- Analytics

- News and Tools

- Market News

- WTI heading towards a key area of daily support

WTI heading towards a key area of daily support

- WTI bears are moving in on a key area of daily support in Tokyo.

- The bulls have cashed in on the rally that came on the back of the relaxation of China lockdowns.

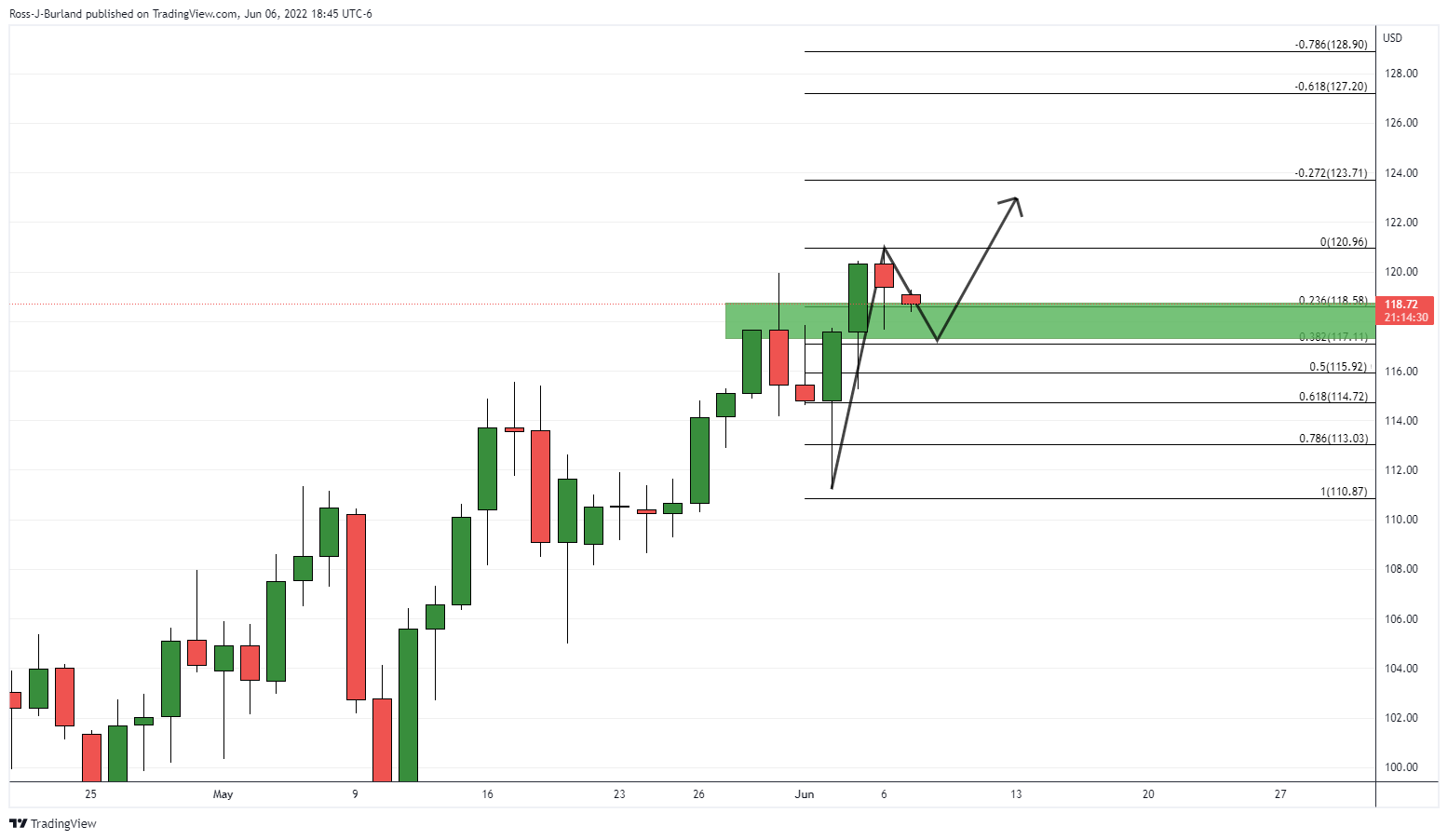

At $118.58, the price of West Texas Intermediate (WTI) crude oil is lower in Tokyo and the bears are advancing towards a potential support structure on the daily chart in what has been a 23.6% Fibonacci correction so far. The price has been pressured due to Saudi Arabia hiking the premium it charges for exports to Asian customers.

Demand from importers as China lifts lockdowns on Shanghai and other centres enabled the price of oil to move higher at the start of the week, but the bulls have been cashing in over New York trade and through the Asian session so far. Last week, the OPEC+ group announced that it would double its monthly quota increases for members to 648,000 barrels per day in July and August. However, it is noted that Russia and other members are unable to boost output, meaning actual production increases will be just more than 100,000 bpd.

''Energy supply risk continues to rise. After all, pent-up demand for mobility continues to fuel a recovery in energy demand with little evidence of demand destruction from higher prices,'' analysts at TD Securities explained.

''We've reiterated that Chinese mobility likely troughed in April, before making substantial improvements by early-May, but continues to improve with our tracking of congestion data for China's top 15 cities by vehicle registrations pointing to a +1.3% improvement in mobility on the week. In this context, supply continues to underwhelm. After all, with only a few Gulf nations effectively holding spare capacity, the OPEC+ group's decision to open their taps at a faster clip result in an underwhelming number of barrels hitting the market, with operational constraints biting into supply for many producers.''

''Meanwhile, the market is awaiting further clarification regarding how the EU and UK will adopt a ban on insurance for Russian oil cargoes,'' the analysts added. ''We reiterate that this will create a significant logistical bottleneck for Russian crude exports, likely resulting in an immediate drop in exports, but may also impact long-term contracts. In this context, we remain long Dec23 Brent crude in anticipation of a continued rise in supply risk premia.''

WTI technical analysis

The bears are closing in on the support structure and should the bulls commit to here on a daily basis, this could be the making s for a continuation to the upside for the days ahead.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.