- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD traders are getting set for US inflation data

Gold Price Forecast: XAU/USD traders are getting set for US inflation data

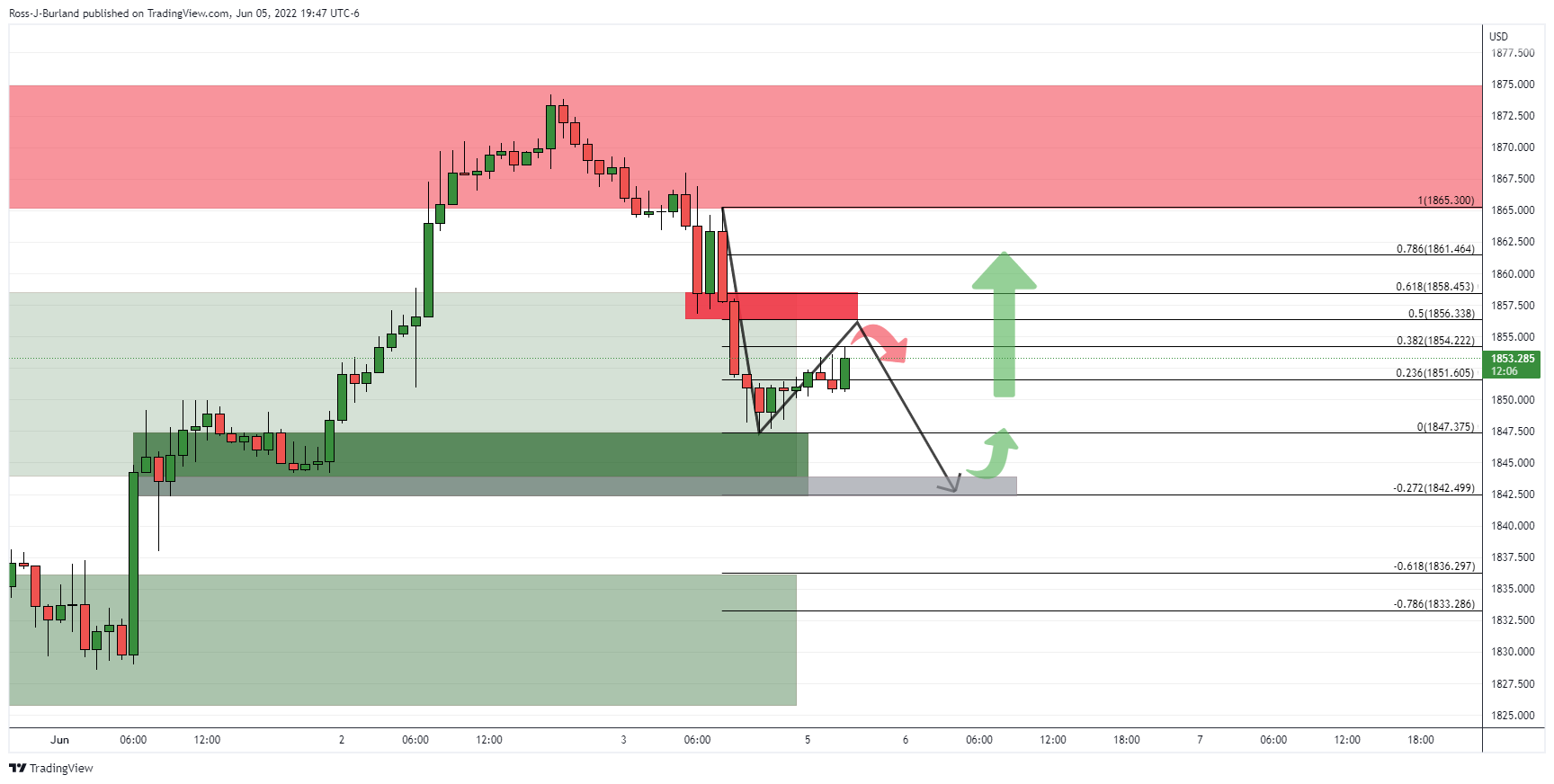

- Gold is correcting some of the downsides in Friday's sell-off to a 38.2% Fibo.

- US inflation data is on the cards for this week in the build-up to the Fed.

At $1,853.70, the gold price is advancing on the day, mitigating some of the imbalance in price left over from Friday's trade when the US rallied following the US Nonfarm Payrolls data, extending gains for the day.

The solid jobs report reinforced views that the Fed would continue with its aggressive rate hike cycle and higher Treasury yields, which reduce bullion’s appeal, were the straw that broke the camel's back. The 10-year yield traded as high as 2.99% Friday, up from the previous week’s low near 2.70% but still below the May 9 peak near 3.20%. Elsewhere, the 2-year yield traded as high as 2.69% Friday, up from the previous week’s low near 2.44%.

The US Nonfarm Payrolls increased by 390,000 jobs last month, the Labor Department said in its closely watched employment report on Friday, way exceeding the forecasts or around 325,000 jobs in May.

''The May report supports the view that while the labour market remains firm, it continues to gradually slow,'' analysts at TD Securities said. ''We think the report does not change the calculation for the Fed, supporting their inclination to front-load interest rate hikes until it reaches a more neutral stance by the fall.' This report will do little to change the price action in the FX space, but it does mean that the better the data, the more difficult a pause or reduced pace of tightening later this year becomes.

US CPI coming up

The upcoming US Consumer Price Index and MoM readings will be far more important for broad USD dynamics, the analysts argued.

Core prices likely stayed strong in May, with the series registering a second consecutive 0.5% MoM increase. A drag on inflation recently, we now expect used vehicle prices to be a contributor, advancing for the first time in four months. We also look for continued momentum in airfares and shelter inflation. Our MoM forecasts imply 8.4%/5.9% YoY for total/core prices.''

As for gold, the analysts at TD Securities argued that ''the pandemic has reinvigorated discretionary trading in gold, leaving 'Other Reportables' to play a larger role in speculative markets. This group has accumulated a significant amount of length during the pandemic, which appears to be entirely inconsistent with their historical position sizes. This length also does not appear to be correlated with inflation-sentiment or trend-following.''

This cohort, which the analysts said is yet to capitulate, ''appears to have driven prices higher as the group was forced to aggressively cover shorts into the war in Ukraine, leading to price action which has likely saved the consensus longs from additional liquidations in the face of a hawkish Fed.''

However, the analysts argued that ''with gold prices below their bull-market defining trendline and without conviction that the Fed could blink, these traders represent the greatest risk for a liquidation vacuum as we exit the pandemic-regime. A break below $1800/oz could catalyze additional CTA liquidations which we expect will further weigh on gold.''

Meanwhile, traders will be looking ahead to the June 14-15 Federal Open Market Committee meeting. Fed speakers last week were unanimous in their support for 50bp hikes at both the June and July meetings. Markets are also pricing in another 50bp in September, watching for month-to-month inflation readings, however, to ensure that they don’t cool meaningfully before then. In that regard, the Fed’s Beige Book highlights that growth prospects are souring and that inflation and wage pressures may be peaking.

Gold technical analysis

As per the pre-open analysis, Gold, Chart of the Week: XAU/USD bulls eye a break of critical daily resistance, where the price was expected to mitigate some of the price imbalance left over from Friday's sell-off, the bulls have indeed moved in on the 38.2% Fibonacci retracement level as illustrated above. ''The 50% mean reversion area aligns with the prior support as a target. However, should resistance hold up, there could be a move into the downside to fully test the demand area in the $1,840s again.''

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.