- Analytics

- News and Tools

- Market News

- AUD/JPY Price Analysis: Bears in control, though, would face support around the 92.40-50 region

AUD/JPY Price Analysis: Bears in control, though, would face support around the 92.40-50 region

- The AUD/JPY recovered some ground as the Asian Pacific session began.

- The sentiment is still sour, with Asian futures poised to a lower open.

- AUD/JPY Price Forecast: In the near term might extend the pullback towards 92.40-50s before resuming the uptrend.

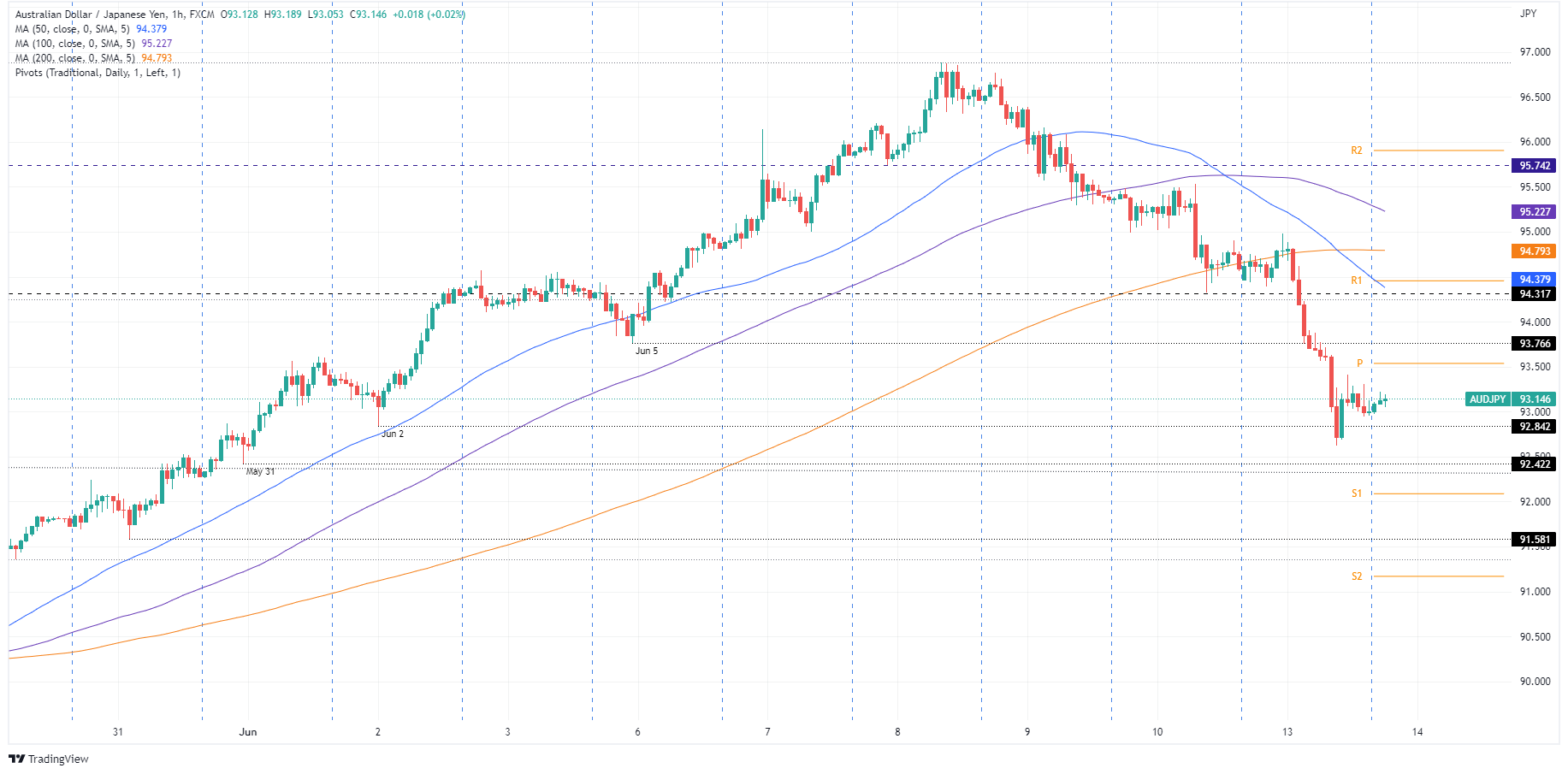

The AUD/JPY plunged 160 pips on Monday due to sour market sentiment, spurred by investors’ fears that the Federal Reserve could tighten monetary policy at a pace that the US economy might not survive a recession, as reflected by US Treasury yields, elevating to multi-year highs. At 93.14, the AUD/JPY records minimal gains of 0.16% as the Asian Pacific session begins.

Portraying the abovementioned were US equities registering huge losses. Asian futures are poised to a lower open, except for the Nikkei, which is up 0.09%. In the meantime, US Treasury yields, led by the 10-year benchmark note rate, finished at 3.362%, 11-year highs, up 20 bps in the day.

In the FX space, the greenback was the leading currency, except vs. the Japanese yen. On Friday, Japan’s government and the central bank said they were concerned by recent sharp falls in the yen in a rare joint statement, Reuters reported.

AUD/JPY Price Forecast: Technical outlook

The AUD/JPY is hovering around the 93.00 figure, for the first time, since June 2. Nevertheless, albeit falling more than 150 pips on Monday, the cross-currency keeps trading above the daily moving averages (DMAs), which remain below the spot price, with the 50-DMA being the closest to the exchange rate at 92.35.

The AUD/JPY 1-hour chart depicts the pair as downward biased. The 1-hour simple moving averages (SMAs) reside above the spot price, with the 50-hour SMA below the long-time frame ones, around 94.31. Additionally, once AUD/JPY’s price action broke below the June 5 daily low at 93.76, it opened the door for further losses.

Therefore, the AUD/JPY first support would be the 93.00 figure. Once cleared, the following support would be June 2 low at 92.84. A breach of the latter, an area full of sell stops, would send the pair towards the May 31 low at 92.42 before resuming to the upside, aligned with the daily chart overall bias.

Key Technical Levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.