- Analytics

- News and Tools

- Market News

- BoJ Minutes: Will ease further if needed, USD/JPY stalling in the sell-off

BoJ Minutes: Will ease further if needed, USD/JPY stalling in the sell-off

The Bank of Japan published a study of economic movements in Japan after its actual meeting, coming in as follows:

BoJ minutes

Board members agreed on no change to BoJ's stance of taking additional easing steps without hesitation if needed.

One member said rising raw material costs would hurt the economy so must keep powerful monetary easing.

One member said japan's monetary policy challenge is to address too-low inflation, unlike in the western economy.

One member said inappropriate to change the monetary policy stance as Russia's invasion of Ukraine adds downside risks to Japan's economy.

One member said BoJ must remain mindful of the need to make its monetary framework sustainable as the ultra-loose policy is likely to be prolonged.

Several members said forex should move in a stable manner reflecting fundamentals.

A few members said recent short-term excessive forex volatility could make it hard for firms to set business plans.

Several members said must communicate to markets that BoJ conducts monetary policy to achieve price stability, not at controlling forex moves.

One member said BoJ must look not at commodity, and forex moves, but the impact they have on the economy and prices.

One member said a weak yen is positive for japan's economy at a time like now when the output gap remains big, and the inflation trend is very low.

Govt rep said that they hope BoJ works closely with govt and guides monetary policy appropriately to achieve sustainable price stability.

One member said more companies passing on higher costs to consumers, which is a development not seen during japan's period of deflation.

Many members said trend inflation, excluding the effect of energy prices, remains low.

One member said japan's core consumer inflation may move around 2% for the first half of fiscal 2022 due to rising raw material costs.

One member said core consumer inflation to hover around 2% for time being but is unlikely to exceed 2% in a sustained manner.

One member said there is growing chance core consumer inflation will reach 2% but that is driven by one-off factors.

One member said trend inflation is likely to gradually heighten ahead as a driver of price rises shifts from supply to demand.

USD/JPY update

As per the analysis from the New York session, the yen is firming as follows:

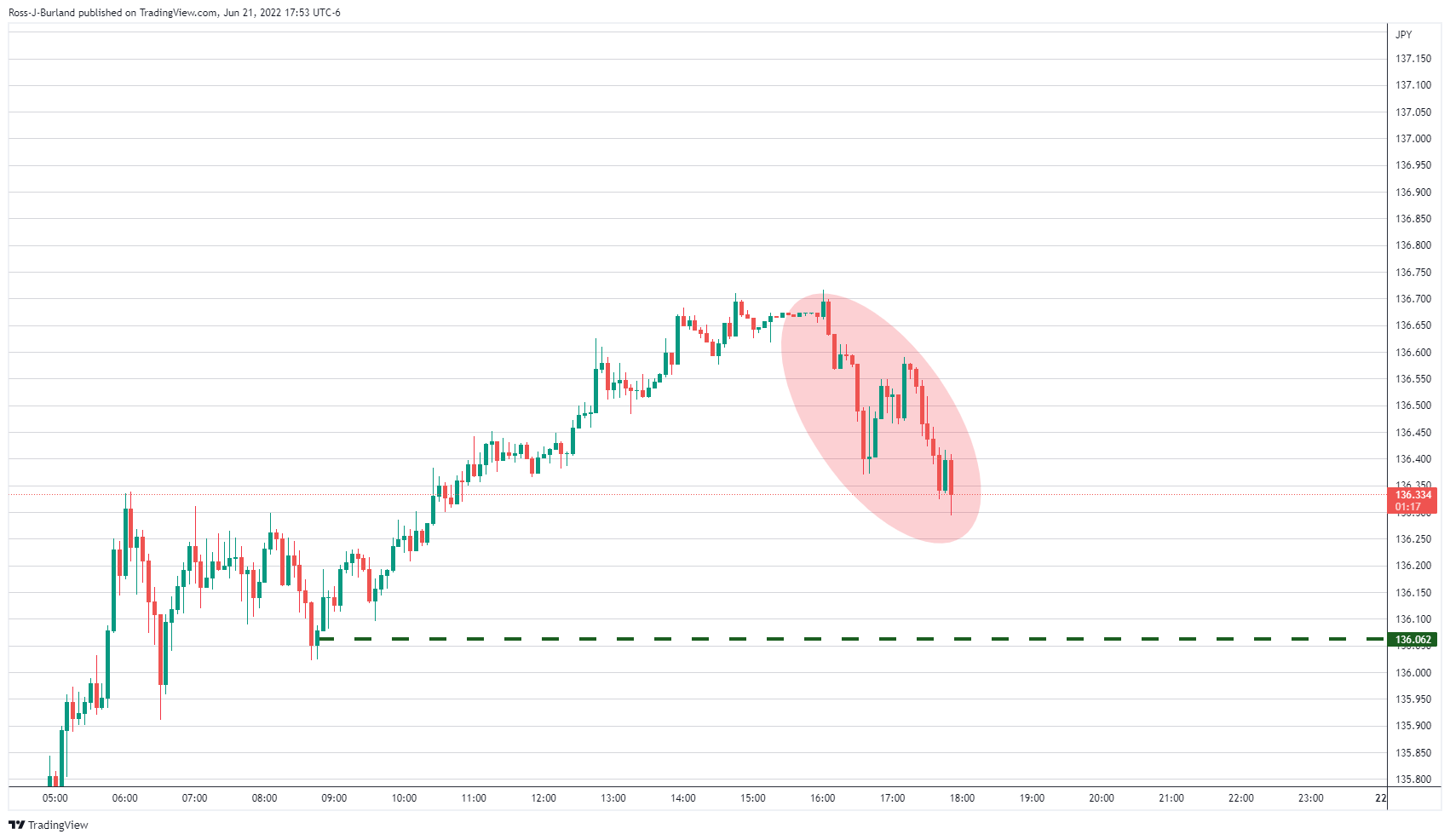

In the prior multi-timeframe analysis, USD/JPY Price Analysis: Bears are lurking and a significant correction could be on the cards, a topping formation was highlighted on the 5-min chart:

Live market:

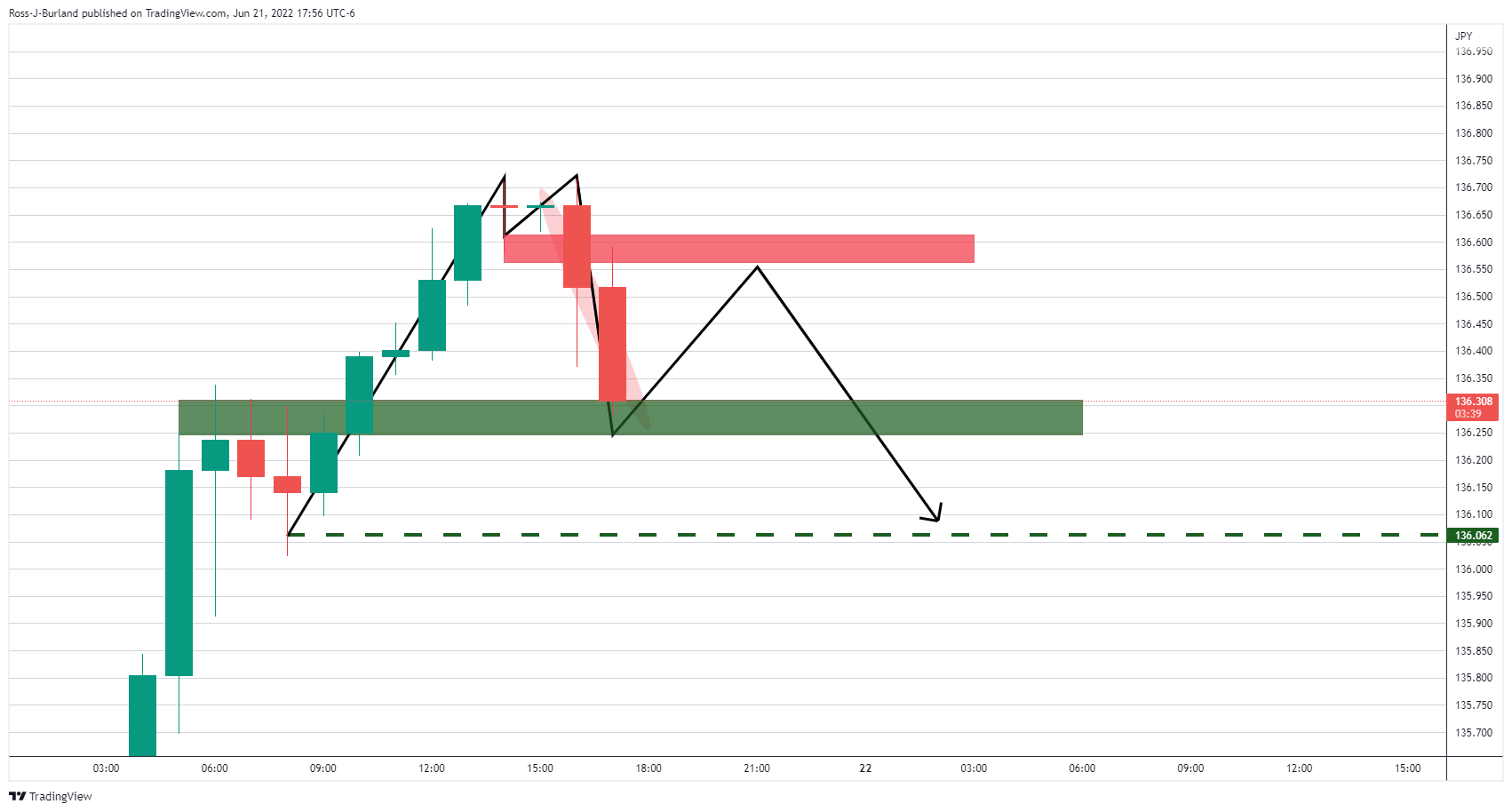

The price is moving in the direction of the target, although the hourly chart's M-formation would be expected to see the price drawn in to test the neckline as illustrated below:

About the BoJ minutes

These meetings are held to review economic developments inside and outside of Japan and indicate a sign of new fiscal policy. Any changes in this report tend to affect the JPY volatility. Generally speaking, if the BoJ minutes show a hawkish outlook, that is seen as positive (or bullish) for the JPY, while a dovish outlook is seen as negative (or bearish).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.