- Analytics

- News and Tools

- Market News

- AUD/USD Price Analysis: Trades mixed below 0.7200 ahead of Aussie GDP, rising wedge eyed

AUD/USD Price Analysis: Trades mixed below 0.7200 ahead of Aussie GDP, rising wedge eyed

- AUD/USD consolidates pullback from three-week high, sidelined of late.

- Australia’s Q1 2022 GDP is estimated to have softened by 0.7% QoQ.

- Bearish chart pattern, RSI retreat keeps sellers hopeful.

- 200-SMA adds to the downside filters, recovery moves have multiple hurdle to tackle.

AUD/USD picks up bids to 0.7178 as bears lick their wounds after the quote’s U-turn from a three-week high. In doing so, the Aussie pair consolidates the first daily loss in four ahead of the key Australia Q1 Gross Domestic Product (GDP) release during Wednesday’s Asian session.

Also read:

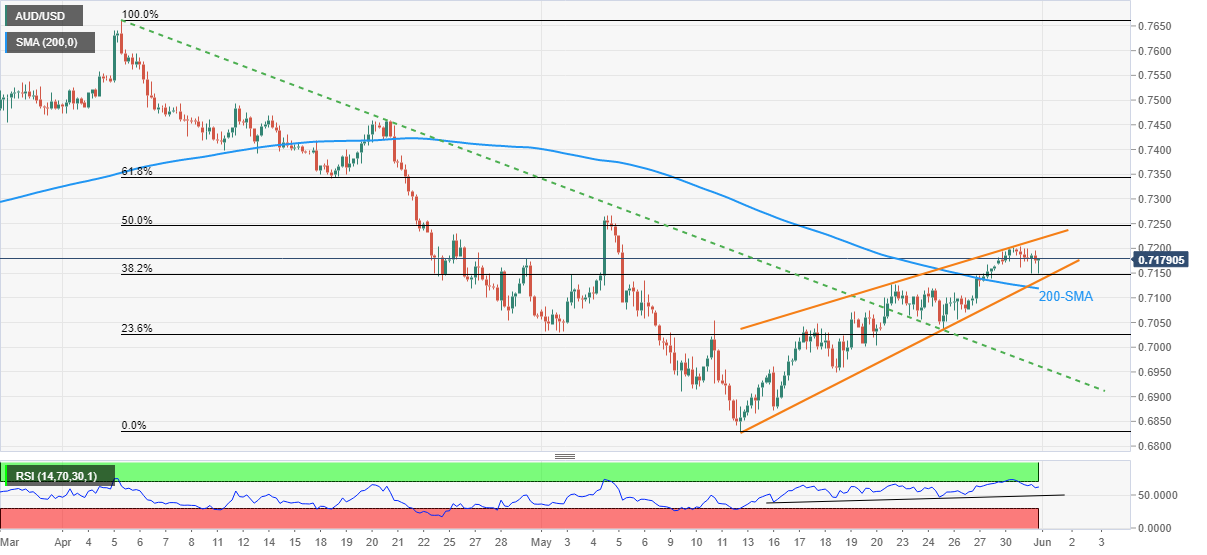

The AUD/USD pair’s pullback the previous day portrays a rising wedge bearish chart pattern on the four-hour play. The downside bias also gains support from the RSI (14) retreat.

However, the 200-SMA offers an additional barrier to the south around 0.7120, in addition to the stated wedge’s support line near 0.7135.

Should the quote drops below 0.7120, theory backs bears to expect a fresh yearly high under the previous month’s trough of 0.6828. During the fall, the 23.6% Fibonacci retracement (Fibo.) of April-May fall, around 0.7030, as well as the 0.7000 psychological magnet may offer intermediate halts.

On the flip side, recovery moves need to reject the wedge formation, by crossing the 0.7220 immediate hurdle, to convince short-term buyers.

Even so, the 50% Fibo. level and the previous monthly high, respectively around 0.7245 and 0.7270, can challenge the upside momentum past-0.7220.

Overall, AUD/USD teases bears ahead of the key Aussie data but the downtrend requires strong disappointment from scheduled data and has multiple challenges.

AUD/USD: Four-hour chart

Trend: Grinds lower

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.