- Analytics

- News and Tools

- Market News

- USD/CHF Price Analysis: Fades bounce off 61.8% Fibo. below 0.9600

USD/CHF Price Analysis: Fades bounce off 61.8% Fibo. below 0.9600

- USD/CHF fails to extend the corrective pullback from two-month low.

- Bearish MACD signals, sustained break of previously key support line favor sellers.

- 21-EMA adds strength 0.9690 hurdle, 100-EMA offers immediate support.

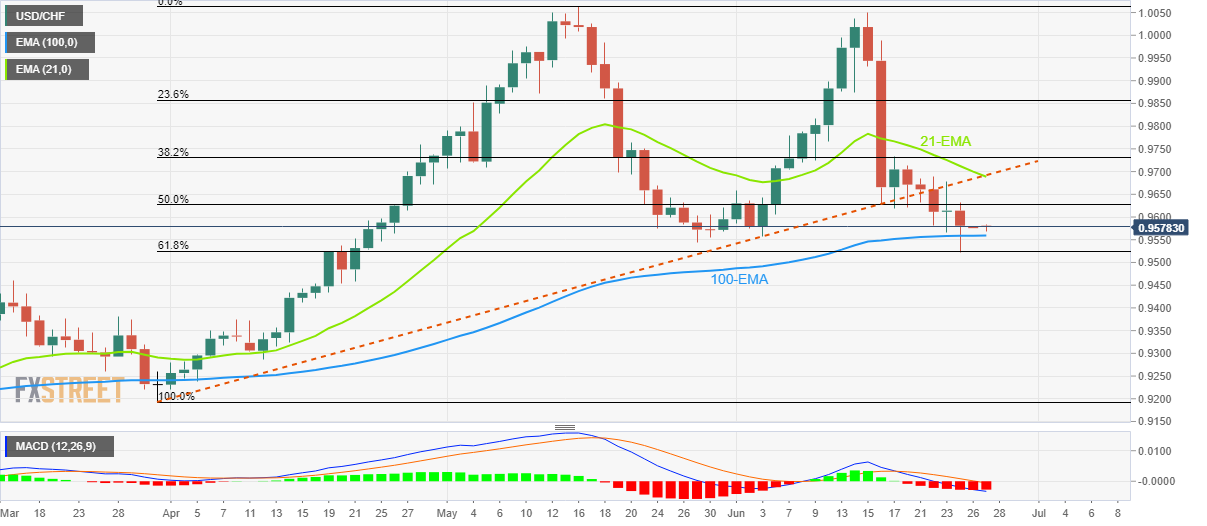

USD/CHF remains pressured around 0.9580, after declining for the last two weeks, as it fades bounce off the 61.8% Fibonacci retracement level of April-May upside. In doing so, the Swiss currency (CHF) pair eyes to refresh the two-month low during Monday’s initial Asian session.

Not only the failures to rebound but the bearish MACD signals and successful trading below the support-turned-resistance line from late March also keep sellers hopeful.

That said, the 100-EMA level of 0.9560 appears to restrict the short-term USD/CHF downside ahead of the aforementioned key Fibonacci retracement (Fibo.) level near 0.9525.

In a case where the quote drop below 0.9525, March’s high near 0.9460 will be important to watch as a break of which won’t hesitate to direct bears towards refreshing a three-month low, currency around 0.9195.

On the contrary, recovery remains elusive until the quote stays below the confluence of the 21-EMA and the previous support line from March, around 0.9690.

It’s worth noting, however, that the 50% Fibo. near 0.9630 restricts the immediate upside of the USD/CHF pair.

Should the pair rise past 0.9690, the 0.9700 and the 38.2% Fibonacci retracement level around 0.9730 could challenge the upside momentum.

USD/CHF: Daily chart

Trend: Further downside expected

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.