- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAUUSD needs acceptance above $1,982 to resume the uptrend – Confluence Detector

Gold Price Forecast: XAUUSD needs acceptance above $1,982 to resume the uptrend – Confluence Detector

- Gold Price treads water amid a broad US dollar retreat and cautious market mood.

- US Treasury yields resume the uptrend, keeping XAUUSD bulls on the back foot.

- Gold Price Forecast: $1,961 could emerge as key support for XAUUSD amid firmer USD.

Gold Price remains at the mercy of the price action in the US dollar and the Treasury yields, courtesy of the aggressive Fed’s tightening expectations. Meanwhile, the absence of the first-tier US economic data leaves the attention on the Fed commentary and rising concerns over inflation and growth risks, in the face of a protracted Russia-Ukraine war. Should the market mood worsen, the haven demand for the US dollar will be back in play, limiting the upside in Gold Price. Additionally, the renewed upside in the Treasury yields could also keep a check on XAUUSD.

Also read: Gold technical picture for 2022

Gold Price: Key levels to watch

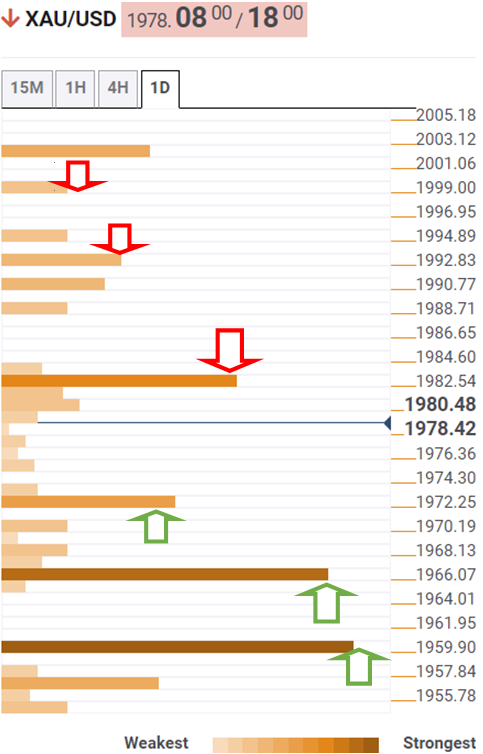

The Technical Confluences Detector shows that gold price is struggling to take on the recovery above $1,982, the convergence of the Fibonacci 61.8% one-day, the previous week’s high and Bollinger Band one-day Upper.

Acceptance above the latter is critical to resume the uptrend towards the previous day’s high of $1,998.

Ahead of that level, a bunch of stiff resistance levels are seen around $1,991, where the Fibonacci 23.6% one-day, pivot point one-week R1 and pivot point one-day R1 coincide.

On the flip side, the previous day’s low of $1,971 acts as strong support, below which a drop towards the Fibonacci 38.2% one-week at $1,966 will be in the offing.

Further down, XAUUSD sellers could target powerful support at $1,960, the confluence of the previous year’s high and the Fibonacci 61.8% one-month.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.