- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAUUSD eyes $1,906 as the next bearish target – Confluence Detector

Gold Price Forecast: XAUUSD eyes $1,906 as the next bearish target – Confluence Detector

- Gold Price remains vulnerable amid hawkish Fed bets, firmer US dollar.

- Risk-aversion remains at full steam and boosts the USD at XAUUSD’s expense.

- Friday’s closing is critical for XAUUSD’s bullish traders after the decline.

The US dollar march northward appears unstoppable amid the hawkish Fed narrative, Beijing lockdown fears and global economic growth concerns on the whole. Gold Price, therefore, remains on slippery slopes amid a ‘sell everything’ mode playing out so far. The market’s perception of risk sentiment, the dollar and the yields’ price action will have a notable influence on XAUUSD, as the Fed policymakers step aside during the ‘blackout period’. The US Q1 Preliminary GDP will remain the key event risk this week.

Also read: Gold Price Forecast: $1,900 could be next key support as bears refuse to give in

Gold Price: Key levels to watch

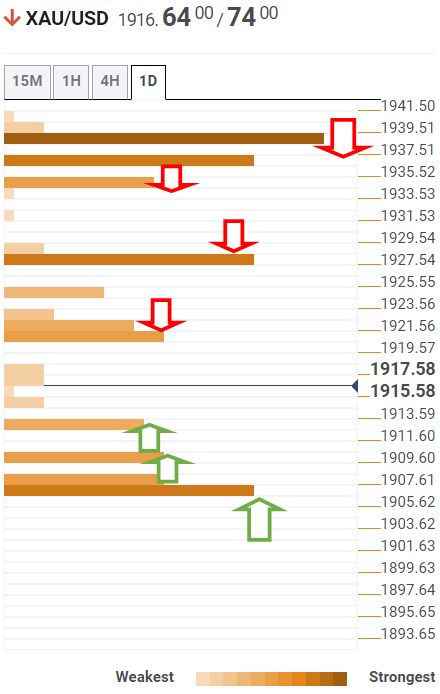

The Technical Confluences Detector shows that Gold Price is gyrating near daily lows of $1,912, awaiting a fresh impetus to extend the downside momentum towards $1,910. That level is the pivot point one-day S2.

The next critical support is seen at $1,906, which is the confluence of the pivot point one-week S1 and the Bollinger Band one-day Lower.

Further down, the $1,900 round level could challenge the bullish attempts.

On the upside, strong resistance is placed around $1,920, where the pivot point one-day S1 and Bollinger Band four-hour Lower merge.

The previous day’s low of $1,927 will be next on the buyers’ radars.

XAUUSD bulls will then try to take out the Fibonacci 23.6% one-day at $1,934. The last line of defense for gold bears is pegged around $1,937, the convergence of the SMA50 one-day and Fibonacci 38.2% one-day.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.