- Analytics

- News and Tools

- Market News

- When is the UK inflation and how could it affect GBP/USD?

When is the UK inflation and how could it affect GBP/USD?

The UK CPIs Overview

The cost of living in the UK as represented by the Consumer Price Index (CPI) for May month is due early on Wednesday at 06:00 GMT. May’s inflation data will be keenly watched by the GBP/USD traders as a positive side deviation in overall and core inflation figures will bolster the odds of a 50 basis point (bps) rate hike by the Bank of England (BOE) and downside pressure on already vulnerable Gross Domestic Product (GDP) numbers.

The annual UK Inflation is seen refreshing the four-decade high at 9.1% vs. 9% reported earlier. While the Core CPI that doesn’t include volatile food and energy prices is expected to shift lower to 6% against the prior print of 6.2%. Talking about the monthly figures, the CPI could fall significantly to 0.6% versus 2.5% prior.

It’s worth noting that the recent pressure on average earnings and upbeat jobs report highlight the Producer Price Index (PPI) as an important catalyst for the immediate GBP/USD direction. That being said, the PPI Core Output YoY may rise from 13% to 13.7% on a non-seasonally adjusted basis whereas the monthly prints may increase to 2% versus 1.6% reported earlier. Furthermore, the Retail Price Index (RPI) is also on the table for release and is expected to rise to 11.4% YoY from 11.1% prior while the MoM prints could hit to 0.5% from 3.4% in previous readings.

In this regard, Karl Paraskevas, Chief Economist at VARIANSE said,

UK inflation is my top concern for the British pound. Economic theory suggests that relatively higher inflation should put downward pressure on the nominal exchange rate, all other considerations being equal.

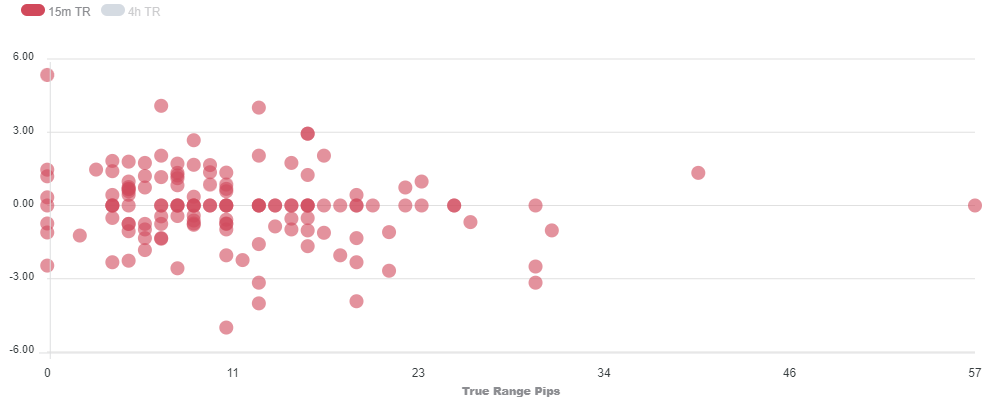

Deviation impact on GBP/USD

How could it affect GBP/USD?

GBP/USD looks vulnerable after a downside break of the round-level support of 1.2250 in the Asian session. The cable is marching downside towards 1.2200 as higher price pressures will dampen the GDP numbers further. No doubt, the labor market is getting tighter in the UK economy. Thanks to the lower Claimant Count Change at -19.7k for May and the upbeat Employment Change at 177k till March, which are supporting the BOE to dictate higher interest rate hike for July monetary policy. The jobless rate elevated to 3.8% but a figure below 4% is still manageable. However, lower growth prospects will restrict the BOE to take bold decisions without hesitation.

The UK’s Office for National Statistics reported the monthly GDP at -0.3% against the prior print of -0.1%. Also, the monthly Industrial Production tumbled to -0.6% from the expectation of 0.2%. A higher inflation rate will further dampen the UK economic data and henceforth will restrict the BOE to dictate higher interest rate hikes.

Technically, the cable is auctioning in Thursday’s range from the past three trading sessions that signal a volatility contraction. At the press time, the greenback bulls have dragged the asset below Tuesday’s low at 1.2240 and more downside looks likely if the asset drops further below Friday’s low at 1.2173. On a daily scale, the asset is trading below all short-to-long term Moving Averages (MA), which strengthens the greenback bulls.

Key notes

GBP/USD: Looks cheap for good reason

GBP/USD teases bears around 1.2250 ahead of UK inflation, Fed Chair Powell’s testimony

About the UK CPIs

The Consumer Price Index released by the Office for National Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of GBP is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or Bearish).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.