- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD hovers around $1,820 on a well telegraphed 75bp Fed rate hike, awiats Powell

Gold Price Forecast: XAU/USD hovers around $1,820 on a well telegraphed 75bp Fed rate hike, awiats Powell

- Gold is under pressure as the US dollar firms on the back of the Fed.

- The Fed raised as expected and now markets are tuned into the Chairman's presser.

The gold price has made little of a reaction to what was a well-telegraphed move from the Federal Reserve on Wednesday. The central bank has raised the benchmark interest rate by 75bps so to leave the target range standing at 1.50% - 1.75%. This was in line with expectations and as a consequence, there has been a mooted reaction in financial markets so far following plenty of positioning and volatility ahead of the event.

The lift was the biggest hike since 1994 and the statement signals that there will be more o the same to come in the foreseeable future.

- Fed swaps price 75bp rate hike for July; 140bp over July/Sept.

- US rate futures price in 93.4% chance of 75 bps hike in July; 55% probability of 50 bps rise in September after Fed decision - CME's FEDWATCH.

As such, the greenback and front-end yields are bid following the decision and statement. Now markets await to hear from Fed's chairman, Jerome Powell which is where the meat on the bone for markets could be.

Follow our live coverage of the Fed's policy announcements and the market reaction.

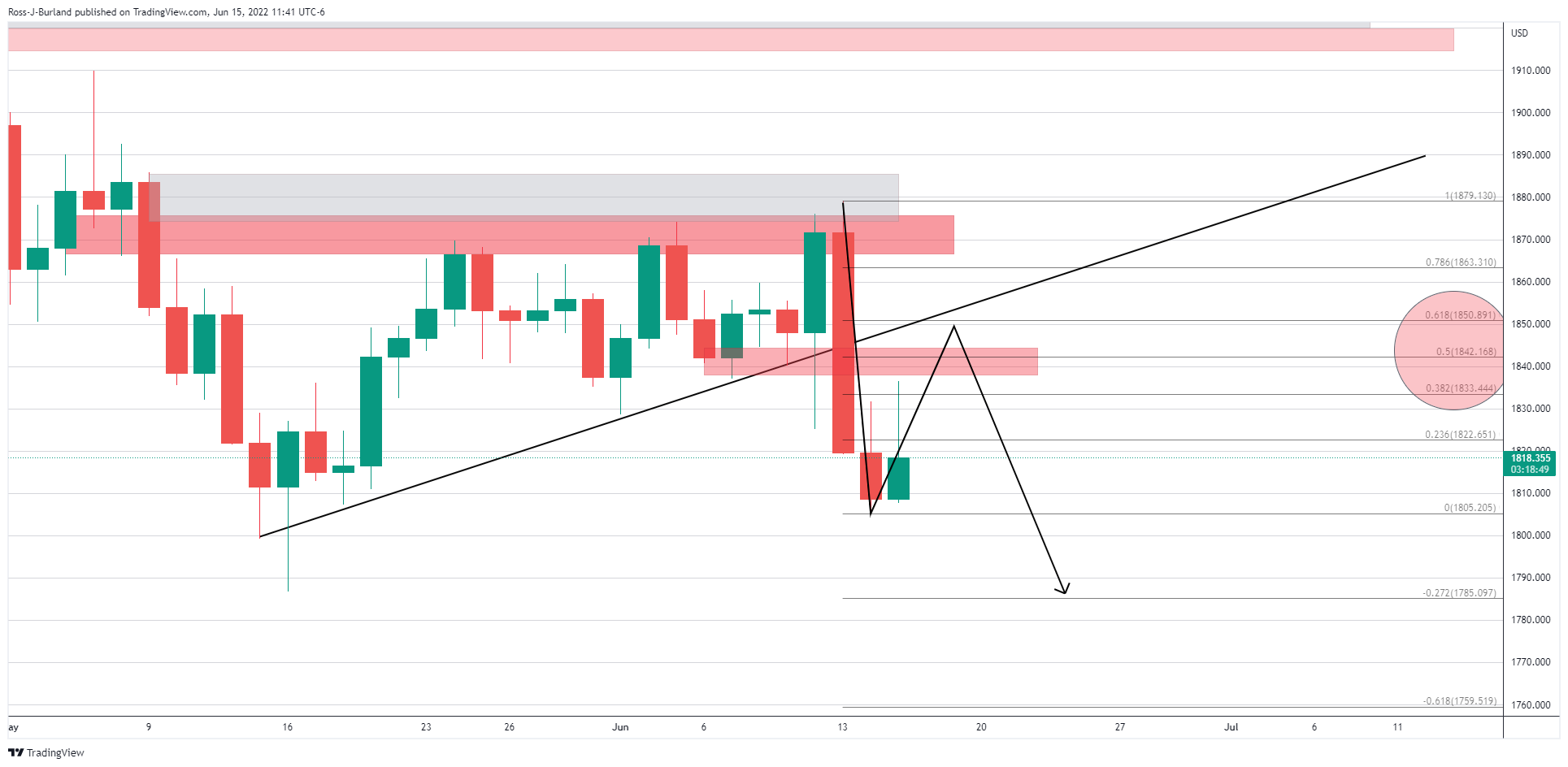

Gold technical analysis

From a technical perspective, the daily chart is poised for further downside while below the 61.8% ratio's confluence with the counter trendline.

On the hourly chart, the breakout points are illustrated as follows:

The W-formation is a reversion pattern that would be expected to keep the price hamstringed to the neckline and potentially see the bears take over.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.