- Analytics

- News and Tools

- Market News

- EUR/USD bears have 1.04 clocked ahead of the Fed

EUR/USD bears have 1.04 clocked ahead of the Fed

- EUR/USD bears have stayed in control and eye 1.04 the figure.

- The FOMC is in focus for the week ahead following the data on Friday.

At 1.0517, EUR/USD is down some 0.1% at the start of the week suffering from a firm US dollar as the DXY eeks out a fresh high for the month of June. Financial markets reeled in response to higher-than-expected US inflation data for May and record low consumer confidence – with rising inflation expectations giving the greenback the edge as investors moved out of risk.

The market is now pricing in a peak in fed funds above 3.5%, analysts at ANZ Bank noted when explaining that the May Consumer Price Index rose 1.0% MoM to hit 8.6% YoY, its highest level since December 1981 (exp: 8.3%).

''US inflation is proving stubbornly persistent around multi-decade highs, and there was nothing in the data to indicate either headline or underlying inflation pressures are moderating.''

''Underscoring concerns about the economy,'' the analysts said, ''Michigan Consumer Confidence slumped to a record low of 50.2 (exp: 58.1, prev: 58.4) as cost of living concerns weighed on sentiment. Inflation is weighing heavily on consumers, the principal engine of economic growth. The preliminary data for June also showed 1-year ahead inflation expectations rising unexpectedly to 5.4% (exp: 5.3%). 5-year ahead inflation expectations rose to 3.3% – the highest reading since 2008. No comfort for the Fed here, then.''

This latest data comes ahead of the Federal Open Market Committee meeting the markets are priced for a 50bps rate hike and more to come, potentially extending beyond September. ''As inflation stays high, the FOMC’s estimates of the neutral fed funds rate is under upward pressure, and the risks to energy prices lie to the topside, meaning inflation may not have peaked yet,'' the analysts at ANZ Bank added. ''Recession risks are rising as the challenge facing the Fed intensifies. These are of course global themes, but the Fed is by far the most important central bank for global markets.''

Meanwhile, the European Central Bank intends to end QE by 1 July and hike policy rates by 25bp in connection with the July meeting, according to its latest statement released last week. The door for hiking by 50bp in September has been left ajar also and will be a strong possibility "if the medium-term inflation outlook persists or deteriorates".

''We now expect the ECB to hike by 25bp in July, 50bp in September and 25bp on each of the following meetings until March 2023 when the hiking cycle is likely to end, in our view. We see risks as skewed towards more 50bp rate hikes,'' analysts at Danske Bank said.

EUR/USD technical analysis

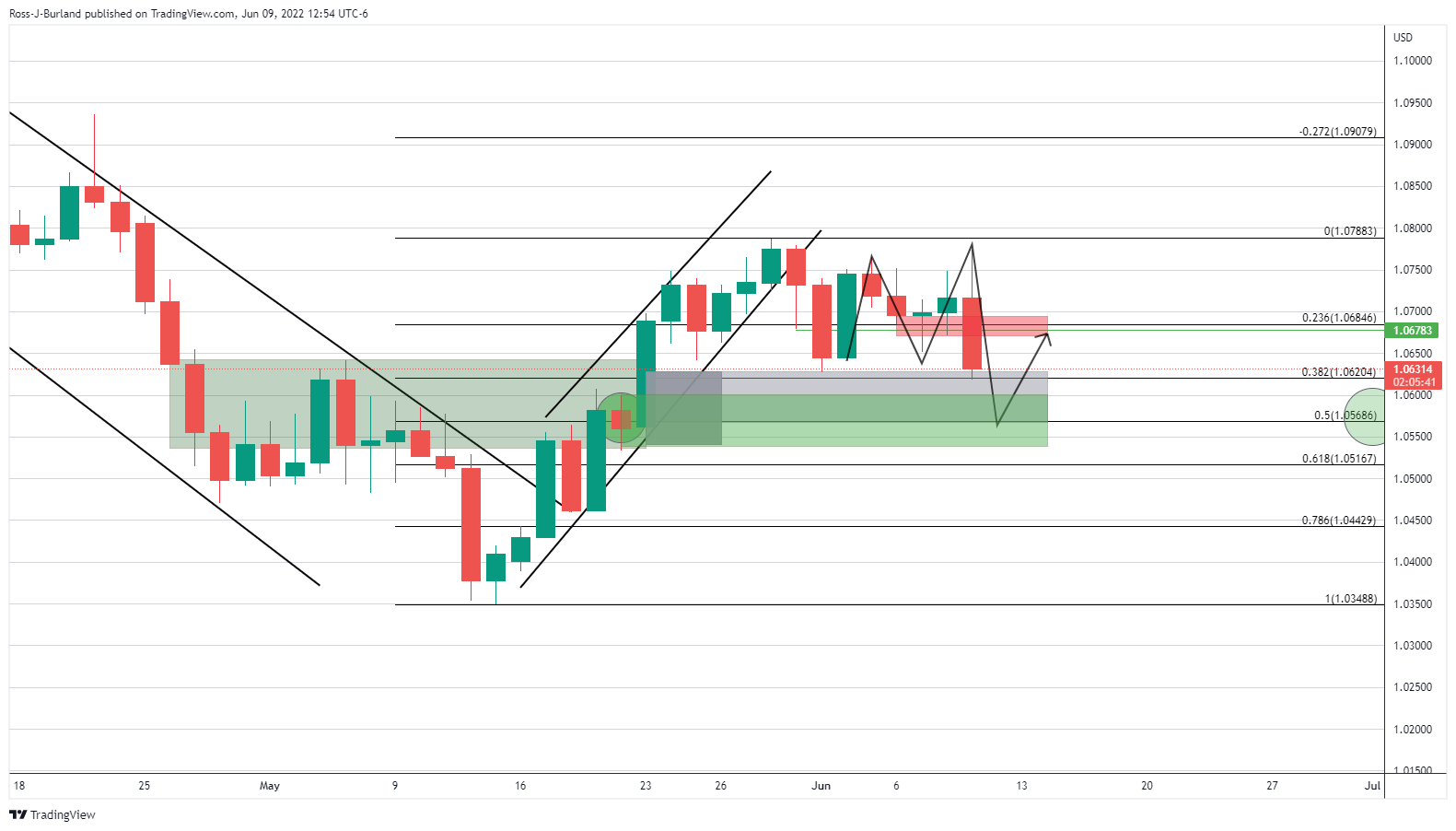

As per the prior analysis, EUR/USD Price Analysis: Bears march the bulls back to the edge of the abyss, the price came under pressure and sank deeper on the weekly chart to test the support of the W-formation, mitigating the price imbalances on the lower time frames. It was explained that from a daily perspective, there was an M-formation being formed from Thursday's price action.

However, the analysis also stated that ''while this too is a reversion pattern, there is a price imbalance between June 1's low and May 20 lows of 1.0532 that the bears are embarking on. Mitigation of this price area, around 80 pips to the downside, could play out over the course of the next sessions if bears stay in control.'' And,'' from an hourly perspective, the price is testing the mitigation area, but the drop could be ripe for a meanwhile correction.''

EUR/USD prior analysis, weekly, daily & hourly charts:

EUR/USD live charts:

The hourly chart above represents the mitigation of the daily price imbalance below:

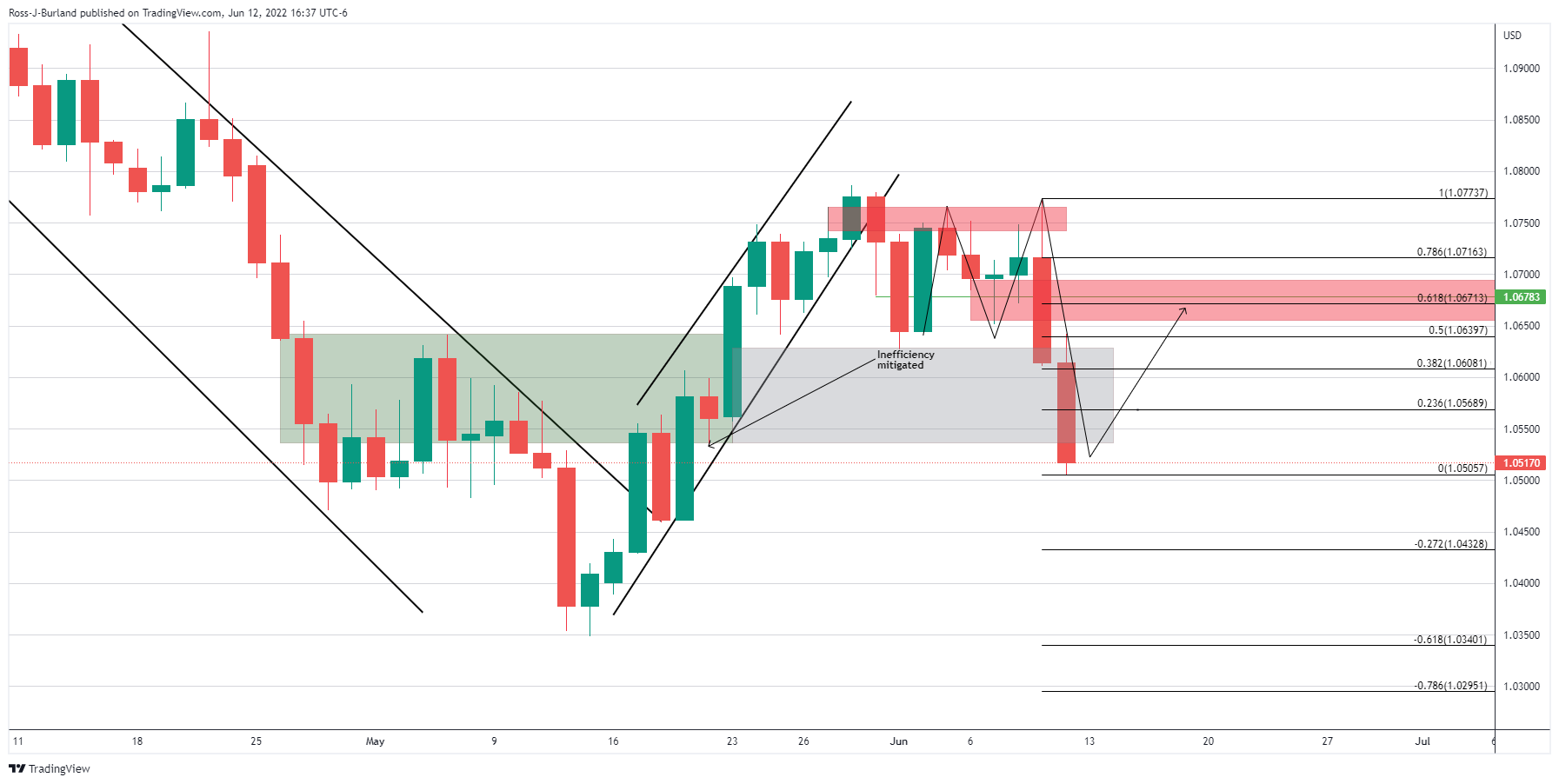

We can now be in anticipation of a correction of the bearish impulse which could target as high as the neckline o the M-formation near a 61.8% ratio. However, from a weekly perspective, the bearish impulse was strong and there is an inefficiency in the price below the neckline of the W-formation to the lows of mid-May between 1.04 the figure and 1.0350:

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.