- Analytics

- News and Tools

- Market News

- USD/JPY is melting to the downside from 1998 highs, eyes on 136.06, BoJ minutes released

USD/JPY is melting to the downside from 1998 highs, eyes on 136.06, BoJ minutes released

- USD/JPY bears take over and eye 136 the figure, or thereabouts.

- The 10-min chart's M-formation's neckline aligns with a 36.2% Fibo, offering additional conviction for the downside bias.

USD/JPY has been an early mover on Wednesday in Asia, falling from a high of 136.71 and dropping to 136.24 so far. The price is however stalling here and consolidation is taking shape after the dovish Bank of Japan Minutes.

-

BoJ Minutes: Will ease further if needed, USD/JPY stalling in the sell-off

Before the sell-off in USD/JPY, the yen weakened to the lowest point since 1998 as investors bought up risk assets following last week's rout in equities. Bargain hunting put a global bid on equities. MSCI's broadest index of Asia-Pacific shares outside Japan rose 1.3%, moving higher from a more than five-week low and set for its best day in around two weeks.

Japan's benchmark Nikkei average gained 2.22%. European shares also closed higher for a second consecutive day on Tuesday. The Stoxx Europe 600 gained 0.35%, London's FTSE 100 added 0.42%, France's CAC rose 0.75% and Germany's DAX edged up by 0.20%. The Swiss Market Index was off 0.06%. On Wall Street, all sectors in stocks are in the green with the Dow Jones Industrial Average (DJI) climbing 641.47 points, or 2.15%, to 30,530.25, and the S&P 500 adding 89.95 points, or 2.45%, at 3,764.79. The Nasdaq Composite put on 270.95 points, or 2.51%, at 11,069.30.

Consequently, the yen is gaining against a softer US dollar and rising euro. The single unit rose on Tuesday, drawing support from the European Central Bank's plans to raise interest rates to contain inflation. The dollar index DXY, which tracks the greenback against six major peers including the euro and the yen, was down 0.2% at 104.23, with eyes on Federal Reserve Chair Jerome Powell's testimony to Congress, which kicks off on Wednesday. Investors will be pivoting to Fed Chair's testimony, looking for further clues on future interest rate hikes and his latest views on the economy.

USD/JPY technical analysis

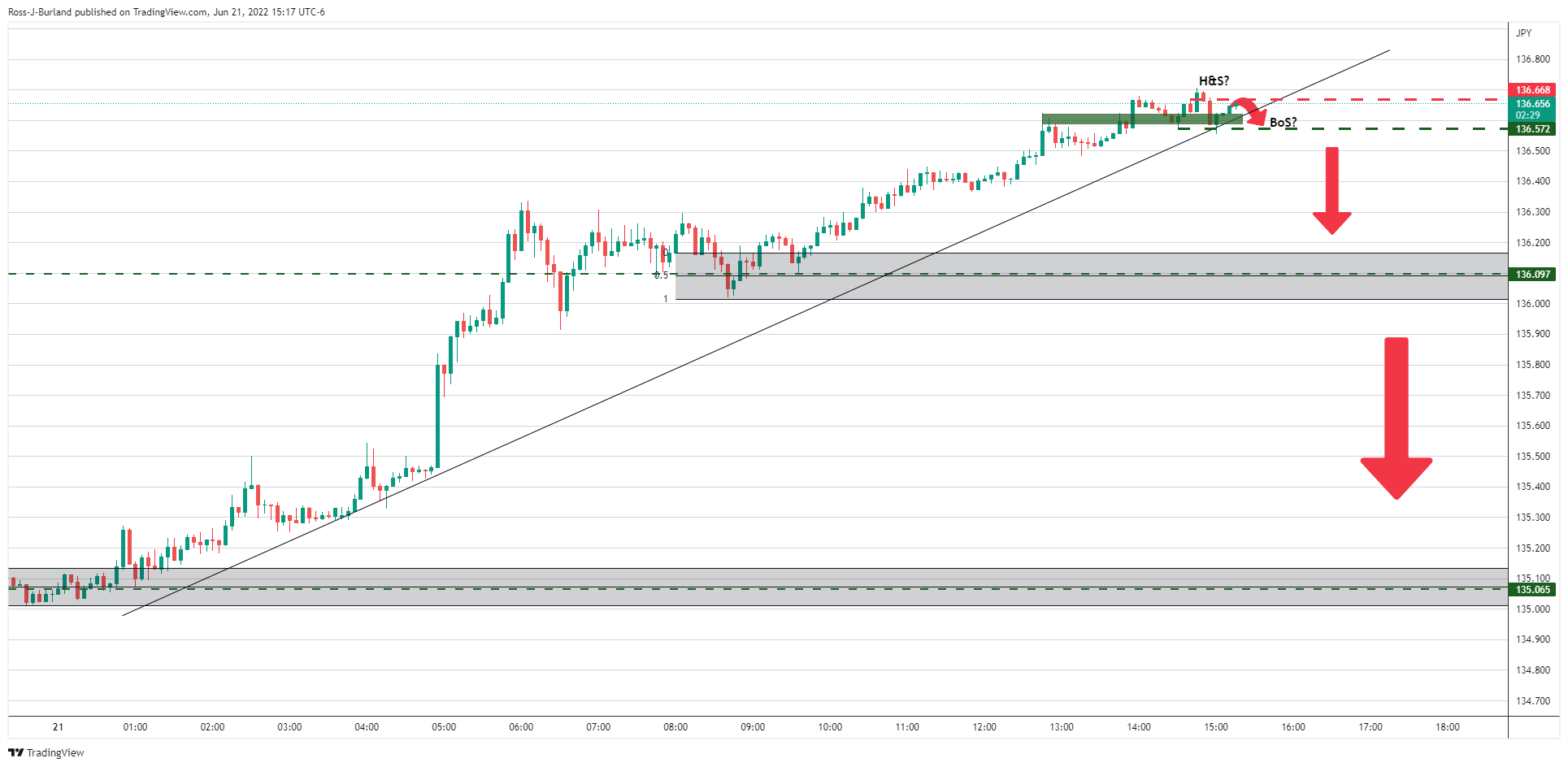

As per the prior multi-timeframe analysis from the New York session, USD/JPY Price Analysis: Bears are lurking and a significant correction could be on the cards, a topping formation was highlighted on the 5-min chart:

The price has subsequently dropped as follows, leaving a menacing M-formation on the hourly chart:

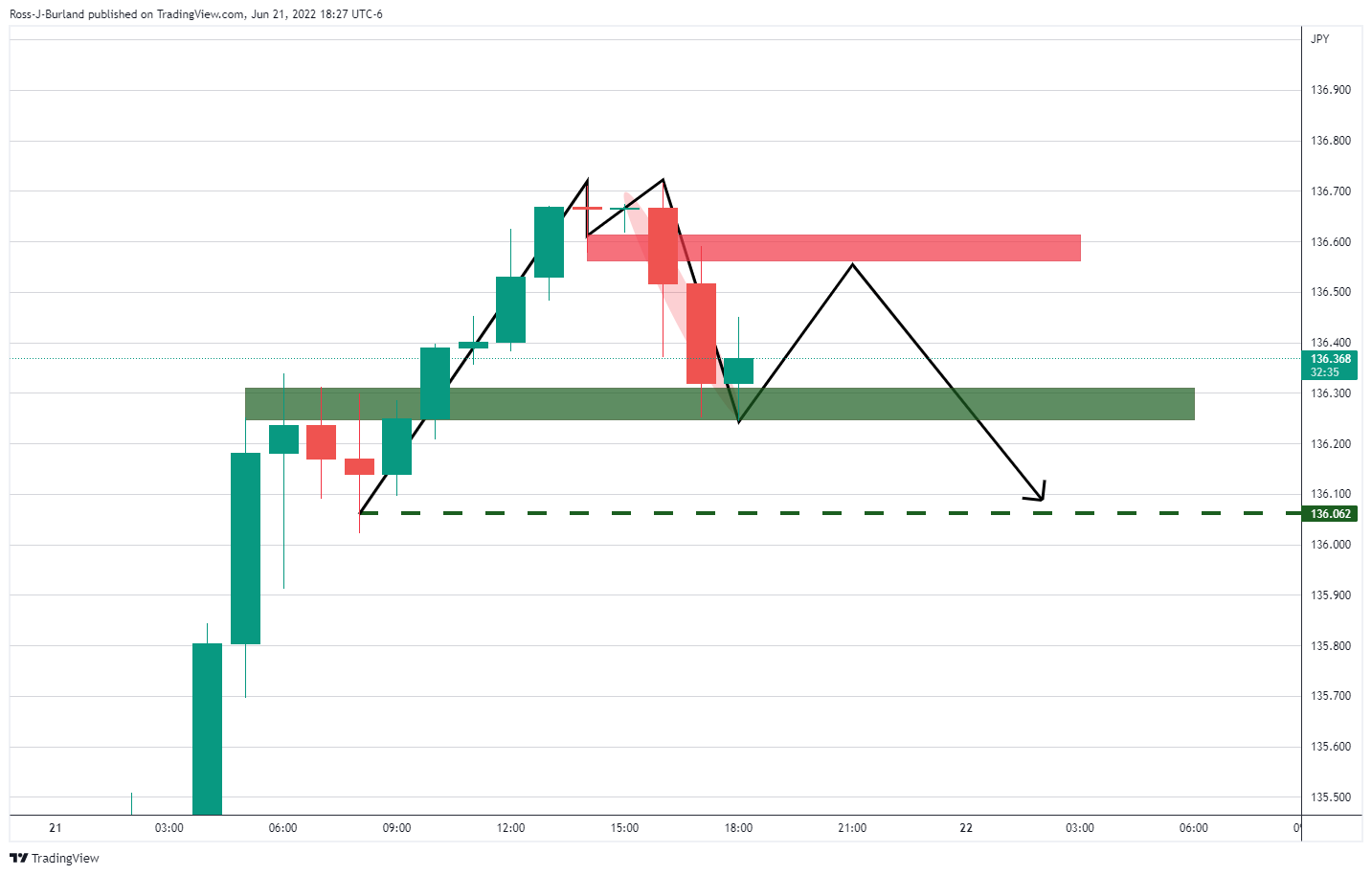

The bulls are moving in at this juncture and the price imbalance could be mitigated below any further downside towards 136 the figure. If, on the other hand, the bears commit at this juncture, then the 36.2% Fibo may be confirmed as a strong enough correction:

The 10-min chart's M-formation's neckline aligns with the Fibo, offering additional conviction to the downside case:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.