- Analytics

- News and Tools

- Market News

- AUD/JPY bulls step-it-up as the yen is dumped towards 130 USD/JPY on dovish BoJ

AUD/JPY bulls step-it-up as the yen is dumped towards 130 USD/JPY on dovish BoJ

- Yen is hit hard n the back of a uber dovish BoJ.

- AUD/JPY rockets but there is daily resistance on the horizon.

The yen has dropped across the board following an uber dovish Bank of Japan meeting that has seen USD/JPY shoot towards 130 the figure in a parabolic rally of around 130 pips. This has pulled AUD/JPY higher within its correction on the daily chart by some 65 pips so far.

AUD/JPY is currently 0.66% higher on the session so far at 92.07 and has travelled from a low of 91.32 to a high of 92.24. While the BoJ was expected to keep its existing ultra-loose policy settings, the yen tumbled as the central bank announced its plan to conduct unlimited fixed-rate bond purchase operations every business day "until it is highly likely that no bids will be submitted".

-

Breaking: Bank of Japan keeps policy steady, tweaks forward guidance, yen at fresh session lows, 129.52+

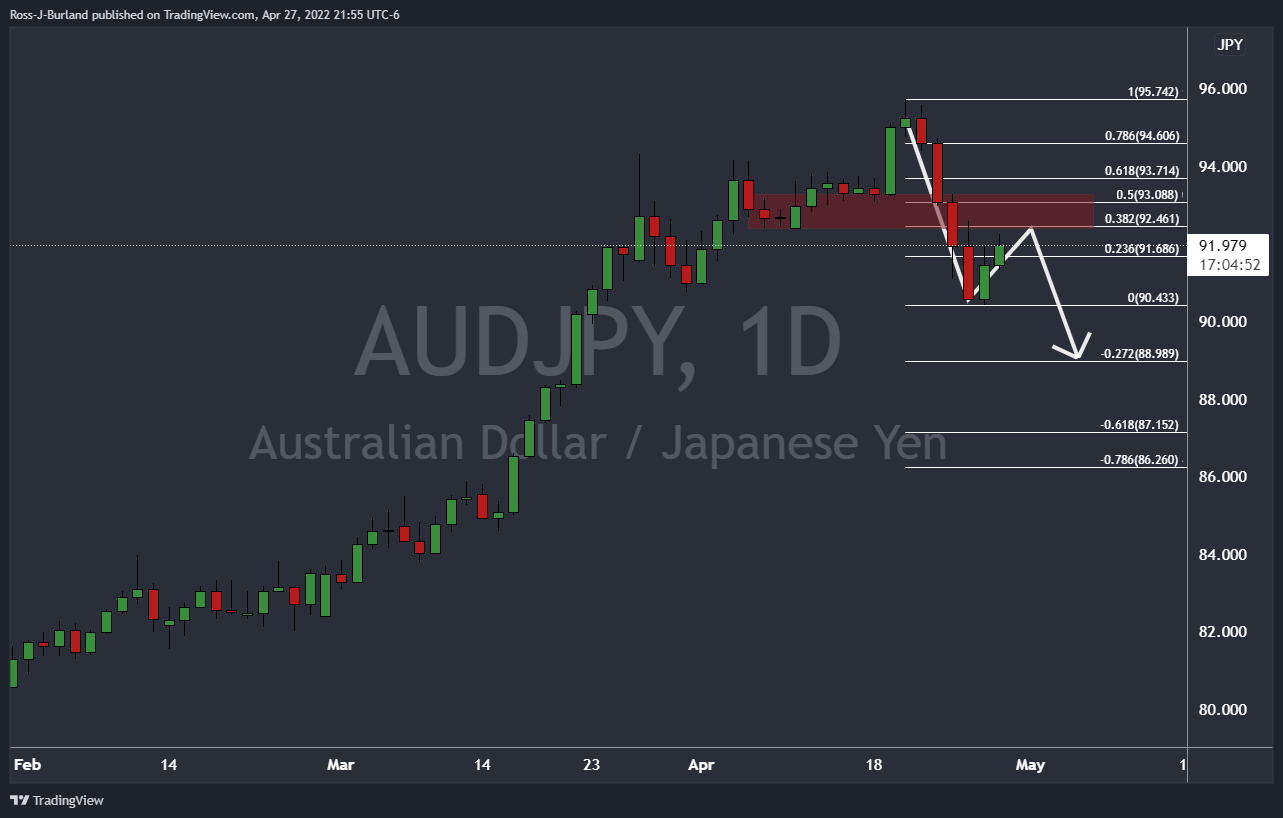

Meanwhile, this leaves a compelling opportunity on the charts of the contrarian traders, if considering the risks to global growth and the Aussies' high beta status. While there is a case for a supported AUD on the back of hotter than expected inflation and a faster rate hike timetable from the Reserve Bank of Australia, the backdrop is pessimistic in the global economy and external factors are weighing the currency down. If yen weakness is faded, then there would be prospects of a downside continuation as per the following daily chart:

AUD/JPY technical analysis

A correction of the bearish impulse into resistance and the confluence of the Fibonacci levels could be the fuel for bears to move in again for a downside extension in due course. the 38.2% and 50% ratio retracements align with prior lows on the daily chart.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.