- Analytics

- News and Tools

- Market News

- China COVID crisis keeps markets on the backfoot

China COVID crisis keeps markets on the backfoot

It has been a rocky start to Tuesday in equity markets in ASPAC equities. This is on the heels of the S&P 500 that ended below 4,000 for the first time since late March 2021 while the Nasdaq dropped more than 4% on Monday in a selloff led by mega-cap growth shares.

Investors have grown more concerned about rising interest rates as well as China's stringent zero-Covid policy that has clouded the outlook for its US$9.6 trillion stock market. China’s Vice Premier Liu He has reaffirmed China's Covid Zero policy on Tuesday.

The South China Morning post reported on May 9 that the Politburo Standing Committee, Beijing's highest decision-making body, at a meeting last Thursday struck a surprisingly harsh tone to defend the policy, pledging to fight any attempt to "distort, question and dismiss" it.

''The hawkish stance also marks a setback for stock investors who had bet that Beijing would relax the zero-Covid approach to strike a balance between stabilising growth and bringing the pandemic under control.The Shanghai Composite Index has slumped by 17 per cent this year, making it the worst performer in Asia, as the lockdowns in Shanghai and 40 other cities heighten jitters over a deepening slowdown.''

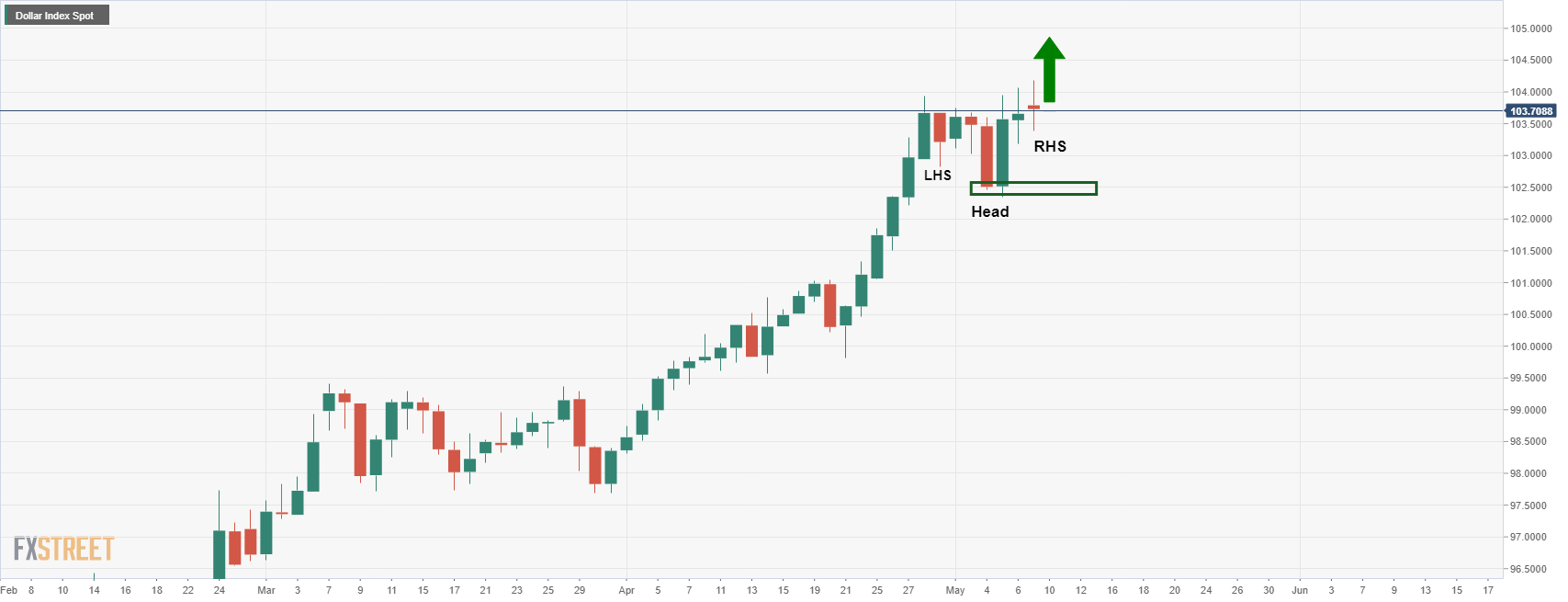

With investors juggling so many worries, one place they are looking for safety is in the dollar. The dollar index, which measures the greenback against a basket of currencies, rose to a 20-year high by as much as 0.6%.

-

US dollar sits firm below the freshly scored 20-year high

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.