out in the monthly supply area.

The gold price has corrected to a 23.6% Fibonacci retracement and has left two daily dojis on the charts but a stronger than expected US Services ISM and a solid US Labor report have seen the market add 14bp to end-2022 Fed Funds pricing.

This leaves the US dollar in charge and will keep pressure on gold which hovers above a fresh nine-month low as investors continue to slash their holding of the precious metal. Gold-backed ETFs have seen their holdings fall by 39t over the past week to their lowest level in almost four months.

Nevertheless, the spot market is attempting to correct both on the DXY and gold charts as follows:

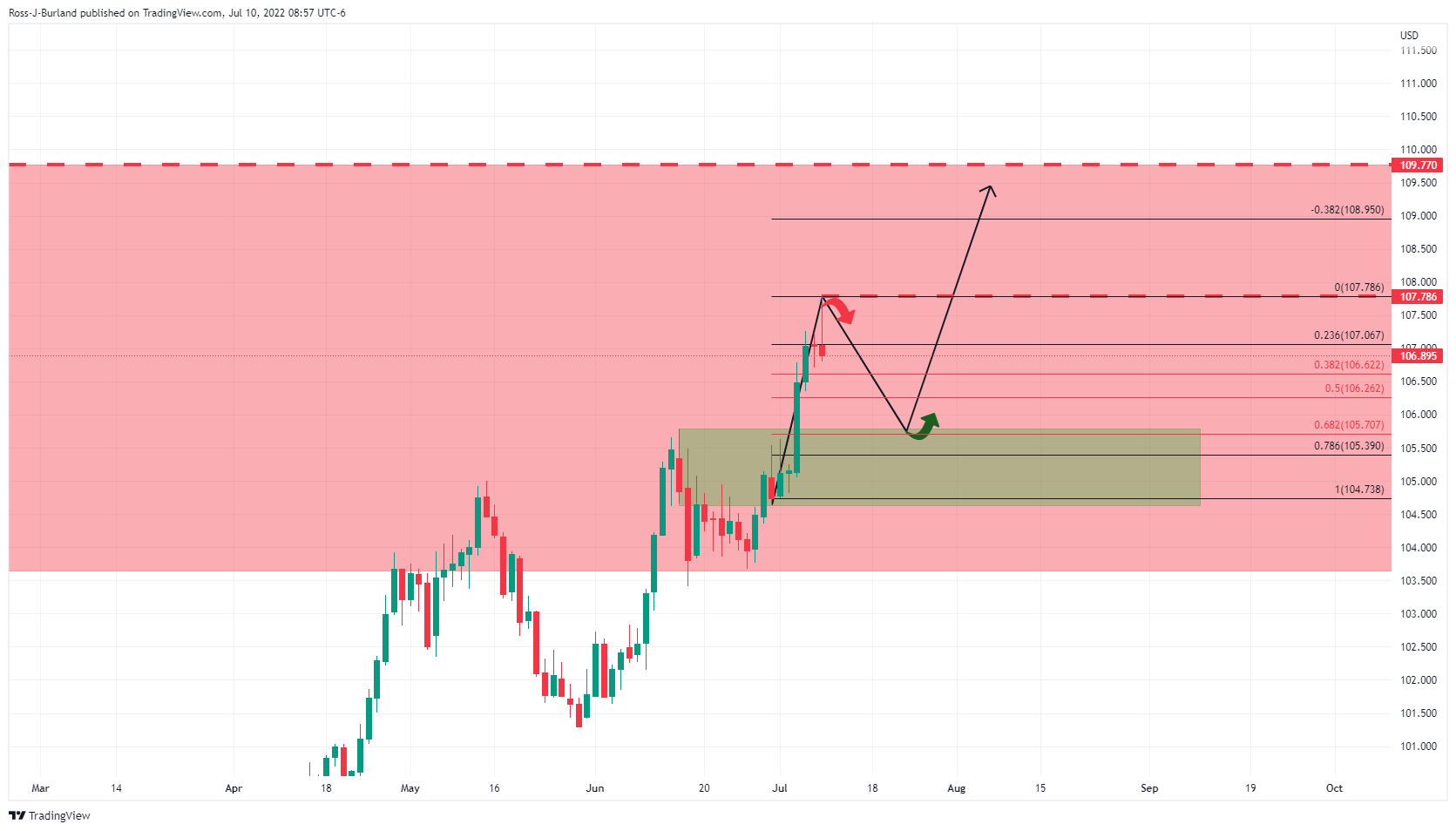

DXY daily chart

The DXY is meeting a monthly supply area that could hold off the bulls for a moment giving rise to prospects of a correction on the daily chart as it appears to top out near 107.80. A 61.8% Fibonacci retracement sits near prior swing highs near 105.70. If this were to play out, we would have had a bullish setup in gold for the week ahead.

Gold daily chart

Gold, H4 chart

The question is whether the last low was the spring, otherwise known as the final test lower and commitments from the bulls. A break of $1,750 will be encouraging. On the hourly chart, we have seen a 50% mean reversion and retest of what could be the spring so a bullish open could set the stage for a significant bullish breakout as per the hourly chart:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.