- Analytics

- News and Tools

- Market News

- EUR/USD bears losing momentum, French elections in focus for the open

EUR/USD bears losing momentum, French elections in focus for the open

- EUR/USD has been under pressure, but French elections results could draw out the bulls.

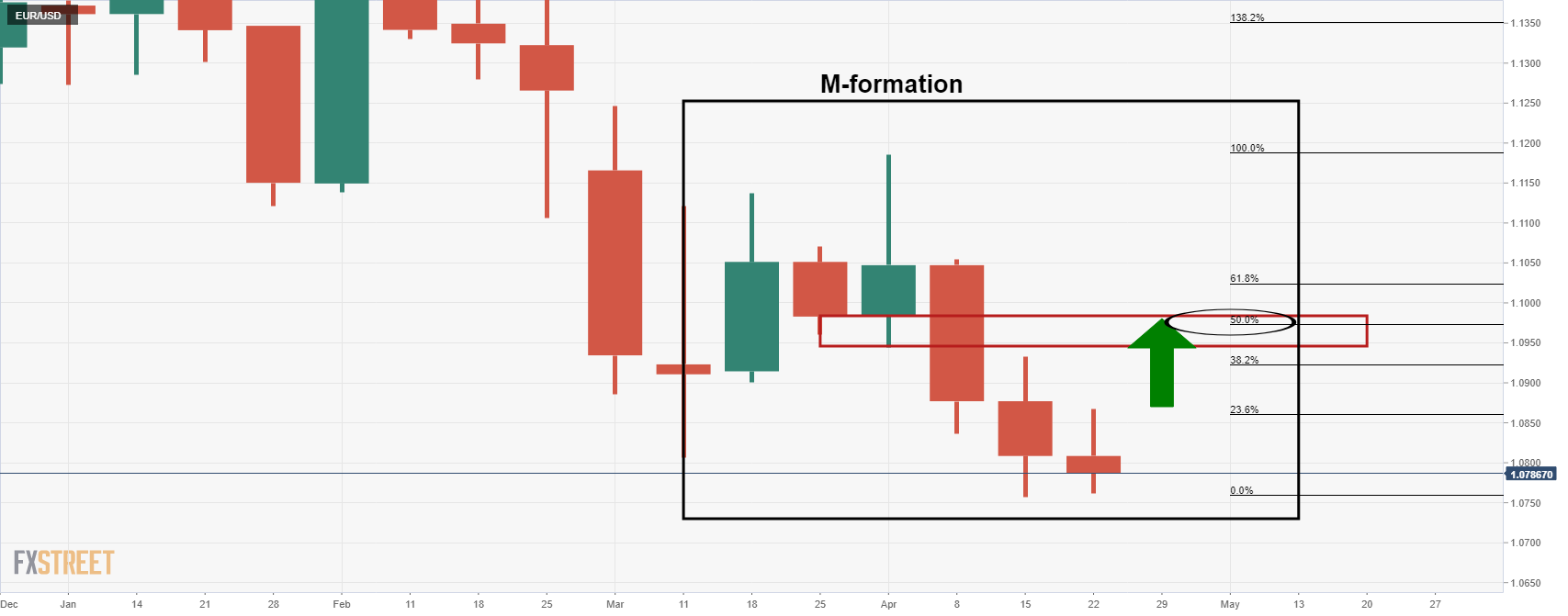

- Weekly chart's M-formation eyed for the week ahead.

EUR/USD ended Friday on the back foot but momentum in the week's price action lost some momentum and the bulls could be about to show up. The French election result should be reflected in the price for the open as it is euro friendly considering markets prefer the status quo. Even though Le Pen has toned down her anti-euro rhetoric, plenty of her initiatives would have put Paris on a collision course with EU partners.

Emmanuel Macron has beaten far-right candidate Marine Le Pen to win the French presidency, projections show. He has taken 58% of the vote to her 42% in a narrower victory than their previous contest in 2017. The result could see EUR/USD pare back some of the 0.33% lost on Friday with the single currency touching a low of 1.0796, although some way off the cycle low of 1.0757 printed the prior week.

''The yield premium demanded by investors to hold French 10-year bonds versus European benchmark Germany, a key barometer of relative risks, fell to a three-week lows around 42 basis points on Friday as investors anticipated a Macron win,'' Reuters wrote.

Meanwhile, the Russia/Ukraine conflict on the doorstep of NATO and the borders of the EU has rapidly replaced Covid as the key source of global risk. The European Central Bank is bracing for the possibility of a long conflict that raises the prospect of a negative supply shock, elevated energy and food prices and untimely, a higher cost of living.

Nevertheless, the ECB is poised to end net purchases in forthcoming months, potentially as soon as July ahead of raising rates by 25bp once per quarter from September this year. However, analysts at Nordea explained that the rise in forward-starting inflation swaps risks forcing the ECB to turn more aggressive despite more and more signs of a growth slowdown ahead. ''ECB rate hikes now priced in for July, Sep (almost) and Dec despite more and more signs of a slowdown.''

EUR/USD technical analysis

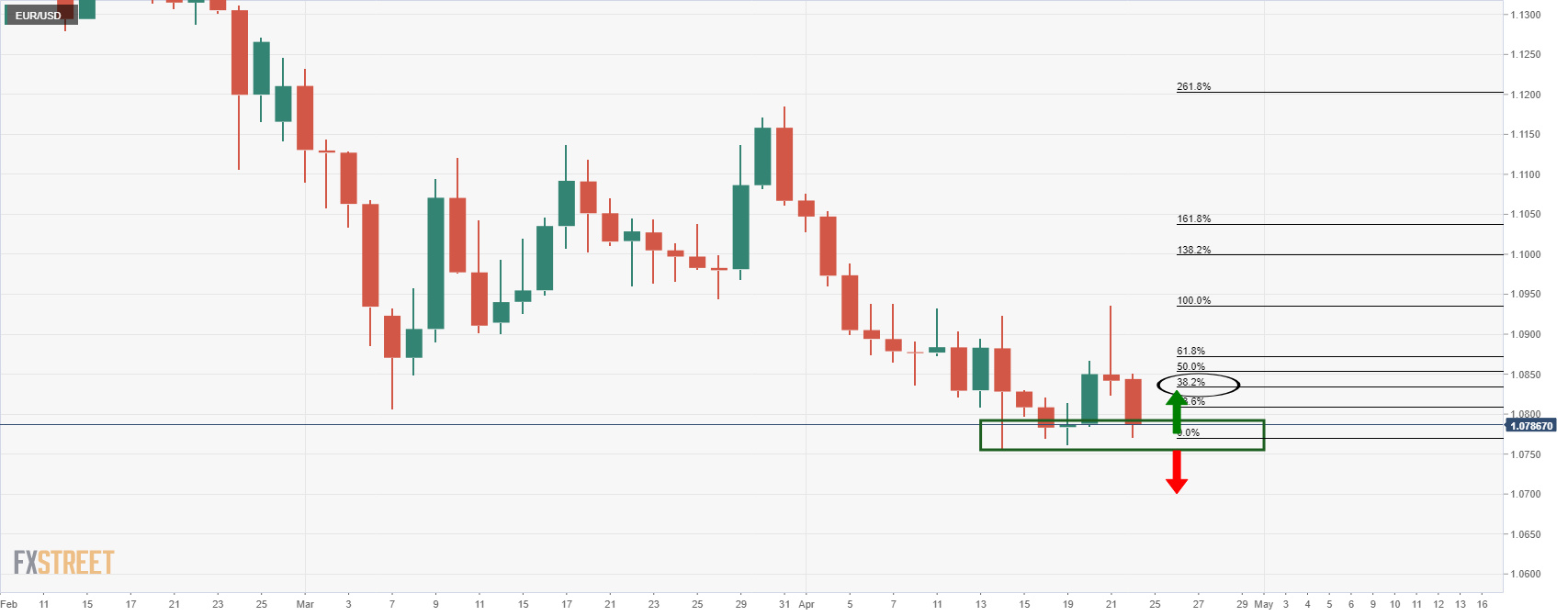

The price has moved in on the prior lows that could prove to be robust in the open and see the euro revert to mitigate the imbalance of price in Friday's bearish impulse. If not, then the downside is wide open for the week ahead. 1.0630 is a target going by the weekly chart, but the M-formation remains compelling for a move higher.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.