- Analytics

- News and Tools

- Market News

- EUR/USD regains 1.0900 and above, climbs to 2-week highs

EUR/USD regains 1.0900 and above, climbs to 2-week highs

- EUR/USD extends the recovery above the 1.0900 barrier.

- Hawkish ECB-speak suggested a potential hike in July.

- Chief Powell, Initial Claims, Philly Fed Index comes next.

The buying interest gathers extra steam and pushes EUR/USD further north of the 1.0900 barrier to clinch new 2-week highs in the 1.0935/40 band on Thursday.

EUR/USD boosted by ECB chatter

EUR/USD advances for the third session in a row for the first time since late March on Thursday, as sentiment around the European currency was boosted by hawkish comments from ECB Vice-president L. De Guindos, who suggested a probable interest rate hike in July. Earlier in the session, ECB Board member P.Wunsch also anticipated that rates could be positive as soon as this year.

In the debt market, US yields resume the upside along the curve, while the German 10y bund yields also trade in the positive territory above the 0.90% mark.

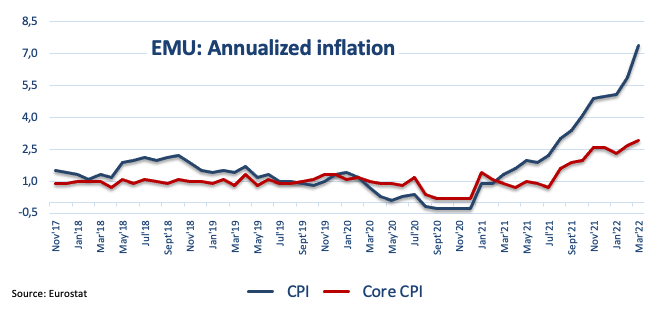

Data wise in the Euroland, final inflation figures showed the CPI rose a tad below the preliminary reading at 7.4% YoY (from 7.5%) and the Core CPI gained 2.9% YoY (from 3.0%). In addition, the European Commission will publish its preliminary gauge for the Consumer Confidence in the region for the month of April.

Later in the session, Chief Powell will speak on The Global Economy at an IMF event. In the docket, weekly Claims are due in the first turn seconded by the Philly Fed Index and the CB Leading Index.

What to look for around EUR

EUR/USD regains some composure and trespasses 1.0900 on quite a sustainable fashion so far. The duration and extension of the ongoing bounce, however, remains to be seen, as the outlook for the pair still remains tilted towards the bearish side, always in response to dollar dynamics, geopolitical concerns and the Fed-ECB divergence. As usual, occasional pockets of strength in the single currency should appear reinforced by speculation the ECB could raise rates before the end of the year, while higher German yields, elevated inflation, the decent pace of the economic recovery and auspicious results from key fundamentals in the region are also supportive of a rebound in the euro.

Key events in the euro area this week: Final EMU Inflation Rate, Flash EMU Consumer Confidence (Thursday) – EMU, Germany Flash Manufacturing, Services PMIs (Friday).

Eminent issues on the back boiler: Asymmetric economic recovery post-pandemic in the euro area. Speculation of ECB tightening/tapering later in the year. Second round of the presidential elections in France (April 24). Impact on the region’s economic growth prospects of the war in Ukraine.

EUR/USD levels to watch

So far, spot is up 0.57% at 1.0912 and faces the next up barrier at 1.0936 (weekly high April 21) seconded by 1.1000 (round level) and finally 1.1078 (55-day SMA). On the other hand, the break below 1.0757 (2022 low April 14) would target 1.0727 (low April 24 2020) en route to 1.0635 (2020 low March 23).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.