- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAUUSD rebound appears elusive below $1,755, US NFP eyed – Confluence Detector

Gold Price Forecast: XAUUSD rebound appears elusive below $1,755, US NFP eyed – Confluence Detector

- Gold Price fades recovery from yearly low as traders await US employment numbers for June.

- Risk-aversion underpins US dollar even if policymakers talk down recession woes.

- XAU bulls battle key resistance area while bracing for a bumpy road to the north, supports seem weak.

Gold Price (XAUUSD) remains pressured towards the yearly low as geopolitical concerns join fears of global economic slowdown, despite the Fed policymakers’ efforts to tame recession woes. The risk-aversion wave also takes clues from the inverted yield curve between the 2-year and 10-year US Treasury yields. It’s worth noting, however, that chatters surrounding China’s $220 billion stimulus and the Sino-American trade peace put a floor under the gold prices. Also keeping the buyers hopeful are recently mixed US data and the latest gains in equities ahead of the Q2 2022 earnings season. That said, the metal’s further weakness hinges on the US Nonfarm Payrolls, expected post the lowest monthly increase in jobs since April last year.

Also read: US June Nonfarm Payrolls Preview: Analyzing gold's reaction to NFP surprises

Gold Price: Key levels to watch

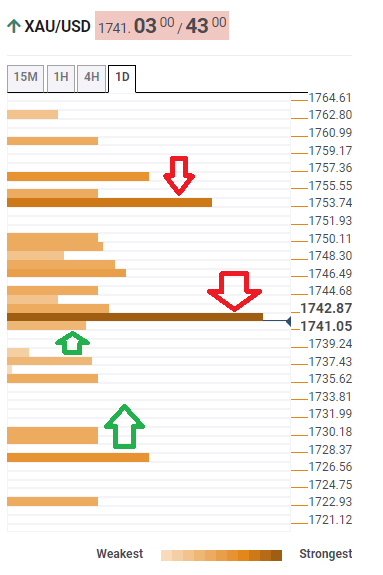

The Technical Confluence Detector shows that Gold Price pokes the key resistance near $1,743 comprising Fibonacci 61.8% one-day and SMA 5 and 10 on four-hour, as well as SMA 10 on the hourly play.

Following that, upper Bollinger Bank on one-hour and Fibonacci 23.6% one-day could test the bulls around $1,747.

In a case where the XAUUSD rises past $1,747, the monthly Pivot Point S2 near $1,754 will act as the last defense for bears.

Alternatively, the weekly Pivot Point S3 near $1,727 could lure the gold sellers if prices fail to defend the $1,740 round figure.

It’s worth noting that multiple small supports around $1,735 and $1,730 could also entertain XAUUSD bears.

Here is how it looks on the tool

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.