- Analytics

- News and Tools

- Market News

- US Dollar Index: Bears push harder and approaches 101.00

US Dollar Index: Bears push harder and approaches 101.00

- DXY loses further ground and revisits the 101.50 area.

- Activity around US yields remain anaemic on Friday.

- Inflation tracked by the PCE, U-Mich Index next of note in the docket.

The greenback, in terms of the US Dollar Index (DXY), loses further the grip and extends the downtrend well south of the 102.00 mark.

US Dollar Index weaker on risk-on trade

The index accelerates losses and breaks below the 102.00 support quite convincingly amidst further improvement in the appetite for the risk complex.

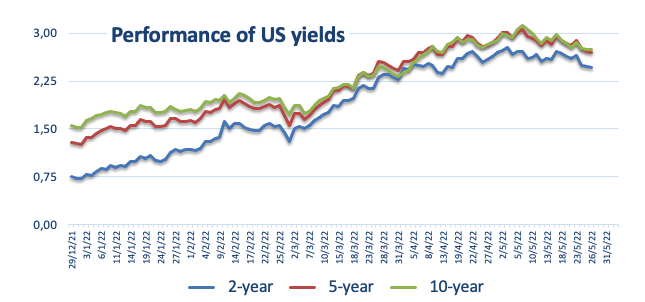

The poor performance of US yields in the cash markets do not help the buck either in a context where investors appear to have already fully priced in the well-telegraphed 50 bps rate hile at both the Fed’s June and July events.

On the latter, the probability of such scenario at the June 15 meeting is at 93% and nearly 90% when it comes to the July 27 gathering, according to CME Group’s FewdWatch Tool.

In the US docket, the inflation gauged by the PCE will take centre stage seconded by the final print of the Consumer Sentiment. In addition, Trade Balance figures will be published along with Personal Income and Personal Spending.

What to look for around USD

The dollar extends the weekly leg lower and threatens to put the 101.00 zone to the test in the not-so-distant future.

In the meantime, a tighter rate path by the Federal Reserve looks more and more priced in, while the elevated inflation narrative and the tight labour market seem to still support further upside in the dollar in the longer run.

On the negatives for the greenback, the incipient speculation of a “hard landing” of the US economy as a result of the Fed’s more aggressive normalization carries the potential to undermine the bullish prospects for the buck.

Key events in the US this week: Core PCE, Personal Income/Spending, Final Consumer Sentiment (Friday).

Eminent issues on the back boiler: Speculation of a “hard landing” of the US economy. Escalating geopolitical effervescence vs. Russia and China. Fed’s more aggressive rate path this year and 2023. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is retreating 0.18% at 101.57 and faces initial support at 101.43 (monthly low May 27) followed by 101.06 (55-day SMA) and then 99.81 (weekly low April 21). On the flip side, the breakout of 105.00 (2022 high May 13) would open the door to 105.63 (high December 11 2002) and finally 106.00 (round level).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.