- Analytics

- News and Tools

- Market News

- China PMIs remain below 50, AUD/USD is hamstrung

China PMIs remain below 50, AUD/USD is hamstrung

The China PMIs, Manufacturing & Services, have been released as follows:

NBS Manufacturing PMI(May)

Rises: 49.6 VS 47.4 for April and vs. a 49.6 consensus.

Non-Manufacturing PMI(May)

Rises: 47.8 VS 41.9 in April and vs. a 50.7 consensus.

China Official Composite PMI (May)

- 48.4 vs. 42.7 prior.

Both PMIs were expected to remain in contraction despite the partial easing in lockdown measures, although this will help reduce some negative sentiment in manufacturing.

''Weaker export trends, lacklustre demand for loans, and soft infrastructure spending suggest manufacturing will not move back to expansion quickly,'' analysts at TD Securities argued. ''Services recovery is likely to be even slower amid constrained consumer activity.''

AUD/USD update

AUD/USD is attempting to correct higher but the data is still in negative territory and the bulls are struggling. The pair is trading lower on the day near 0.7170.

- AUD/USD Price Analysis: The bulls are up against a firmer US dollar in Tokyo

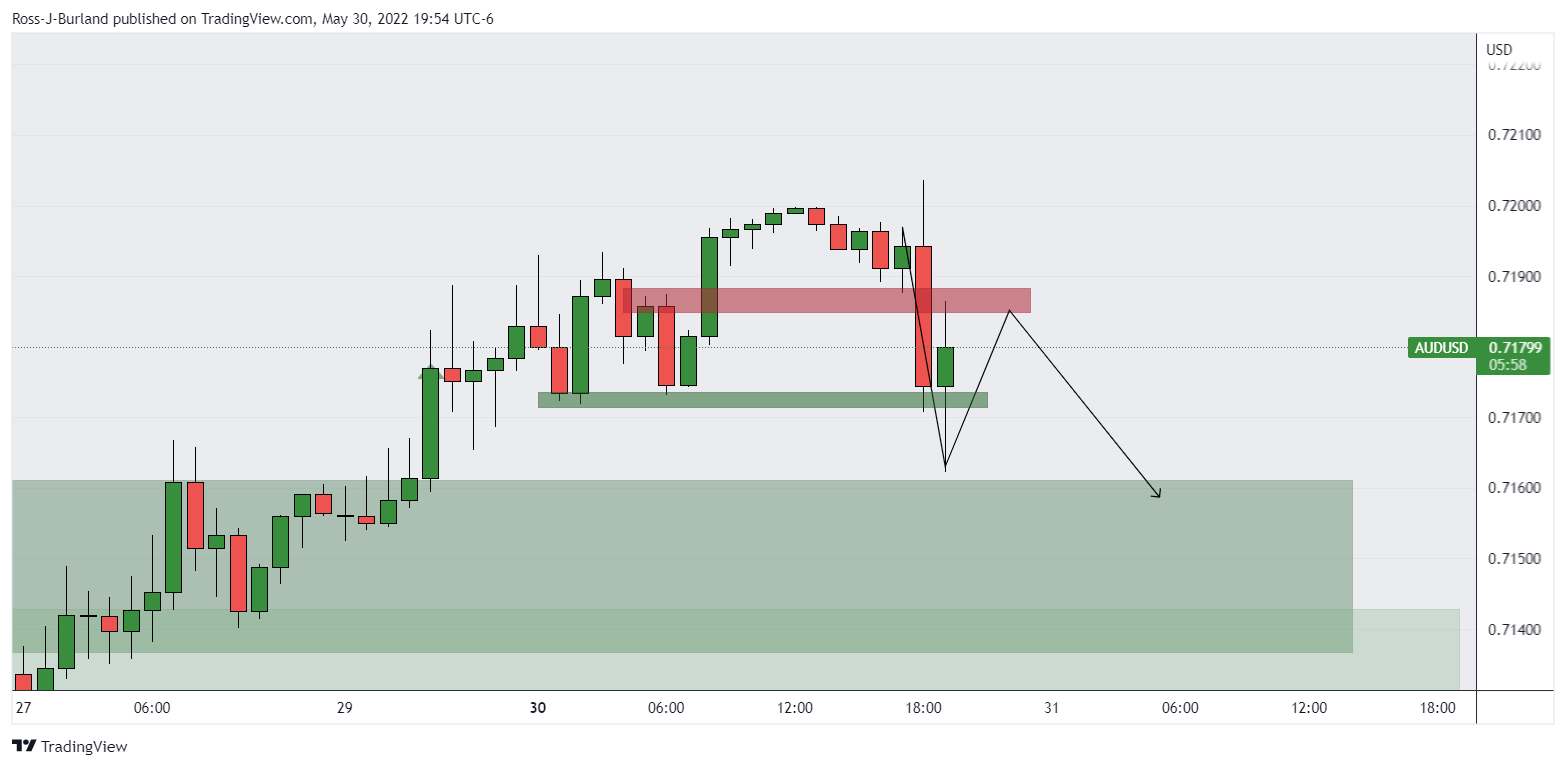

US dollar and AUD/USD charts, H1

Whatever relief the Aussiemight enjoy could be hindered by a stronger US dollar for the forthcoming trade. The DXY price has broken a key hourly resistance and should this continue to hold as support, AUD will struggle to break higher vs the greenback:

About the official Non-Manufacturing & Manufacturing PMIs

These data are released by China Federation of Logistics and Purchasing (CFLP), is based on a survey of about 1,200 companies covering 27 industries including construction, transport and telecommunications. It's the level of a diffusion index based on surveyed purchasing managers in the services industry and if it's above 50.0 indicates industry expansion, below indicates contraction.

The Manufacturing Purchasing Managers Index (PMI) studies business conditions in the Chinese manufacturing sector. Any reading above 50 signals expansion, while a reading under 50 shows contraction. As the Chinese economy has influence on the global economy, this economic indicator would have an impact on the Forex market.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.