- Analytics

- News and Tools

- Market News

- USD/TRY remains bid near 16.80 post-CPI

USD/TRY remains bid near 16.80 post-CPI

- USD/TRY adds to recent gains and approaches 16.80.

- Türkiye annual CPI climbed further in June.

- Producer Prices in Türkiye rose nearly 140% YoY.

The Turkish lira remains on the defensive and lifts USD/TRY to new daily highs in the 16.80 region at the beginning of the week.

USD/TRY on its way to 17.00

USD/TRY advances for the third session in a row on Monday and slowly approaches the key barrier at the 17.00 yardstick. Indeed, after bottoming out near 16.00 on June 27, the lira already depreciated more than 4%, reflecting the persistent scepticism in the FX community regarding any attempt of the government/central bank to fight the bearishness surrounding the currency.

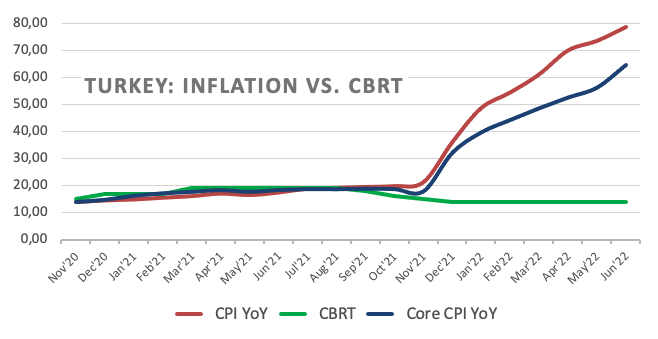

The pair edges higher despite the dollar gives away part of recent gains and after inflation figures in Türkiye showed consumer prices rising at an annualized 78.62% in the year to June and 4.95% on a monthly basis. The Core CPI rose 64.42% YoY and Producer Prices increased 138.31% over the last twelve months.

What to look for around TRY

USD/TRY looks to consolidate the sharp rebound from 16.00 neighbourhood, as investors continue to digest the latest announcement by the Turkish banking watchdog (BDDK) on June 27.

So far, the lira’s price action is expected to keep gyrating around the performance of energy prices, the broad risk appetite trends, the Fed’s rate path and the developments from the war in Ukraine.

In addition, the effects of this new measure aimed at supporting the de-dolarization of the economy will also have its say, at least in the very short term.

Extra risks facing the Turkish currency also come from the domestic backyard, as inflation gives no signs of abating, real interest rates remain entrenched in negative figures and the political pressure to keep the CBRT biased towards low interest rates remain omnipresent.

Key events in Türkiye this week: Inflation Rate, Producer Prices (Monday) – Current Account (Friday).

Eminent issues on the back boiler: FX intervention by the CBRT. Progress (or lack of it) of the government’s new scheme oriented to support the lira via protected time deposits. Constant government pressure on the CBRT vs. bank’s credibility/independence. Bouts of geopolitical concerns. Structural reforms. Presidential/Parliamentary elections in June 23.

USD/TRY key levels

So far, the pair is gaining 0.37% at 16.7900 and faces the immediate target at 17.3759 (2022 high June 23) seconded by 18.2582 (all-time high December 20) and then 19.00 (round level). On the other hand, a breach of 16.0365 (monthly low June 27) would pave the way for a test of 15.6684 (low May 23) and finally 15.3019 (100-day SMA).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.