- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD bears taking on critical daily support

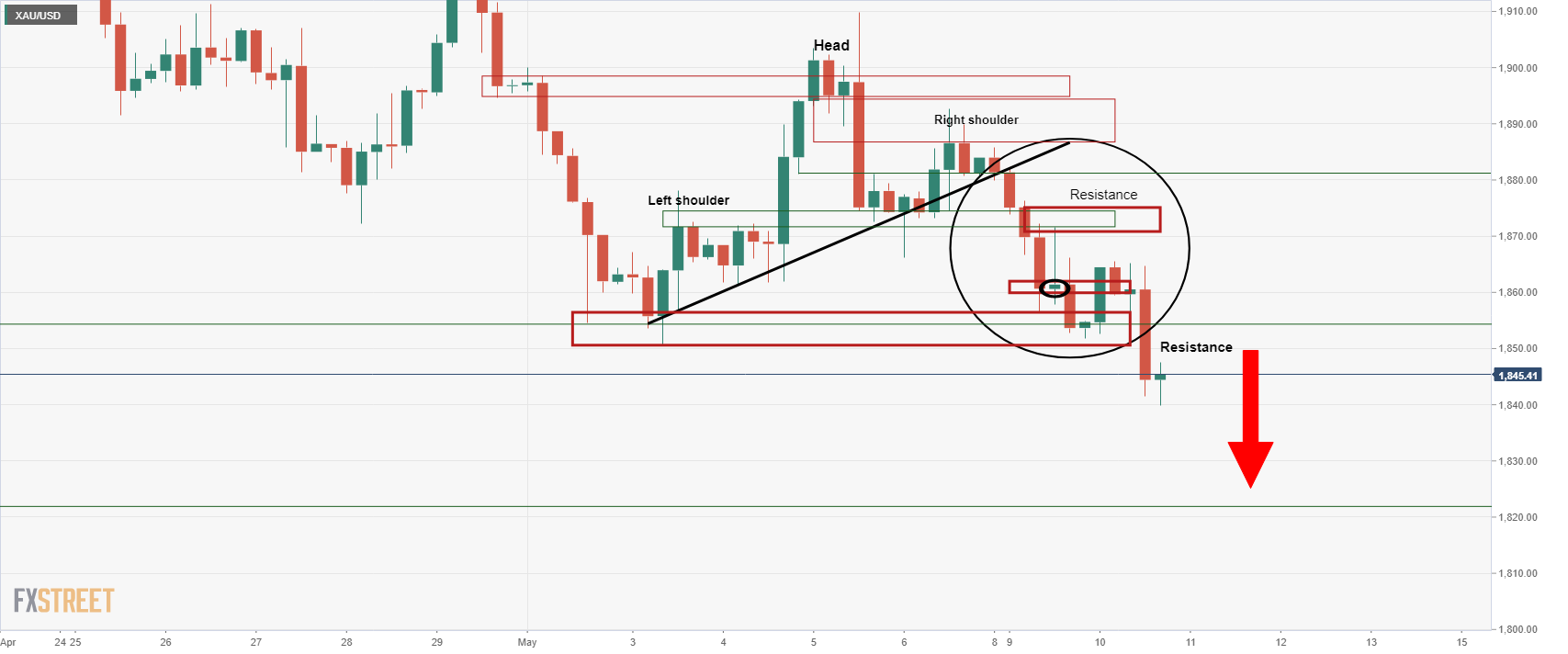

Gold Price Forecast: XAU/USD bears taking on critical daily support

- XAU/USD bears are moving in and taking on the daily support structure.

- US CPI will be a key driver for markets that are in wait and see mode.

- The US dollar is consolidating as US yields pull back giving relief to stocks.

The gold price continues to deteriorate despite some relief in the US dollar's advance. At the time of writing, XAU/USD is down some 0.46% at $1,845 while the DXY is trading at 103.85 and up just 0.1%.

The dollar has been choppy on Tuesday, fluctuating between modest gains as traders get set for Wednesday's big event in the US Consumer Price Index which could give clues on the likely path of the Federal Reserve's monetary policy.

Investors have been in a risk-on mood, as the yield on the benchmark US 10-year note eased back below the 3% psychological level and from the highest levels since 2018 at 3.20% scored on Monday. This has given some relief to US equity benchmarks that have been mixed in choppy trade. The Dow Jones Industrial Average has recovered to flat, with the S&P 500 up come 0.55%. The Nasdaq Composite is higher by some 1.9%.

However, the outlook is not so bullish for gold, according to analysts at TD Securities.

''Systematic trend followers are joining into the liquidation vacuum in gold. Finally, trend signals have sufficiently deteriorated to catalyze a substantial selling program in gold. With gold prices challenging the psychologically important $1850/oz range, the additional CTA flow could be sufficient to spark a breakdown in this technical level.''

Eyes on US CPI

Tomorrow's CPI is expected to rise by 0.5% MoM in April and headline to rise by 0.3%, as food and energy prices eased, according to analysts at ANZ bank. ''Inflation has probably peaked on a YoY basis, but monthly inflation trends remain stubbornly high and above rates consistent with 2%. Fed Chair Powell wants to reduce the excessive demand in the labour market by achieving a reduction in job openings without unemployment rising. Navigating that path will be challenging.''

Gold technical analysis

The price has fallen through the bottom of 4-hour support and is now testing daily support as follows with the focus now on $1,820 to the downside:

The M-formation is a reversion pattern so there could be a meanwhile bid at this juncture on failures to crack the daily support initially.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.