- Analytics

- News and Tools

- Market News

- US dollar sits firm below the freshly scored 20-year high

US dollar sits firm below the freshly scored 20-year high

- The US dollar sits just below its 20-year high.

- The Fed sentiment and global growth concerns are underpinning safe-haven US dollars.

The US dollar reached a new 20-year high as traders moved out of risk assets due to ongoing worries over global growth following further poor Chinese data.

The concerns over the Federal Reserve's ability to combat high inflation boosted the greenback's safe-haven appeal as well. Also contributing to the defensive tone was the ongoing war in Ukraine and concerns about rising COVID-19 cases in China.

The dollar index (DXY) slipped to a low of 103.392 after touching 104.19, its highest level since December 2002 as equities remained under heavy selling pressure as concern about inflation and the demand outlook weighed.

US equities did not perform well with the S&P 500 ending below 4,000 for the first time since March 2021 and the Nasdaq dropped more than 4% in a selloff led by mega-cap growth shares as investors grew more concerned about rising interest rates. The yield on the US 10-year note eased 6.3bps to 3.063% despite the expectations the Fed will be aggressive in attempting to tamp down inflation.

On Monday, Minneapolis Fed President Neel Kashkari said the US central bank may not get as much aid from easing supply chains as it is hoping for in helping to cool inflation.

Atlanta Fed President Raphael Bostic said he already sees signs of peaking supply pressures and that should give the Fed room to hike at half-percentage-point interest rate increments for the next two to three policy meetings, but nothing bigger.

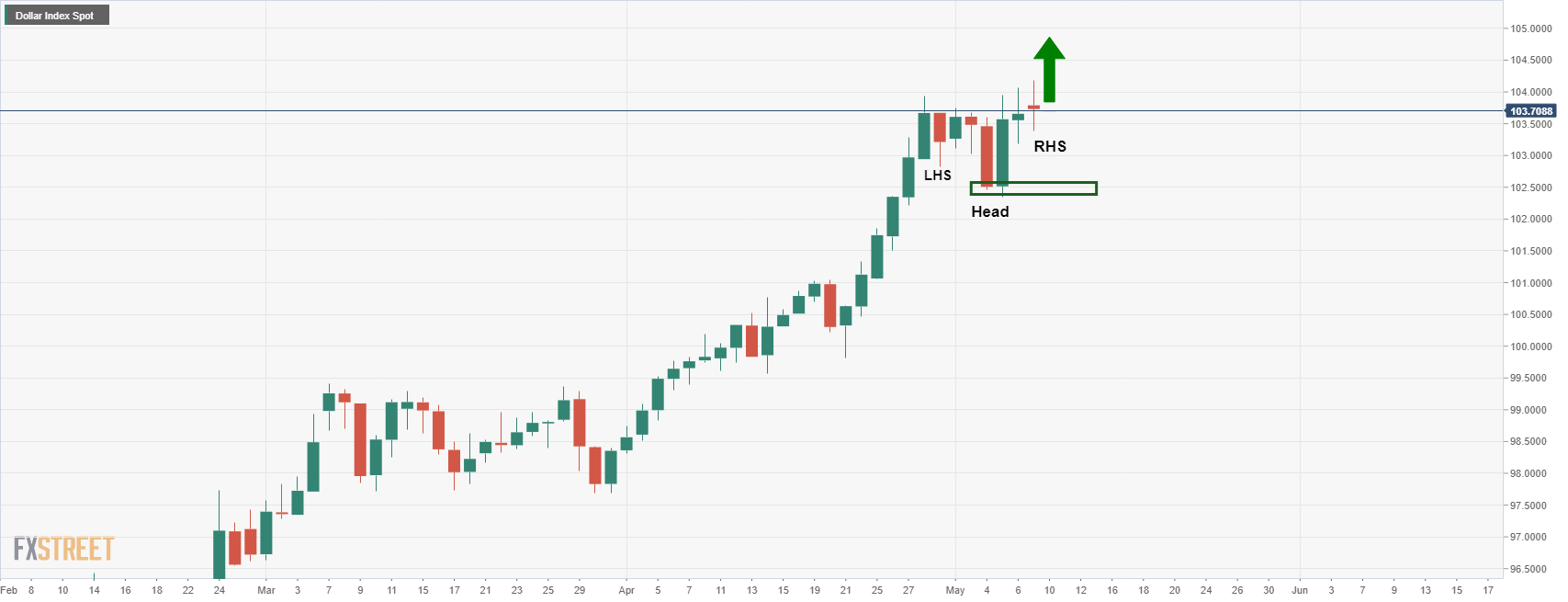

US dollar technical analysis

The price is forming a bullish inverse head and shoulders on the daily chart.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.