- Analytics

- News and Tools

- Market News

- EUR/USD bears are fighting to the death, taking on bullish commitments at key hourly support

EUR/USD bears are fighting to the death, taking on bullish commitments at key hourly support

- EUR/USD bulls losing grip but could be about to step in again.

- French elections are bullish for the euro although the US dollar remains the obstacle.

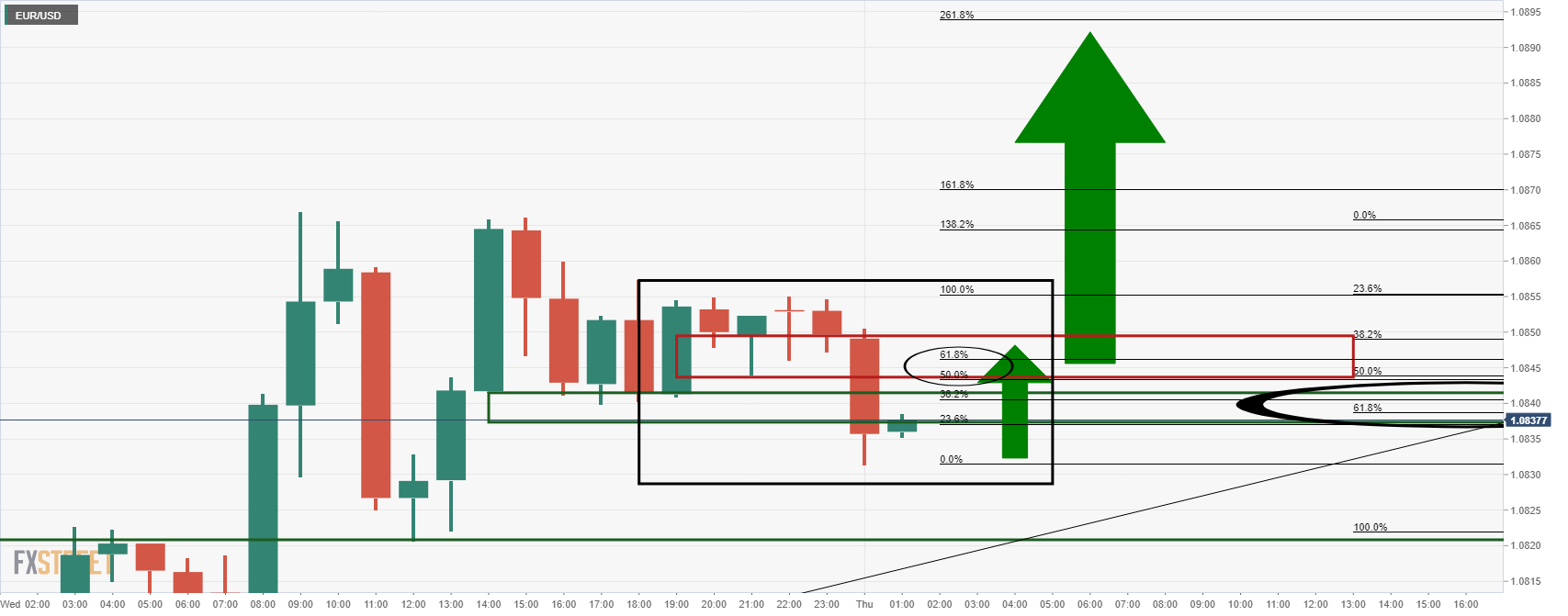

EUR/USD bears have gritted their teeth and growled in the face of a bullish stampede, recently sending the euro onto the backfoot despite a favourable prospect in the French elections. At the time of writing, EUR/USD is trading around 1.8040, the 61.8% ratio of the prior bullish impulse. The pair has slid from a high of 1.0854 and has marked a low of 1.0838 in recent trade.

The two finalists in France’s presidential elections faced off in a live TV debate that could be crucial in persuading wavering voters – particularly on the left – four days before the decisive second-round vote.

- Poll: Macron performs in the elections debate, good for the euro

However, despite favouritism in the polls for Macron, the euro is sliding. US yields have popped in recent trade and this has pulled the US dollar up from the floor as well. DXY, in an index that measures the greenback vs. a basket of currencies, is making its way through 100.50 at the time of writing, up from 100.34 lows today.

There are expectations of another weak fix from the People's Bank of China which would be US dollar positive on the fact and potentially give some support to the speculation.

Nevertheless, the moves are irradiating the near-term bullish prospects for the euro, from a technical standpoint:

EUR/USD technical analysis

The price has reverted back to the support area, marking a new low for the support and taking on the 61.8% ratio. However, the price has left an M-formation which would be expected to see a restest of the neckline:

Given the bullish trend, this neckline could well serve as only a temporary resistance and give way to the bulls, resulting in a bullish continuation for the session ahead.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.