- Analytics

- News and Tools

- Market News

- Breaking: FOMC Minutes sink the US dollar a touch despite inflation risk skewed to the upside

Breaking: FOMC Minutes sink the US dollar a touch despite inflation risk skewed to the upside

The Federal Open Market Committee minutes have been released which are so far sending the US dollar DXY index a touch softer. The softness in the greenback come as there were no discussions on larger rate hikes.

At the May 3-4 meeting, the Fed hiked rates from the expected 50 bp to 1.0% and laid out plans for aggressive Quantitative Tightening to begin in June.

FOMC Minutes

- All participants at the Federal Reserves May policy meeting agreed a half-percentage-point interest rate hike was appropriate; 'most' Judged such hikes appropriate at the next couple of meetings, minutes from May 3-4 meeting show.

- All Fed participants agreed the US economy was 'very strong,' labour market was 'extremely tight' and inflation was 'very high,' minutes show.

- Participants agreed fed should 'expeditiously' move monetary policy toward a more neutral stance, and that a 'restrictive' stance on the policy may well become appropriate, minutes show.

- Fed participants saw the Ukraine conflict, china's covid lockdowns posing 'heightened risks,' with particular challenges to restoring price Stability while maintaining a strong job market, minutes show.

- Many participants judged faster removal of policy accommodation would leave the fed 'well-positioned' to assess later this year What further adjustments were needed, minutes show.

- Fed participants emphasized that they were 'highly attentive' to inflation risks and agreed those risks were skewed to the upside, minutes show.

- All participants supported plans to reduce the size of the Fed's balance sheet; 'a number' said after the runoff was well underway, it would be appropriate to consider sales of mortgage-backed securities, and minutes show.

- Participants said Q1 2022 GDP decline contained 'little signal about subsequent growth,' and they expected real GDP would grow 'solidly' in Q2 and be near or above trend for the whole year.

Meanwhile, analysts at Brown Brothers Harriman said, ''our base case remains for another 50 bp hike in September that takes the Fed Funds ceiling up to 2.5%, which many consider close to neutral. However, it’s worth noting that odds of a 50 bp move in September have fallen to less than 50% now from fully priced in at the start of May.''

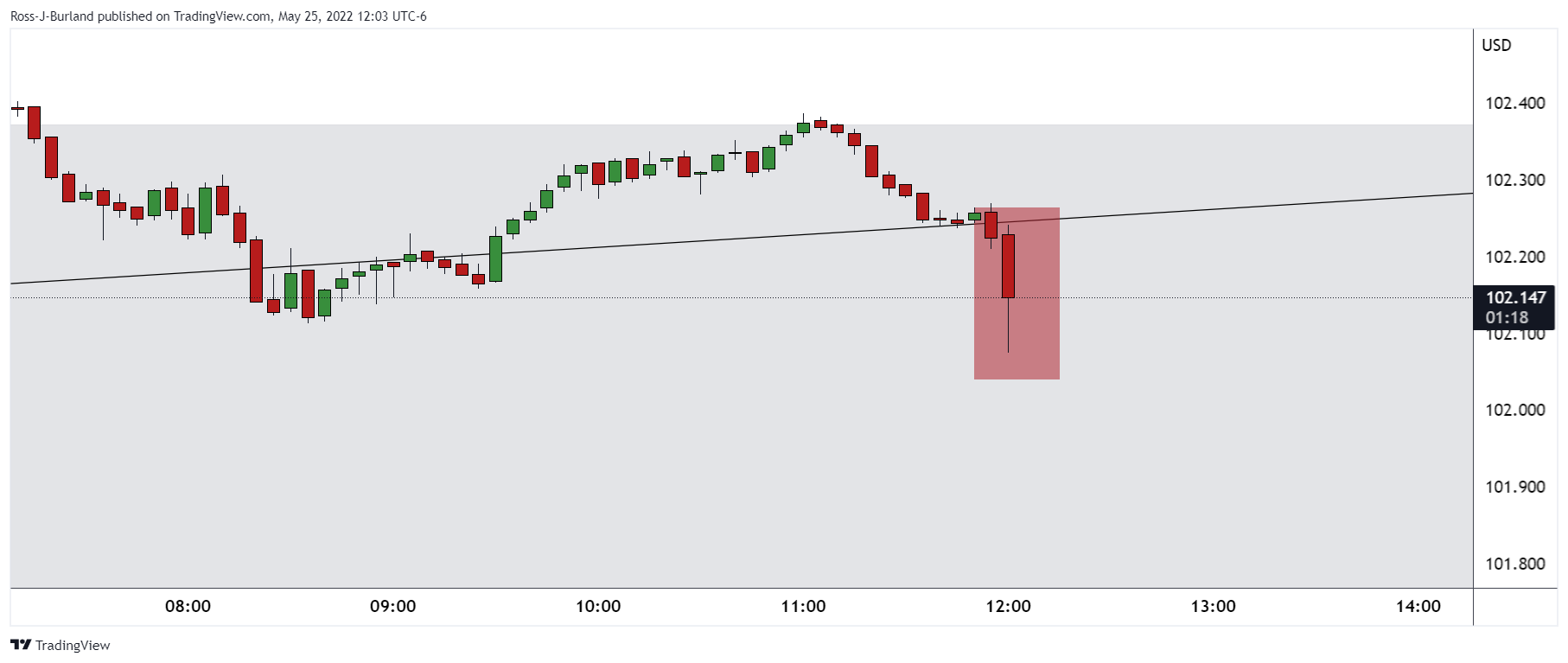

DXY reaction so far...

This was the knee jerk reaction that propelled the euro higher from support as follows, in accordance with the pre-event analysis:

EUR/USD technical analysis

Prior analysis:

For the minutes and sessions ahead, the pair could be based here and result in a higher correction from support:

The softness in the greenback come as there were no discussions on larger rate hikes.

About the FOMC minutes

FOMC stands for The Federal Open Market Committee organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.