- Analytics

- News and Tools

- Market News

- US Dollar Index keeps pushing higher and targets 104.00 ahead of Payrolls

US Dollar Index keeps pushing higher and targets 104.00 ahead of Payrolls

- DXY adds to Thursday’s gains and approaches the 104.00 mark.

- US yields trade on a mixed note on Friday.

- US Nonfarm Payrolls will take centre stage later in the session.

The greenback adds to Thursday’s strong uptick and trades at shouting distance from the key 104.00 barrier when tracked by the US Dollar Index (DXY) at the end of the week.

US Dollar Index now looks to NFP

The index advances for the second straight session on Friday, as the current upside momentum remains well propped up by speculation that the Federal Reserve could hike rates by extra 50 bps (or higher) in the next months.

On the latter, and according to CME Group’s FedWatch Tool, the probability of a 75 bps rate hike at the June 15 meeting is now at nearly 90% from almost 6% seen a week ago.

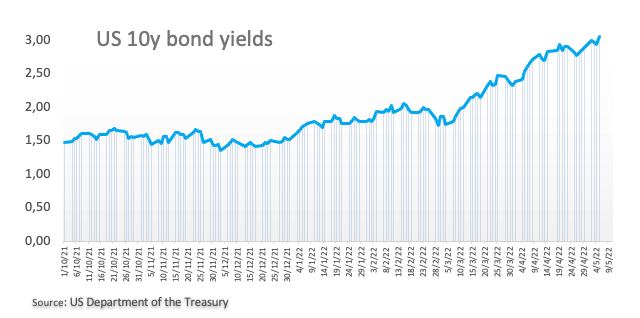

In the US money markets, yields in the short end of the curve trade marginally lower around 2.70%, while the belly and the long end look to extend the advance around 3.05% and 3.15%, respectively.

Data wise in the US calendar, all the attention will be on the publication of April’s Nonfarm Payrolls and the Unemployment Rate, seconded by March’s Consumer Credit Change and speeches by NY Fed J.Williams (permanent voter, centrist) and Atlanta Fed R.Bostic (2024 voter, centrist).

What to look for around USD

The dollar regains its solid appeal and stays en route to a potential visit to the 104.00 mark sooner rather than later, as investors’ expectations for a tighter rate path by the Federal Reserve have been nothing but reinforced by the FOMC event on Wednesday. The constructive stance in the dollar is also underpinned by the current elevated inflation narrative and the solid health of the labour market as well as bouts of geopolitical tensions and higher US yields.

Key events in the US this week: Nonfarm Payrolls, Unemployment Rate, Consumer Credit Change (Friday).

Eminent issues on the back boiler: Escalating geopolitical effervescence vs. Russia and China. Fed’s rate path this year. US-China trade conflict. Future of Biden’s Build Back Better plan.

US Dollar Index relevant levels

Now, the index is gaining 0.21% at 103.76 and the breakout of 103.94 (2022 high May 5) would open the door to 104.00 (round level) and finally 105.63 (high December 11 2002). On the other hand, the next support emerges at 102.35 (low May 5) seconded by 99.81 (weekly low April 21) and then 99.57 (weekly low April 14).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.