- Analytics

- News and Tools

- Market News

- USD/CHF Price Analysis: Retreats from 21-DMA below 0.9700, snaps three-day uptrend

USD/CHF Price Analysis: Retreats from 21-DMA below 0.9700, snaps three-day uptrend

- USD/CHF consolidates the biggest daily gains in three week around a fortnight top.

- Impending bull cross on MACD, sustained trading beyond 100-DMA favor buyers.

- 50-DMA, 38.2% Fibonacci Retracement appears important nearby hurdle to watch.

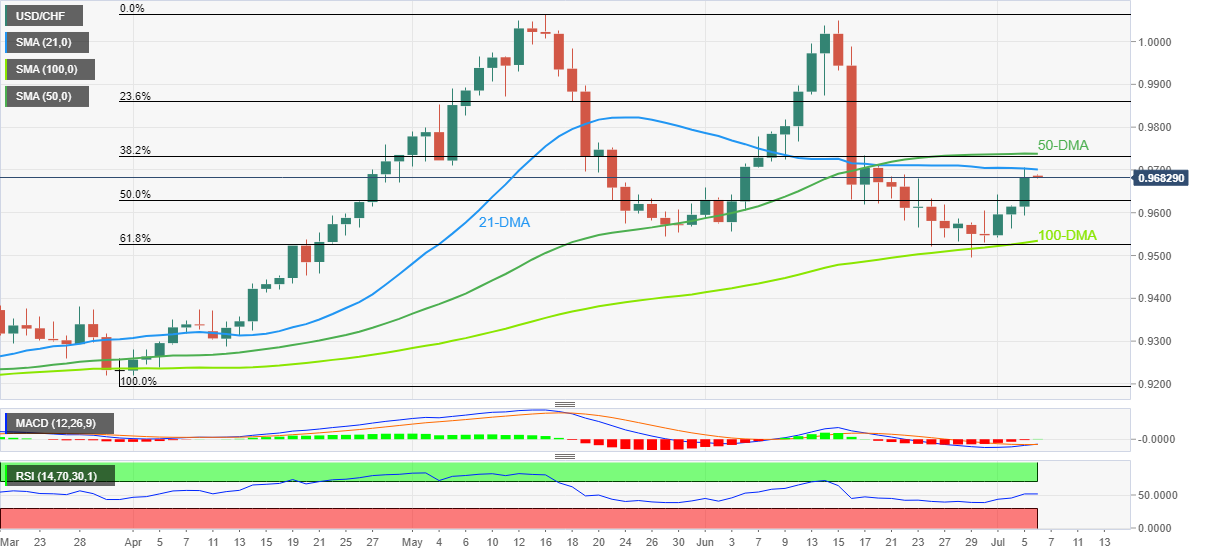

USD/CHF eases from a fortnight high as buyers take a breather around 0.9680, after rising the most in three weeks, during Wednesday’s Asian session. In doing so, the Swiss currency (CHF) pair prints the first intraday loss in four while reversing from the 21-DMA.

Despite the U-turn from the 21-DMA resistance of 0.9700, the USD/CHF remains on the bull’s radar due to the looming bullish signals on the MACD, as well as firmer RSI (14).

Also keeping USD/CHF buyers hopeful is the pair’s successful rebound from the 100-DMA and the 61.8% Fibonacci retracement (Fibo.) of March-May upside.

That said, the quote’s upside break of the 0.9700 DMA resistance isn’t an open invitation to the bulls as a convergence of the 50-DMA and the 38.2% Fibo highlights 0.9740 as an important hurdle for the buyers to cross.

Following that, a run-up towards the 23.6% Fibonacci retracement and the yearly high, respectively near 0.9860 and 1.0065, can’t be ruled out.

Alternatively, pullback moves may revisit the 50% Fibonacci retracement level surrounding 0.9630.

However, the 100-DMA and the 61.8% gold ratio, near 0.9530, appear crucial for the USD/CHF bears to watch to retake control.

USD/CHF: Daily chart

Trend: Further upside expected

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.