- Analytics

- News and Tools

- Market News

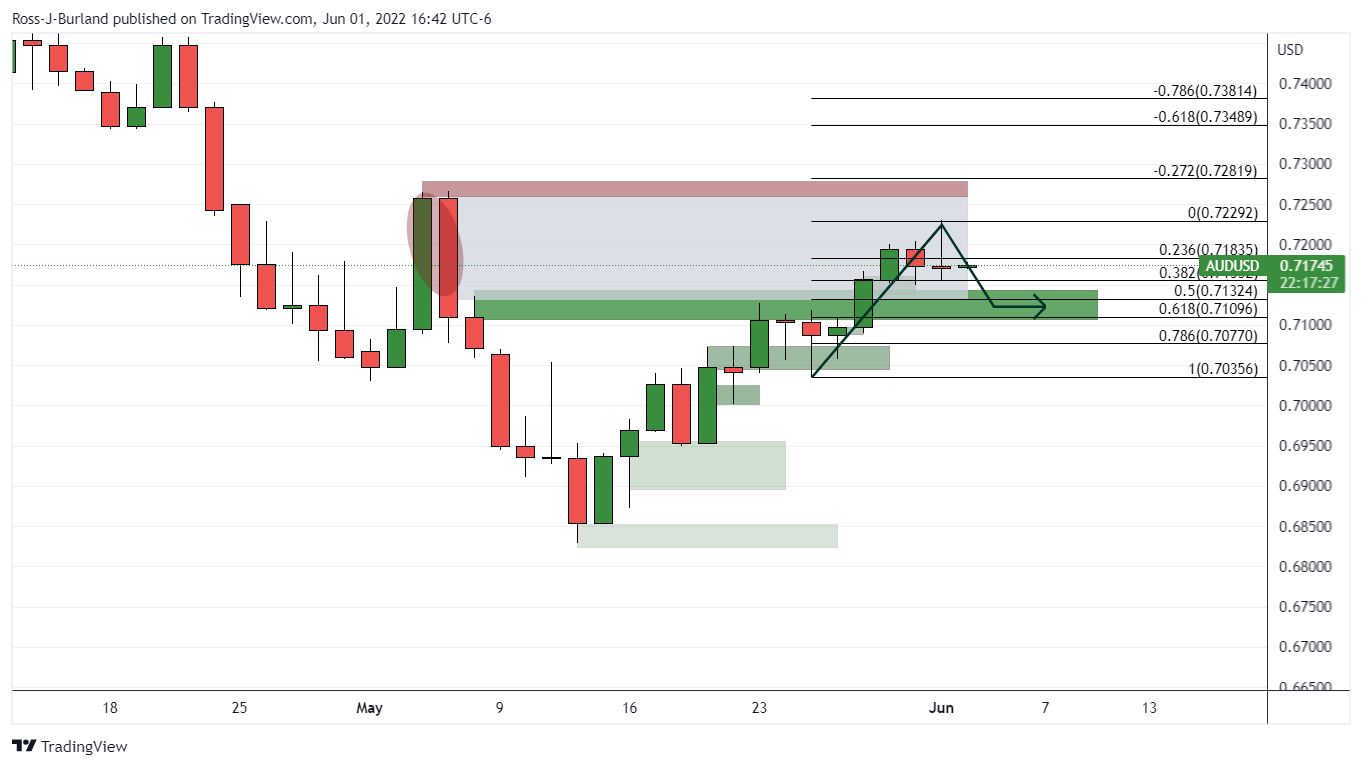

- AUD/USD bulls could be about to throw in the towel, but the 38.2% Fibo is key

AUD/USD bulls could be about to throw in the towel, but the 38.2% Fibo is key

- AUD/USD is consolidating the recent volatility and has left a doji on the daily chart.

- The price could be in for some sideways action as markets take a rest bite ahead of more critical US events.

At 0.7150, AUD/USD is flat on the day and trading in the middle of the overnight ranges. It has been a period of finding equilibrium while the US dollar bounces back to life, spurred on by fears of global inflation.

The dollar index DXY, which measures the currency against six major peers, climbed to 102.71 and stalled near there, extending Tuesday's gains. Equities fell and bond yields rose as strong US manufacturing and job openings data reinforced the need for aggressive Fed funds rate hikes. The US 10-year yield lifted 9.3bps to 2.937%. As such, the high beta currency was pressured before rebounding in the midday session of New York.

In data, the US May ISM manufacturing index surprised by rising to 56.1 (55.4 previously) – the consensus expectation was for a small decline. New orders improved, rising to 55.1 (53.5 previously), while prices paid eased slightly to 82.2 (84.6 previously). Analysts said the latter is still far too high to be comfortable for the Fed.

As for the Reserve Bank of Australia, the analysts said that yesterday's growth data for the first quarter for Australia has prompted them to look for a 40bp hike in the cash rate to 0.75% in June (previously expected 25bps).

''Not only did the data show a healthy 0.8% q/q lift in GDP (as expected), but based on our calculations, non-farm average hourly earnings lifted 5.3% y/y in Q1 – an acceleration from 3.3% previously. While these earnings data can be volatile and thrown around by compositional issues, the print was still much higher than we were expecting to see,'' the analysts explained.

''Combine that with the strongest quarterly increase in the household consumption deflator since 1990 (ex-GST), and we think it should convince Governor Lowe that “there is a very strong argument” to move in larger increments than the usual 25bps.''

AUD/USD technical analysis

Wednesday's doji is not so bullish but the restest of the 38.2% could encourage buying as bulls move in at a discount and see to a full-on mitigation of the price imbalance between the highs of the doji to towards the My 5 highs of 0.7266. Failing that, if the bulls throw in the towel, a deeper correction to the support area below would be likely ahead of US Nonfarm Payrolls on Friday.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.