- Analytics

- News and Tools

- Market News

- NZD/USD Price Analysis: Surrenders RBNZ-inspired gains to multi-week high, near 38.2% Fibo.

NZD/USD Price Analysis: Surrenders RBNZ-inspired gains to multi-week high, near 38.2% Fibo.

- NZD/USD shot to a fresh multi-week high in reaction to the RBNZ’s hawkish outlook.

- Recession fears capped gains for the risk-sensitive kiwi amid resurgent USD demand.

- Bulls might now wait for a move beyond the 38.2% Fibo. before placing fresh bets.

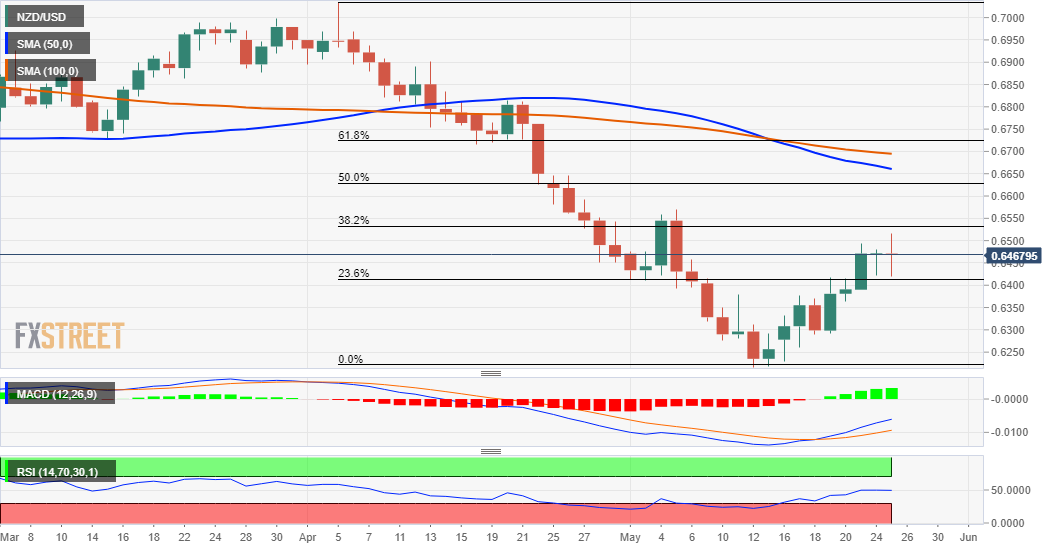

The NZD/USD pair caught aggressive bids near the 0.6420-0.6415 region on Wednesday after the Reserve Bank of New Zealand hinted at even higher rates going forward. Spot prices rallied around 100 pips from the daily low and shot to a nearly three-week high, though bulls struggled to capitalize on the move.

The market sentiment remains fragile amid the worsening global economic outlook and recession fears. Apart from this, a solid US dollar rebound from the monthly low touched overnight kept a lid on any further gains for the risk-sensitive kiwi and attracted some selling near the 0.6515-0.6520 region.

From a technical perspective, the post-RBNZ strong move up faltered just ahead of the 38.2% Fibonacci retracement level of the 0.7035-0.6217 downfall. This should now act as a key pivotal point, which if cleared will set the stage for an extension of a near two-week-old recovery move from the YTD low.

Bulls might then aim back to reclaim the 0.6600 round-figure mark and lift the NZD/USD pair further towards the 50% Fibo. level, around the 0.6625 zone. The next relevant hurdle is pegged near the 0.6655 area (50-day SMA) ahead of the very important 200-day SMA, around the 0.6700 round-figure mark.

On the flip side, the daily swing low, around the 0.6420-0.6415 region, coincides with 23.6% Fibo. level and should protect the immediate downside. A convincing break below will shift the bias in favour of bearish traders and make the NZD/USD pair vulnerable to testing sub-0.6300 levels in the near term.

NZD/USD daily chart

Key levels to watch

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.