- Analytics

- News and Tools

- Market News

- USD/JPY Price Analysis: To reach 130.00 in the near-term as a bullish engulfing pattern looms

USD/JPY Price Analysis: To reach 130.00 in the near-term as a bullish engulfing pattern looms

- The USD/JPY remains positive as the end of the month approaches, up by 5.50%.

- China’s news that Shanghai is about to ease lockdowns lifted investors’ spirits.

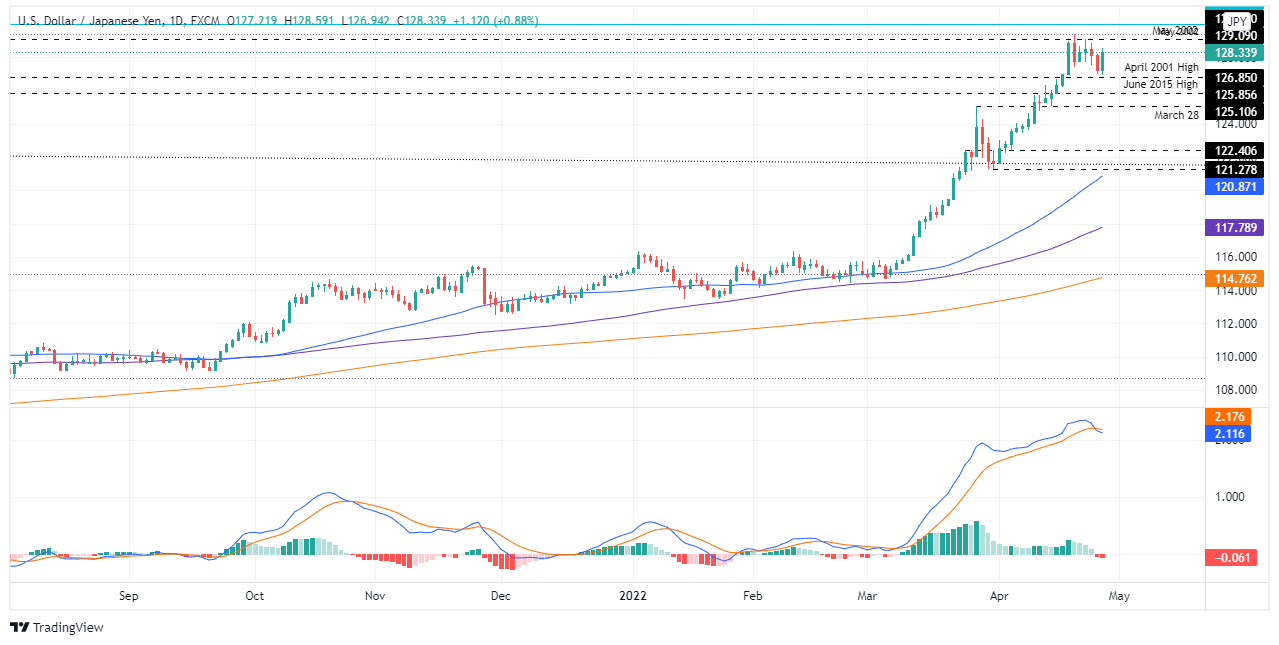

- USD/JPY Price Forecast: A bullish engulfing pattern in the daily chart opens the door toward a renewed YTD high.

The USD/JPY bounces from Tuesday’s lows and rallies above the 128.00 mark, attributed to an upbeat market mood as US Treasury yields grind higher in the North American session. At the time of writing, the USD/JPY is trading at 128.34.

Meanwhile, the buck stays resilient and records gains for the fifth consecutive day. The US Dollar Index, a basket of six currencies that measures the greenback’s value, is up 0.65%, sitting at 102.961, a tailwind for the USD/JPY as Wall Street’s close looms. Also, the US 10-year benchmark note prepares to close near the 2.80% threshold after Tuesday’s close at around 2.726%.

The market sentiment has improved throughout Wednesday. European equities pared losses while US stocks rose. China’s news that Shanghai might be about to “relax” Covid-19 zero-tolerance restrictions, alongside extensive testing in Beijing amid a coronavirus outbreak in the week, calmed market players. In the meantime, the conflict between Russia-Ukraine escalated a tick as Gazprom, a Russian company, halted natural gas shipments to Poland and Bulgaria.

USD/JPY Price Forecast: Technical outlook

In the meantime, the greenback’s bulls regained control in the pair, as shown by price action during the day. In the Asian session, the USD/JPY opened near Tuesday’s lows, around 127.20s, and slid towards 127.00 due to a dampened sentiment. Nevertheless, the pair recovered and rallied more than 150 pips, recording a daily high near 128.50.

The USD/JPY remains upward biased. The price action of the last two days formed a “bullish engulfing pattern,” suggesting the pair might resume upwards.

With that said, the USD/JPY’s first resistance would be Wednesday’s high at 128.59. Break above would expose the 129.00 mark, followed by the April 20 swing and YTD high, at 129.40, followed by the 130.00 mark.

Key Technical Levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.