- Analytics

- News and Tools

- Market News

- US dollar and yields sinking as Powell dials down market expectations of 75bp move

US dollar and yields sinking as Powell dials down market expectations of 75bp move

- US dollar plummets as the Fed dials back expectations of 75bp hikes.

- The Fed gives the nod to a series of 50bps hikes instead.

Both the US dollar and US Treasury yields are under pressure following the Federal Reserve interest rate decision, statement and the Fed chair's presser. The US 2-year Treasury yield has fallen by some 5% to a low of 2.612%.

After hiking by 50bps today and formally starting quantitative tightening as the Fed seeks to get a grip on inflation, Jerome Powell gave the green light to a series of additional 50bp hikes but said 75bps was not something that was being considered.

The Federal Reserve is now "highly attentive" to inflation risks and amid “robust” job gains "ongoing increases" in the Fed funds rate will be "appropriate". The Fed is starting quantitative tightening and a press release with the Fe's plans for reducing the size of the balance sheet was released showing $47.5bn per month that will start on June 1st before getting to a "max" of $95bn in September:

The Committee intends to reduce the Federal Reserve's securities holdings over time in a predictable manner primarily by adjusting the amounts reinvested of principal payments received from securities held in the System Open Market Account (SOMA). Beginning on June 1, principal payments from securities held in the SOMA will be reinvested to the extent that they exceed monthly caps.

For Treasury securities, the cap will initially be set at $30 billion per month and after three months will increase to $60 billion per month. The decline in holdings of Treasury securities under this monthly cap will include Treasury coupon securities and, to the extent that coupon maturities are less than the monthly cap, Treasury bills.

For agency debt and agency mortgage-backed securities, the cap will initially be set at $17.5 billion per month and after three months will increase to $35 billion per month.

Nevertheless, the markets had been pricing in a more aggressive stance at the Fed. The initial knee-jerk “sell-the-fact” reaction in the greenback as the Fed delivered the expected 50bp hike was exacerbated when Powell took 75bps rate hikes off the table. This is giving risk appetite a boost and the euro is making a case for a significant multi-week correction that could take place between now and the next meeting in June.

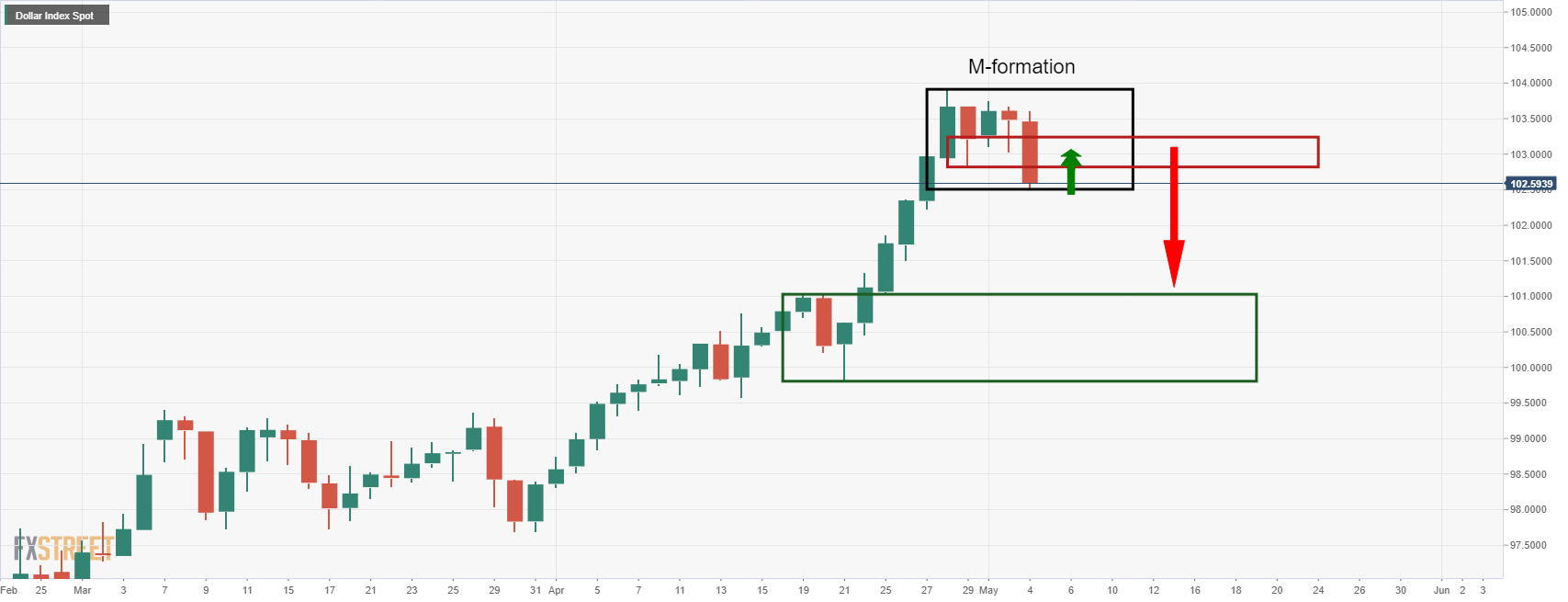

In turn, the DXY index which is calculated by factoring in the exchange rates of six foreign currencies vs. the greenback is set up for a move that could extend as far as 101.00 in the coming days/weeks:

The M-formation is a bullish reversion pattern where the price would be expected to retest the neckline, prior to a more significant move to the downside and towards the old resistance structure. However, much will depend on this week's Nonfarm Payrolls data.

If the US jobs data on Friday fuels expectations around potentially larger than 50bp rate hikes, then the DXY bulls will be back in play and the euro will be at risk of moving below 1.0500. The euro is, by far, the largest component of the DXY index, making up 57.6% of the basket.

The W-formation there is also compelling in this regard:

The euro is headed towards a 38.2% Fibonacci retracement of the daily bearish impulse. This has a confluence with prior daily highs. Either way, the W-formation is a bearish pattern and a retest of the neckline would be expected to occur in due course. Whether the euro can continue higher will depend on matters related to geopolitics as well as the market's appetite for the US dollar. Unstable risk sentiment, COVID and a lower appetite for emerging markets combined with the Fed's focus on fighting inflation are all factor that would be expected to underin the greenback.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.