- Analytics

- News and Tools

- Market News

- US dollar rallies to fresh bull cycle highs on market pivot

US dollar rallies to fresh bull cycle highs on market pivot

- US dollar rallies to fresh cycle highs as markets turn risk-off.

- The start of the new month and rebalancing has seen a shuffle back into the safe haven US dollar.

The US dollar rallied on Thursdays as bulls picked up the currency at a discount figuring the risks associated with global stagflation and ongoing geopolitical tensions will keep the US dollar in favour. At 103.549, the DXY index is 1% higher ahead of the Tokyo open, a touch lower than the overnight bull cycle high of 103.942.

The initial move was illustrated as a prospective scenario in the prior day's post-Fed-analysis here: US dollar and yields sinking as Powell dials down market expectations of 75bp move. More on this below.

Meanwhile, global growth fears mount following a series of worrisome economic data and ongoing geopolitical risks. The Chinese PMIs remain in contraction territory and the COVID lockdowns are disrupting supply chains. Contagion of the Ukraine crisis in the commodity markets has left a dark cloud over global growth prospects and is subsequently damaging high beta currencies and the euro.

Then, the nail in the coffin came as the Bank of England warned of stagflation and weak German data that was showing that industrial orders in March suffered their biggest monthly drop since last October sent the euro below 1.05 the figure.

The greenback was subsequently boosted by safe-haven buying as global equities come back under pressure. The S&P 500 was down 3.6% and the Euro Stoxx 50 fell 0.8%. The yield on the US 10-year Treasury note surged, rising 9.8bps to 3.03% which also helped to propel the US dollar higher ahead of today's critical Nonfarm Payrolls.

NFP could be the clincher for US dollar bulls

The Nonfarm Payrolls is a major risk and could well set the tone for the following weeks ahead of the next Fed rate decision.

''A strong payrolls report could perversely push the market to price in more tightening as the Fed reduced its optionality at its most recent meeting,'' analysts at TD Securities said.

''That leaves a resilient USD vs EUR and yen very much the path of least resistance. A softer wages print should help to temporarily take the edge off but this will be short-lived until evidence of a peak/moderation in CPI emerges.''

Meanwhile, analysts at ANZ Bank explained, ''whilst the Fed is not currently considering a 75bps rate increase, that guidance is based on expectations that the trend increase in monthly Nonfarm payrolls will slow and core inflation is stabilising. But there are no guarantees at all that that will be the case.''

''Demand for labour in the US remains very strong and core services inflation is rising steadily. The April non-farm payroll and employment reports tomorrow night, therefore, carry a lot of significance,'' the analysts added.

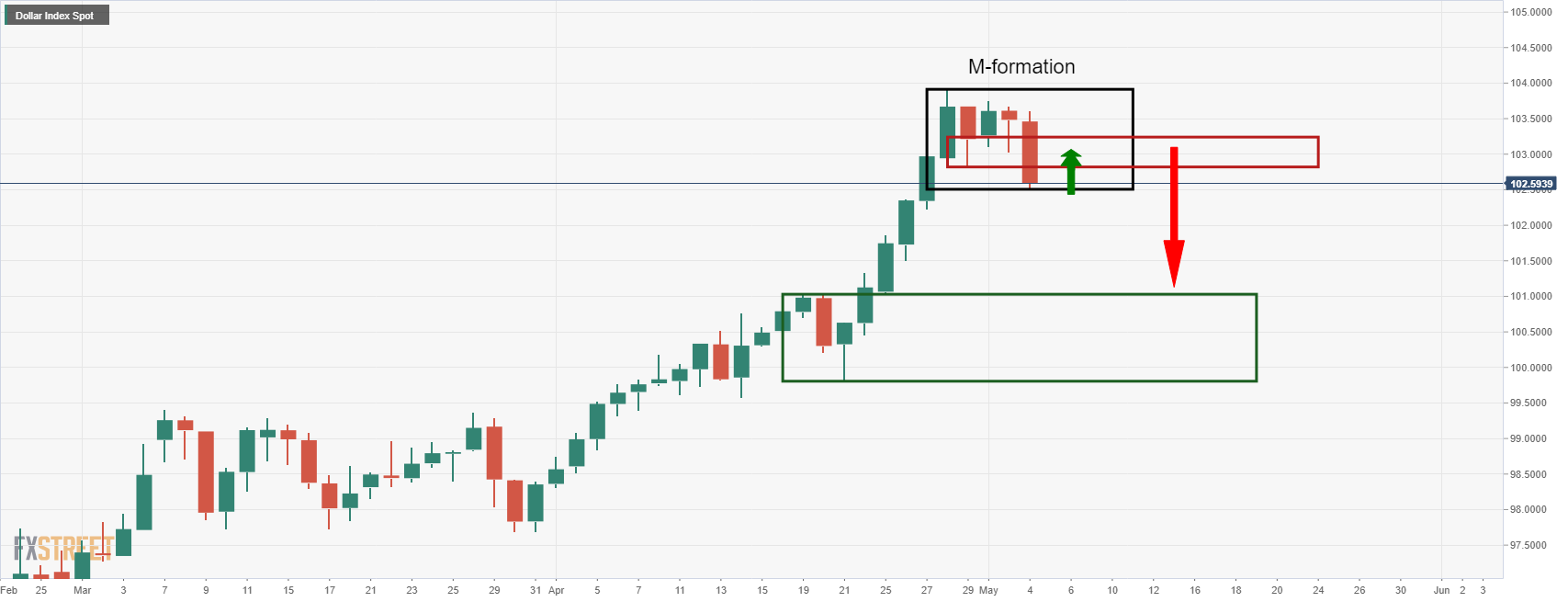

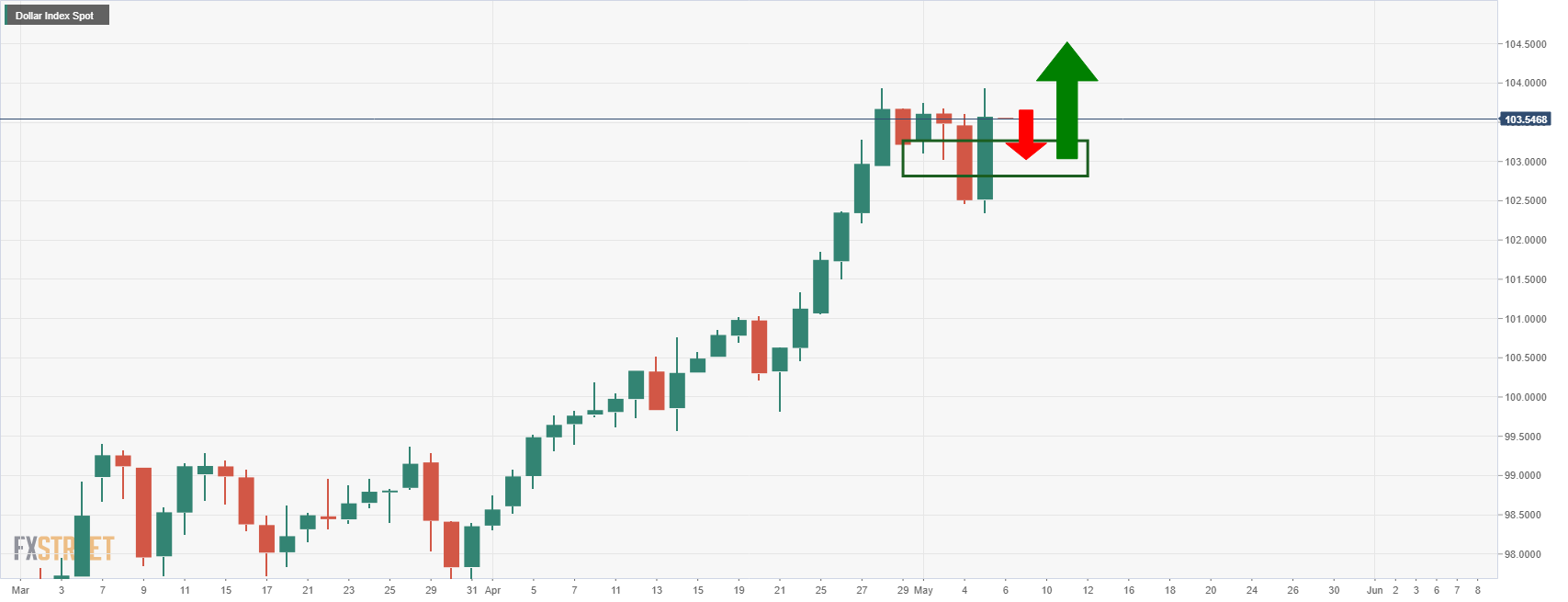

DXY technical analysis

However, the bulls are staying the course at the moment and have cleared the resistance as follows:

Should the above price action play out, the inverse head & shoulders would be a bullish factor on the daily chart.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.